-

Barclays rate strategists believe the 10-year part of the Treasury curve has room to cheapen. "In that case, tax-exempts will likely not only follow, but underperform."

August 16 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

August 15 -

Long-term liabilities have gone down and revenues have gone up, Fitch said.

August 15 -

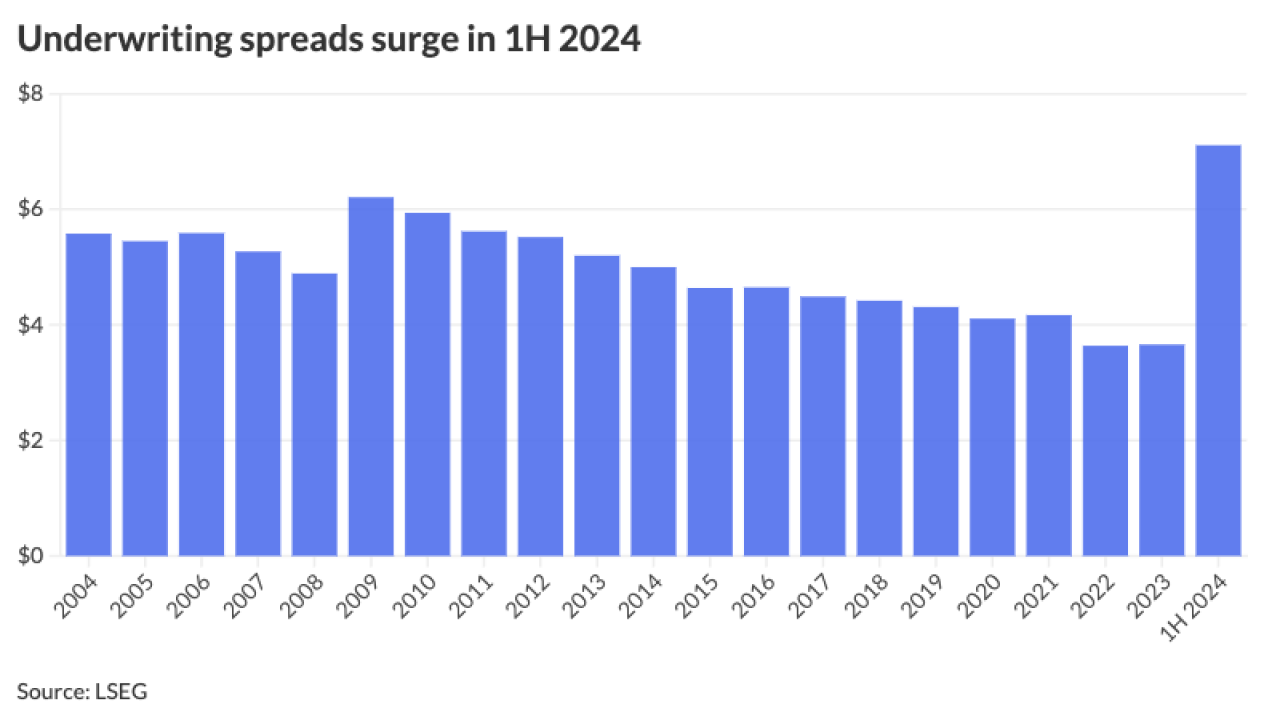

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

August 14 -

Moody's sees strength in New Jersey's economy and governance.

August 14 -

"There's an important 'date certain' the market may overreact to, but by and large, [this] week is looking positive given a lighter new- issue calendar," said AllianceBernstein strategists.

August 13 -

Dallas Fort Worth International Airport received a S&P rating upgrade and a positive rating outlook from Moody's ahead of a $750 million bond sale next week.

August 13 -

Detroit-based Wayne State University will return to market with $31.7 million of general revenue refunding bonds, with proceeds refunding outstanding bonds.

August 13 -

A new classification scheme would allow market participants, both on the buy and sell sides, to correctly identify the source and nature of credit risk in their holdings and to aggregate such risk into meaningful sectors that share common risk drivers.

August 13 DPC Data

DPC Data -

"After a long-period of muni yields not being that attractive relative to corporates, that's starting to shift," Charles Schwab's Cooper Howard said.

August 12 -

The private Massachusetts college is partnering with the Collegiate Housing Foundation to address a good problem for a Northeast school to have: rising demand.

August 12 -

Muni returns so far in August are in the black, with the Bloomberg Municipal Index at 0.53% this month and 1.04% year to date. High-yield continues to outperform with returns at 0.68% in August and 5.99% in 2024.

August 9 -

In an environment characterized by dwindling enrollment, slowing revenues, and the end of COVID-19 federal aid, small private universities are struggling to remain afloat.

August 9 -

California and Oregon are experiencing yet another record-setting year of wildfires amid increasing uncertainty about FEMA and property insurance backstops.

August 9 -

The past several trading sessions have seen "crazy volatility," said Jennifer Johnston, director of research of municipal bonds at Franklin Templeton.

August 8 -

The state bond commission approved Wells Fargo, Bank of America and JPMorgan as part of an underwriting pool Louisiana can hire on debt deals.

August 8 -

Thursday's pricing of senior revenue bonds comes after Fitch Ratings upgraded the airport's subordinate debt.

August 8 -

Recent events have been a "roundtrip" for rates, starting with the sentiment shifting from slowing inflation to a softening labor market, said James Pruskowski, chief investment officer at 16Rock Asset Management.

August 7 -

This week's new-issue calendar will be "outsized," said Anders S. Persson, Nuveen's chief investment officer for global fixed-income, and Daniel J. Close, Nuveen's head of municipals.

August 6