Assured sitting on top

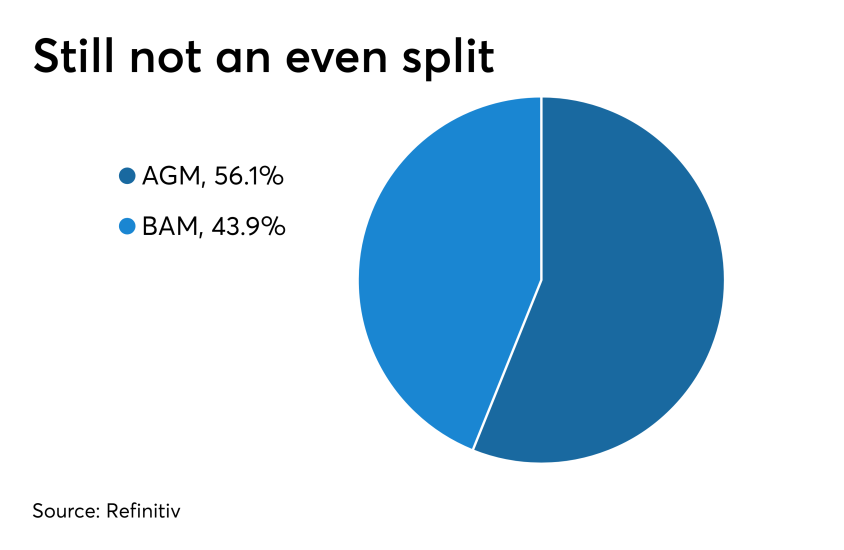

For the first quarter of 2019, Assured Guaranty insured 56% of insured new issue par and 56% of the transactions sold in the quarter and insured approximately $2.4 billion in aggregate in the primary and secondary market with a total transaction/policy count of 261.

Assured also guaranteed the largest insured Green Bond deal on record, $179 million of bonds for the New York MTA across two separate transactions.

“Assured Guaranty continued its leadership position in municipal bond insurance during the first quarter of 2019, which was characterized by low municipal bond yields and tight credit spreads that varied little through the quarter," said Robert Tucker, senior managing director of communications and investor relations for Assured. "We continued to expand our footprint in the healthcare sector, guaranteeing an $81 million taxable insured transaction for the Tufts University Medical Center, and we demonstrated how our financial strength, analytic resources and market acceptance can help lower the financing cost of Green Bonds by insuring the largest Green Bond transaction on record, issued by New York’s Metropolitan Transit Authority.”

In the latest example of Assured Guaranty’s taxable market capabilities for healthcare credits, during the quarter it insured $81 million of Massachusetts Development Finance Authority bonds for Tufts University Medical Center, part of the Wellforce Health System.

BAM building up

“The start of 2019 saw more of the positive trends for BAM-insured bonds we experienced in the second half of last year: Total par insured was up 38% compared with the first quarter of 2018, and market share was stable, and secondary market demand from institutional investors remained strong," said Sean McCarthy, CEO of BAM.

He added that the BAM GreenStar assessment program continued to grow as more issuers and their advisors learned about the opportunity to obtain a third-party green bond verification at no additional cost.

"We designated 14 transactions worth $128 million as green bonds during the quarter, more than any other third-party verifier in the municipal market, and we expect that volume will continue to grow as more issuers adjust their financing plans to establish dedicated tranches of bonds that specifically finance projects with environmental benefits,” he said.