-

SMA growth has been "pretty staggering to see," said Matthew Schrager, managing director and co-head of TD Securities Automated Trading, noting the "interplay between SMA and electronic trading is a very symbiotic relationship."

May 29 -

Munis sold off last week "as the anticipated market correction may have finally started ahead of the summer reinvestment period," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 28 -

A pair of muni market experts propose cities and towns borrow through state-based, credit-enhanced bond banks to make the market more efficient.

May 28 -

Marty Mannion and Matt Schrager, managing directors and co-heads at TD Securities Automated trading division, discuss how automation and electronic trading are creating more opportunities and better outcomes for municipal market participants, including making muni bonds more accessible to a broader range of investors.

May 28 -

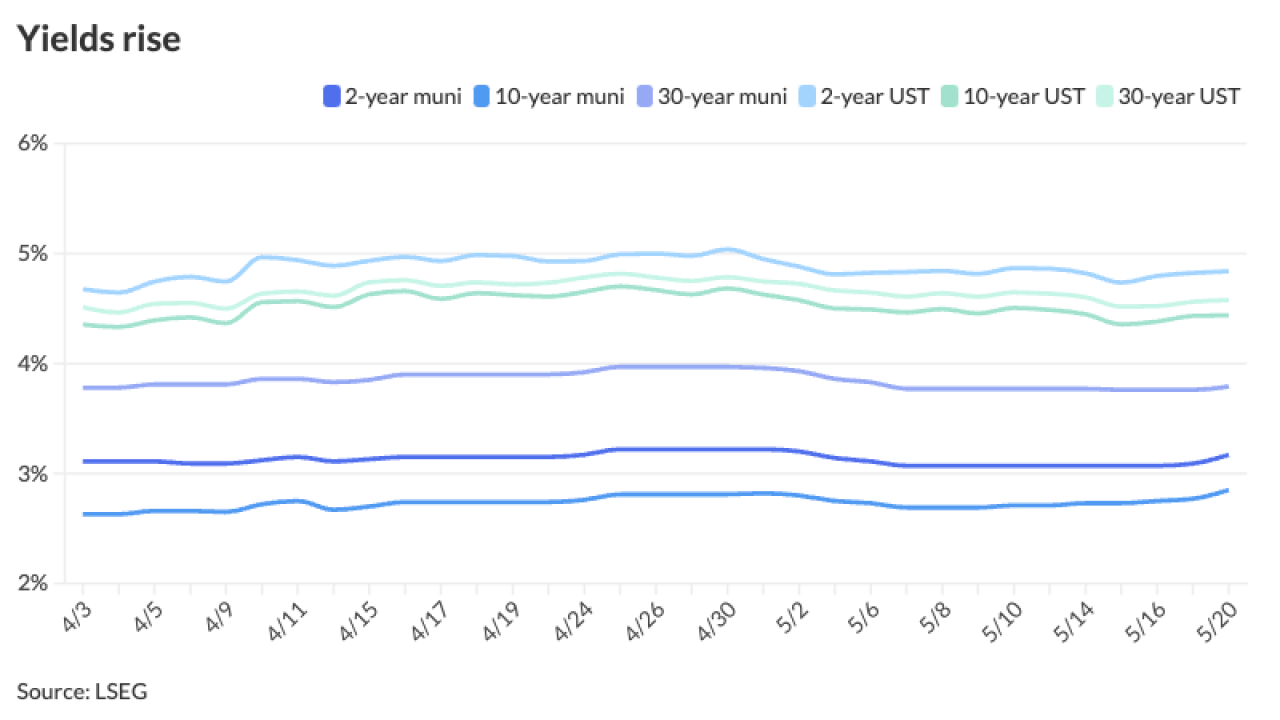

"For each May dating to 2021, the average 30-year MMD was 2.74% — or 122 basis points below the current yield," FHN Financial's Kim Olsan said. "The recent adjustment offers better investor value."

May 24 -

The majority of the debt sold for the state's community choice aggregators came through CCCFA, a conduit issuer that ranked third among all issuers nationwide for volume issued in 2023.

May 24 -

Municipal bond mutual funds saw the second week of outflows as investors pulled $217.6 million from the funds after $546.2 million of outflows the week prior, according to LSEG Lipper. High-yield saw inflows again.

