-

Underperforming since the calendar turned, "munis have continued to cheapen over the past three weeks as Treasury returns are about flat for the year while munis are down 0.31%," said Jason Wong, vice president of municipals at AmeriVet Securities.

January 21 -

The Los Angeles-area wildfires have sparked a negative rating watch for several credits from Fitch Ratings.

January 17 -

The Regents of the University of California leads the negotiated calendar with $2 billion of general revenue refunding bonds.

January 17 -

With losses expected to be measured in the tens or hundreds of billions, the municipal finance industry begins to take stock of the Los Angeles-area wildfires.

January 17 -

Munis "responded in part to a better UST session [Wednesday] but weren't in a position from a supply standpoint to attempt to match the 10-15 basis point rally in taxables," said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

January 16 -

The bonds — $824.8 million tax-exempt and $400 million taxable — follow Orlando Health's major acquisitions of hospitals in Alabama and Florida.

January 16 -

The Fed may make more cuts and there's a floor forming under the Treasury market, per panelists at the Executives' Club of Chicago's Annual Economic Outlook.

January 15 -

Municipals are underperforming USTs month-to-date, with the Bloomberg Municipal Index showing losses of 1.02% versus 0.92% for USTs as of Tuesday, but both are outperforming losses in corporates that are seeing 1.23% losses in January.

January 15 -

S&P Global Ratings downgraded Chicago's general obligation debt to BBB from BBB-plus, saying the 2025 budget fails to address a structural imbalance.

January 15 -

"Even though it will be priced to sell, such large supply in one week may be a struggle for the asset class," said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

January 14 -

Trading in Los Angeles credits has become more volatile. An L.A. Department of Water and Power deal slated for Wednesday went day-to-day.

January 14 -

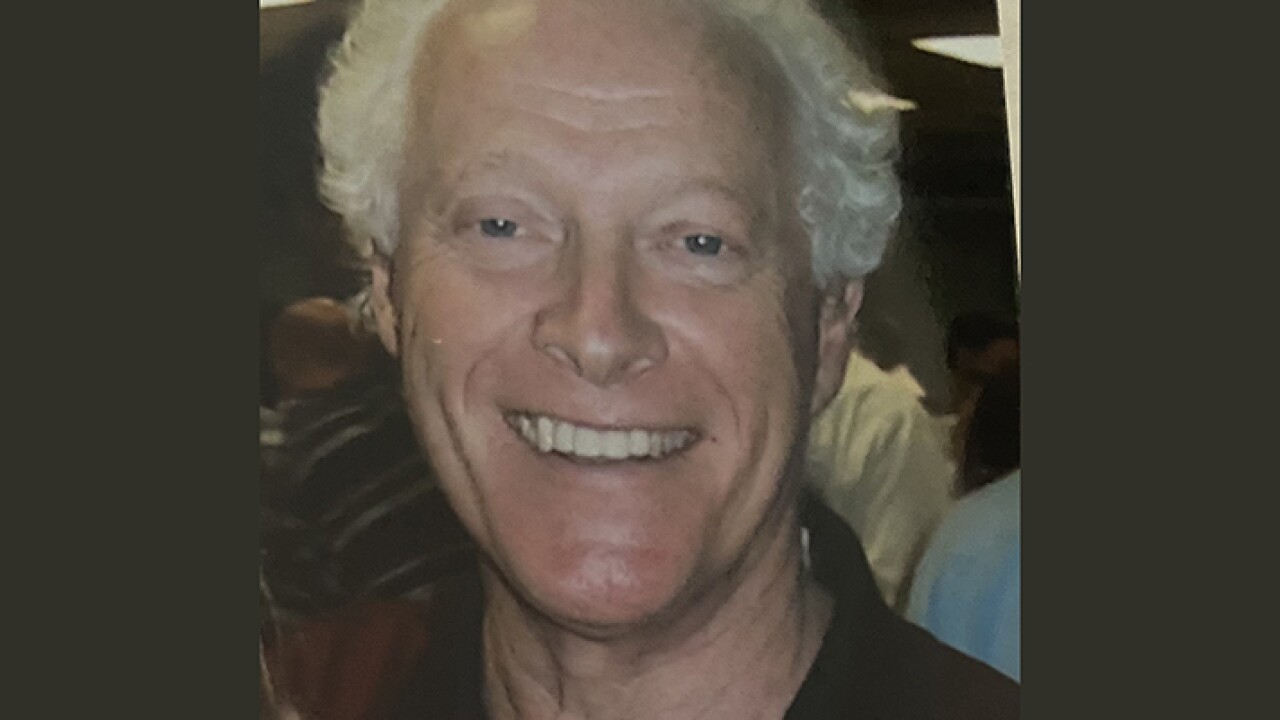

Williams, a former salesman and founder of A. H. Williams & Co., became a "giant" in the Pennsylvania muni world through relationships built on trust.

January 13 -

The muni market also faces an elevated new-issue calendar, which may put additional pressure on muni yields. Bond Buyer 30-day visible supply sits at $17.57 billion.

January 13 -

"It is the first step but that doesn't mean there's a second step," said John Bagley, the MSRB's chief market structure officer.

January 13 -

The billion-dollar deal will be the first bonds backed by the tax since it was created in 2019.

January 13 -

"'The market environment will likely become a bit more difficult in the coming week, as supply will jump to its highest level in weeks, while dealers are heavier than average," said Mikhail Foux, head of municipal research and strategy at Barclays.

January 10 -

The management team sees opportunity in pockets that other investors avoid, like American Dream, Midwestern private colleges and senior living facilities.

January 10 -

The rating agency said the district's strong management helped boost its ratings ahead of an $806 million bond issuance slated for Jan. 22.

January 10 -

Analysts cited growth in the county's reserves, conservative budgeting and strong sales tax revenue as the county prepares to sell GO bonds.

January 9 -

Sizable deals for next week include $1.3 billion of real estate transfer tax revenue bonds from the Triborough Bridge and Tunnel Authority and $996.335 million of second series revenue bonds from the San Francisco International Airport.

January 9