-

LIPA's prepares to go to market with new leadership as it prepares to decide on its next power supply management services provider.

August 5 -

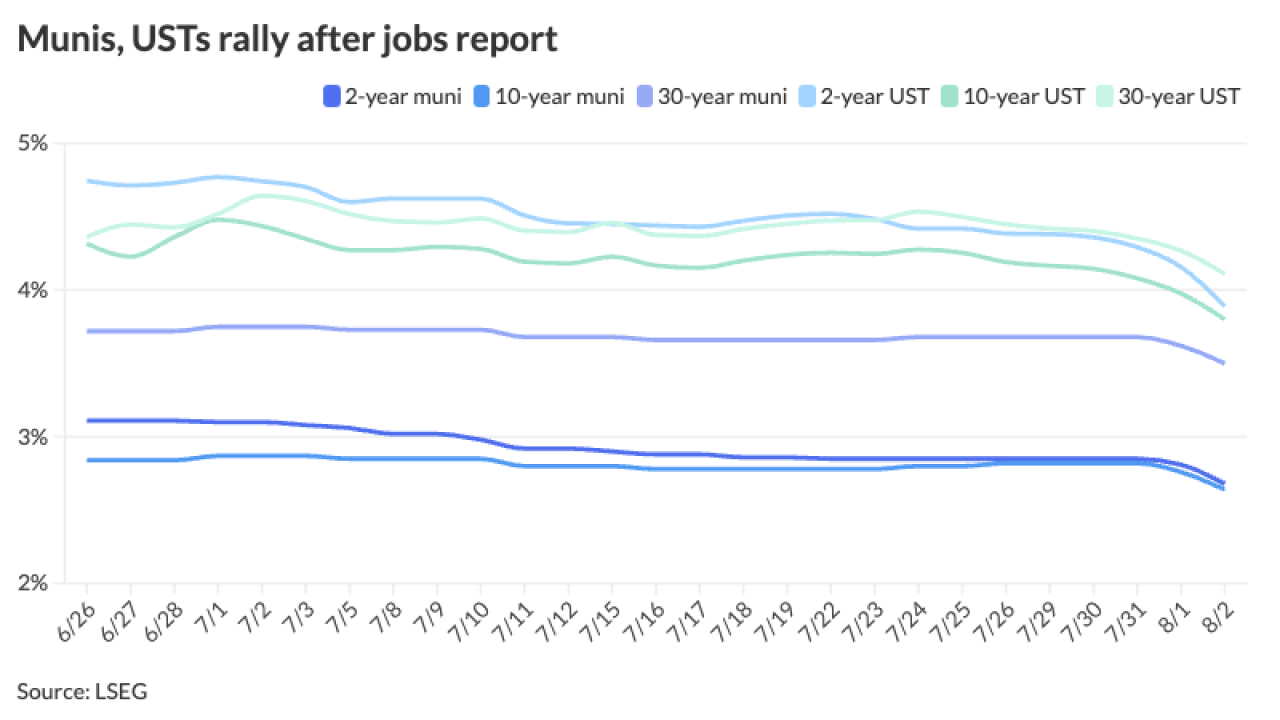

All eyes now turn to the September Federal Open Market Committee meeting where the Fed is expected to cut rates, but market participants are mixed on whether it will be a 25- or 50-basis-point cut.