May 23 -

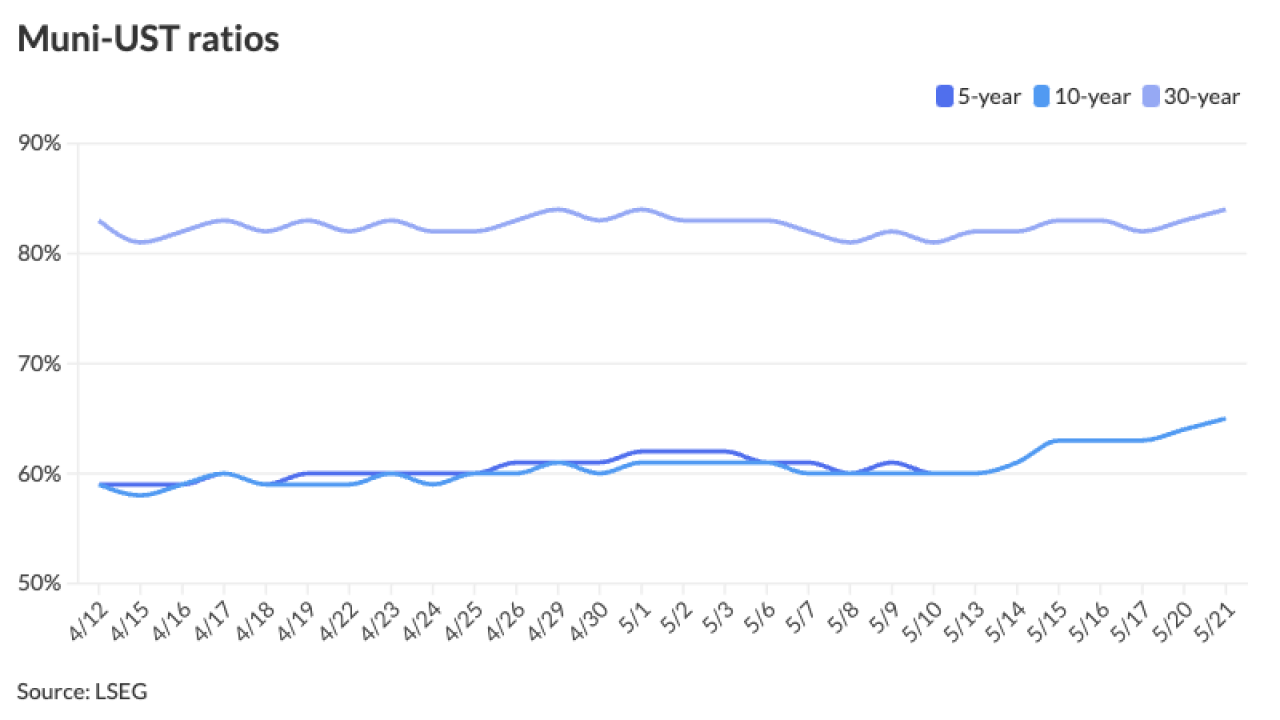

The ongoing influx of new-issue supply has pushed muni-UST ratios to at or near year-to-date highs, J.P. Morgan strategists said.

May 22 -

Mayor Brandon Johnson and Chicago's finance team talked up the Windy City's economy and talked up bond sale plans at an event for municipal bond investors.

May 22 -

Several weeks of elevated supply should theoretically be "weighing more on performance, but the market is now just ahead of its largest reinvestment season, which so far in 2024 has become even more pronounced, with an additional $19.5 billion scheduled for call/redemption between [June 1 and August 30]," said Matt Fabian, a partner at Municipal Market Analytics.

May 21 -

Fitch raised its rating on about $260 million of municipal bonds, backed by payments-in-lieu-of-taxes, from C — the lowest category before default — to CC.

May 21 -

"While we acknowledge that the market tone is weaker [Monday], we are generally constructive regarding valuations and expect this week's supply to be absorbed fairly well after last week's giveback of the richening witnessed over prior weeks," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

May 20 -

"The industry is built on relationships, and it's powered by technology," said Josh Rosenblum, head of algorithmic trading at Brownstone.

May 20 -

The $684 million turnpike deal is one of a spate of recent forward delivery deals driven by interest rate uncertainties.

May 20 -

The Virginia Beach Development Authority priced about $189 million of debt on Thursday with some of the bond proceeds financing portions if the attraction.

May 17 -

There are nearly 30 new-issues over $100 million on tap across the credit spectrum, led by the week's largest negotiated deal from Harris County, Texas, with $950 million of toll road first lien revenue and refunding bonds. The competitive calendar ticks up with several high-grade names.

May 17 -

"In terms of credit quality, high-yield funds proved resilient" while investment-grade funds saw outflows of $673 million, noted J.P. Morgan's Peter DeGroot in a market note.

May 16 -

Fitch Ratings cited new rating criteria and increases in state funding in giving Milwaukee a three-notch bond rating boost. The outlook is stable.

May 15 -

The CPI print keeps the possibility of the Fed cutting rates at least once this year, potentially at least two rate cuts if the data continues to point to a trend of inflation falling further, said Jeff Lipton, a research analyst and market strategist.

May 15 -

Catch up on our recent coverage of the various legal issues and considerations impacting BAB redemptions.

May 15