-

The product is designed to give SOLVE's customers visibility into "next-trade" pricing data for more than 900,000 munis.

September 19 -

After getting positive outlooks from three rating agencies since 2023, Oklahoma received its first upgrade.

September 19 -

The agency cited a sustained commitment to healthy reserves and structural balance.

September 19 -

The city of Clyde defaulted in August and recently revealed it used debt proceeds for debt payments in a manner that "disguised the deficit cash flow."

September 19 -

The record pace of municipal bond supply this year is driven in part by cities and states realizing projects won't get any cheaper if they wait.

September 19 -

The competitive sale comes as the market prepares for a very New York-heavy week next week in the primary.

September 18 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Fed rate cuts "should lead to positive price action for both taxable and tax-exempt bonds, and current nominal yields remain well above where they were when the Fed was more dovish, implying generous room to rally from here," said Matt Fabian, a partner at Municipal Market Analytics, Inc.

September 17 -

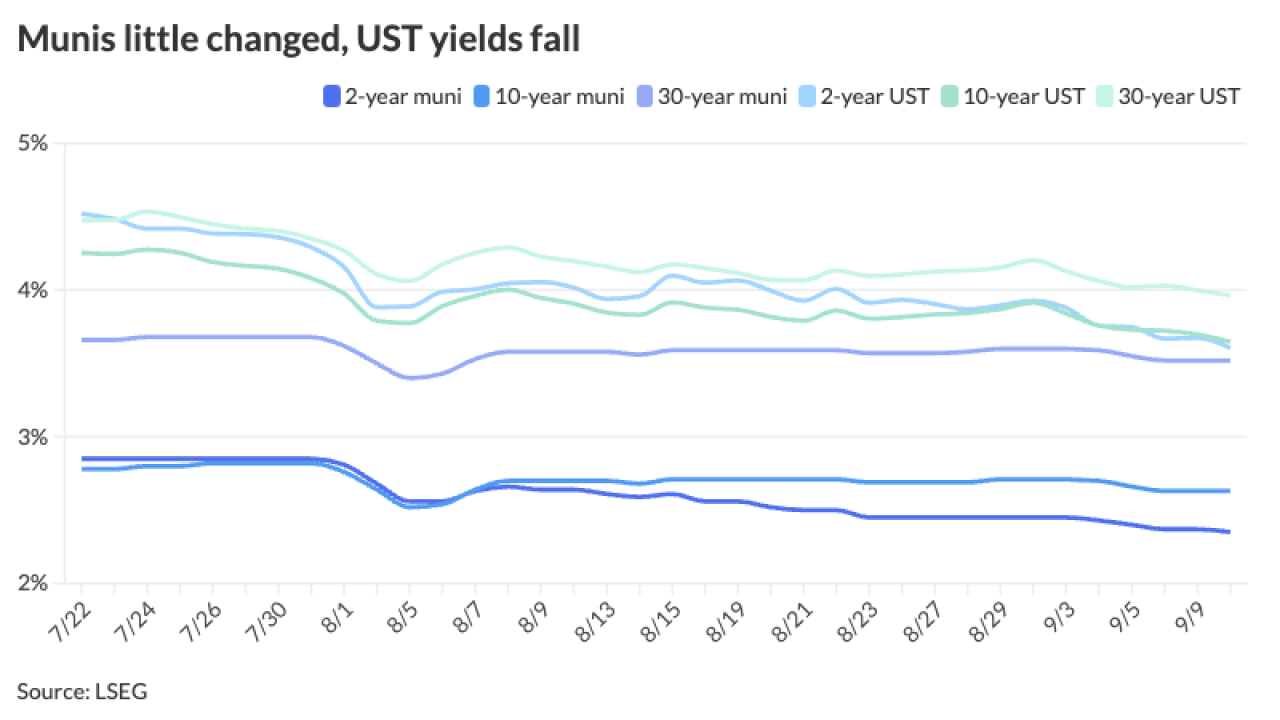

Despite the underperformance to USTs, munis saw positive momentum during the first two weeks of September with the asset class returning 0.68% so far this month and 1.99% year-to-date.

September 16 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

Moodys says it is placing additional weight on the states' Aaa ratings in determining the Garvee ratings.

September 12 -

The commission approved $73 million of limited obligation bonds for Rowan County schools.

September 12 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Fitch also upgraded the city's Georgia Municipal Association certificates of participation (city of Atlanta public safety projects) to AA-plus from AA.

September 10 -

Stagnant per-pupil state funding amid rising costs led to budget deficits, lower reserves, and ballot proposals to raise property tax rates for some districts.

September 10 -

"Despite the underperformance of tax-exempt yields last week, we could see some more pressure on both spreads and ratios due to the heavy supply calendar," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

September 9 -

Piper Sandler has hired Joe Kinder and Brent Blevins as managing directors on its public finance team. Both will focus on Missouri school districts and issuers.

September 9 -

Massachusetts drew multiple bidders for all four tranches when it sold $850 million of general obligation bonds competitively last week.

September 9