August 2 -

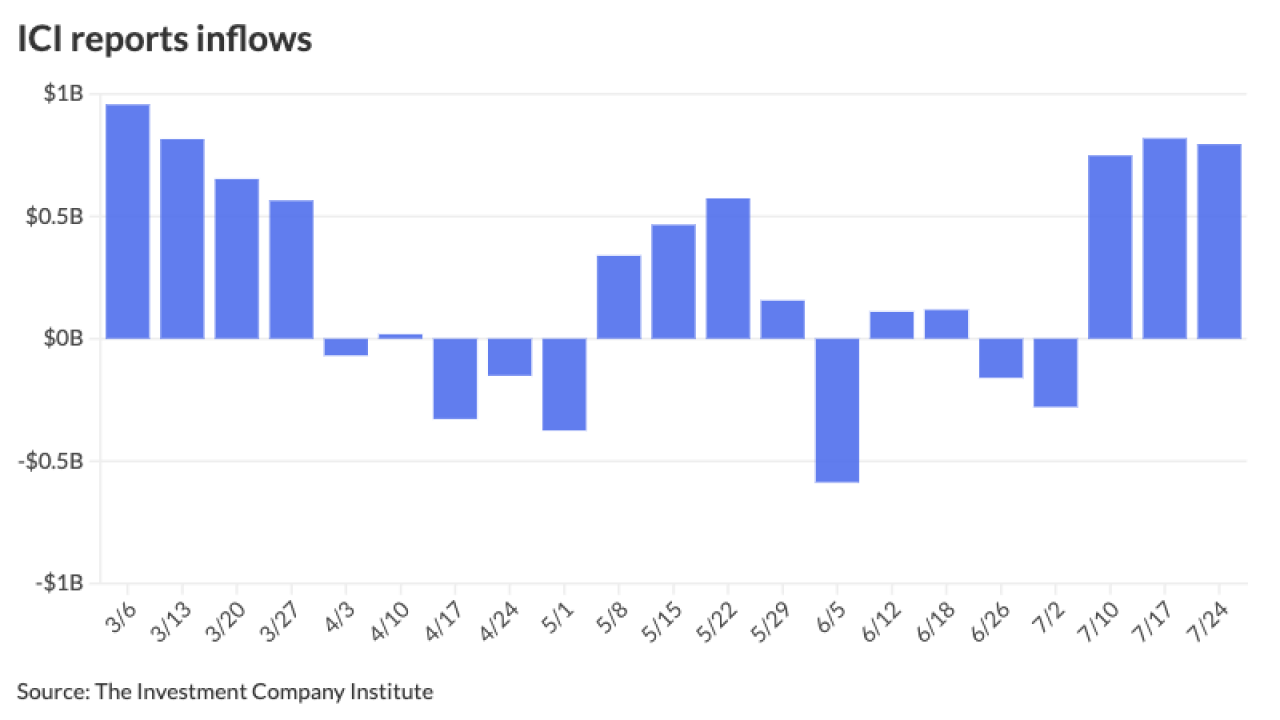

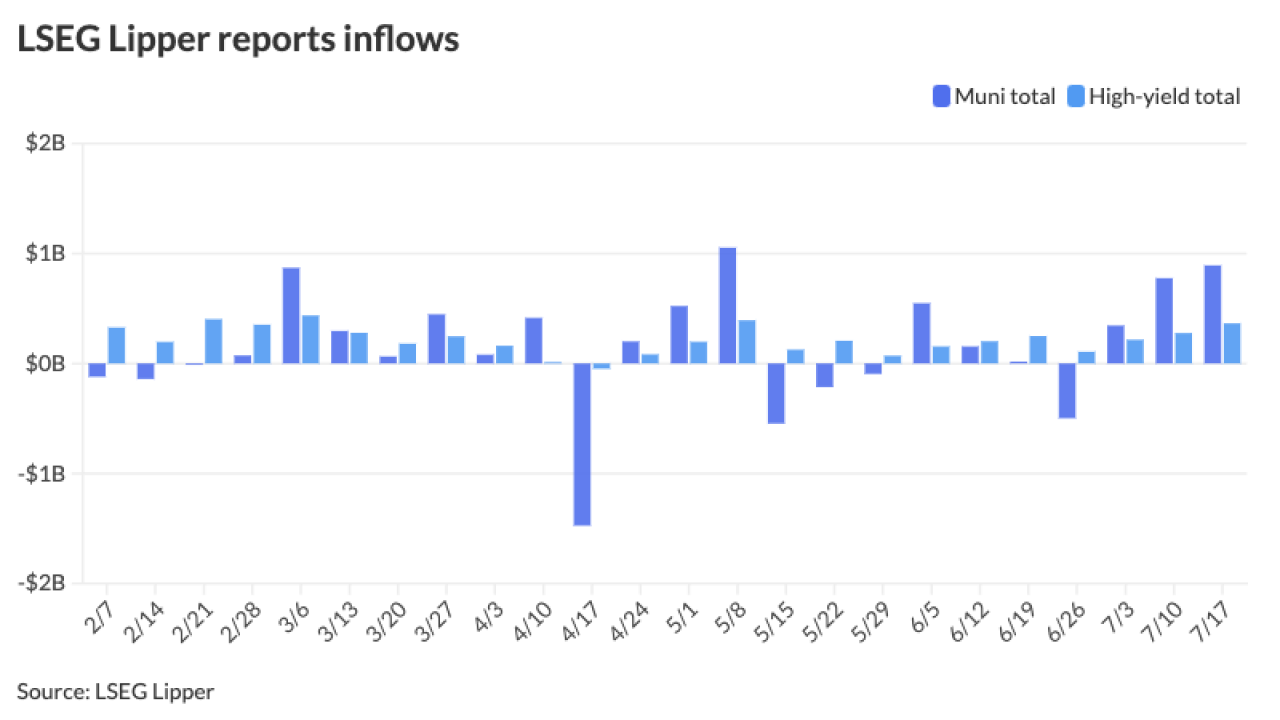

Municipal bond mutual funds saw inflows as investors added $1.112 billion to funds after $892.2 million of inflows the week prior, according to LSEG Lipper.

August 1 -

"The Fed remains data dependent as always, but it now appears that the 'more good data' bar is not as high as it was before, particularly with labor market developments becoming more important," said Michael Gregory, deputy chief economist at BMO Economics.

July 31 -

Yields may move lower after the Federal Reserve "communicates its goals to ease policy in coming meetings," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

July 30 -

Concerns have been raised about audits related to nearly $2.9 billion of ratepayer-backed bonds sold for Oklahoma utilities in 2022.

July 30 -

"The overall muni market appears to be in a good balance despite the hefty slate of primary issuance that has occurred over the past few months," Birch Creek Capital strategists said.

July 29 -

The muni market tends to have "remarkable patience" in relation to USTs, said BofA strategists.

July 26 -

Despite munis being mixed Thursday, the muni AAA yield curve remains inverted, said Taylor Huffman, a client portfolio manager at PTAM.

July 25 -

Local government investment pools remain free from SEC rules

July 25 -

"While supply has been outsized over the last several weeks, the market has also seen outsized reinvestment demand over the last several months," said Nuveen strategists.

July 24 -

This week again sees elevated supply, as issuance sits at $9.673 billion, with Tuesday being a very busy day.

July 23 -

The initial reaction was a little bit a flight-to-quality trade in rates, which is supportive of USTs and munis as safe-haven assets do well during times of uncertainty, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

July 22 -

The new-issue calendar is at $9.7 billion the week, led by the Texas Transportation Commission with $1.7 billion of first-tier and second-tier revenue refunding bonds.

July 19 -

Municipal bond mutual funds saw inflows as investors added $891.4 million to funds after $775.3 million of inflows the week prior, according to LSEG Lipper.

July 18 -

Single party control of a state eases perception of bond default risk associated with laws like Chapter 9, a study found.

July 18 -

Issuance has remained robust over the past two weeks, with Wednesday being a particularly busy day.

July 17 -

Volume is predicted to continue at "robust levels," possibly through the fourth quarter, said Matt Fabian, a partner at Municipal Market Analytics.

July 16 -

With the reputational stain from the county's 1994 bankruptcy long in the rearview mirror, the southern California county had its rating boosted to the highest rating by S&P Global Ratings.

July 16 -

Financial markets are trying to "absorb" the outcome of higher odds of Trump winning in November, said James Pruskowski, chief investment officer at 16Rock Asset Management.

July 15