-

"There are a lot of moving parts here with the potential to either help or hinder the Fed's quest for price stability and maximum employment" this year, noted BMO Deputy Chief Economist Michael Gregory, who says the Fed will "stand pat."

January 28 -

Tech stocks suffered on "worries that Beijing is becoming increasingly competitive in the high-stakes artificial intelligence race," said José Torres, senior economist at Interactive Brokers.

January 27 -

The Massachusetts Clean Water Trust has seen higher demand from local utilities for loans because of climate change threats and clean water regulations.

January 27 -

Kroll Bond Rating Agency downgraded Chicago's general obligation bonds to A-minus from A, citing high fixed costs and one-time fixes. The outlook is negative.

January 27 -

Issuance for next week falls to an estimated $5.151 billion, with $3.959 billion of negotiated deals and $1.193 billion of competitive deals on tap.

January 24 -

Investors added $2.028 billion to municipal bond mutual funds in the week ending Wednesday, following $251.7 million of outflows the prior week, according to LSEG Lipper data.

January 23 -

Issuance was led by a $2 billion retail pricing from the University of California in the negotiated market and a $1.2 billion competitive deal from Washington.

January 22 -

Broker-dealer Siebert Williams Shank's foundation donated $100,000 to two organizations aiding Los Angeles-area residents affected by the wildfires.

January 22 -

Underperforming since the calendar turned, "munis have continued to cheapen over the past three weeks as Treasury returns are about flat for the year while munis are down 0.31%," said Jason Wong, vice president of municipals at AmeriVet Securities.

January 21 -

The Los Angeles-area wildfires have sparked a negative rating watch for several credits from Fitch Ratings.

January 17 -

The Regents of the University of California leads the negotiated calendar with $2 billion of general revenue refunding bonds.

January 17 -

With losses expected to be measured in the tens or hundreds of billions, the municipal finance industry begins to take stock of the Los Angeles-area wildfires.

January 17 -

Munis "responded in part to a better UST session [Wednesday] but weren't in a position from a supply standpoint to attempt to match the 10-15 basis point rally in taxables," said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

January 16 -

The bonds — $824.8 million tax-exempt and $400 million taxable — follow Orlando Health's major acquisitions of hospitals in Alabama and Florida.

January 16 -

The Fed may make more cuts and there's a floor forming under the Treasury market, per panelists at the Executives' Club of Chicago's Annual Economic Outlook.

January 15 -

Municipals are underperforming USTs month-to-date, with the Bloomberg Municipal Index showing losses of 1.02% versus 0.92% for USTs as of Tuesday, but both are outperforming losses in corporates that are seeing 1.23% losses in January.

January 15 -

S&P Global Ratings downgraded Chicago's general obligation debt to BBB from BBB-plus, saying the 2025 budget fails to address a structural imbalance.

January 15 -

"Even though it will be priced to sell, such large supply in one week may be a struggle for the asset class," said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

January 14 -

Trading in Los Angeles credits has become more volatile. An L.A. Department of Water and Power deal slated for Wednesday went day-to-day.

January 14 -

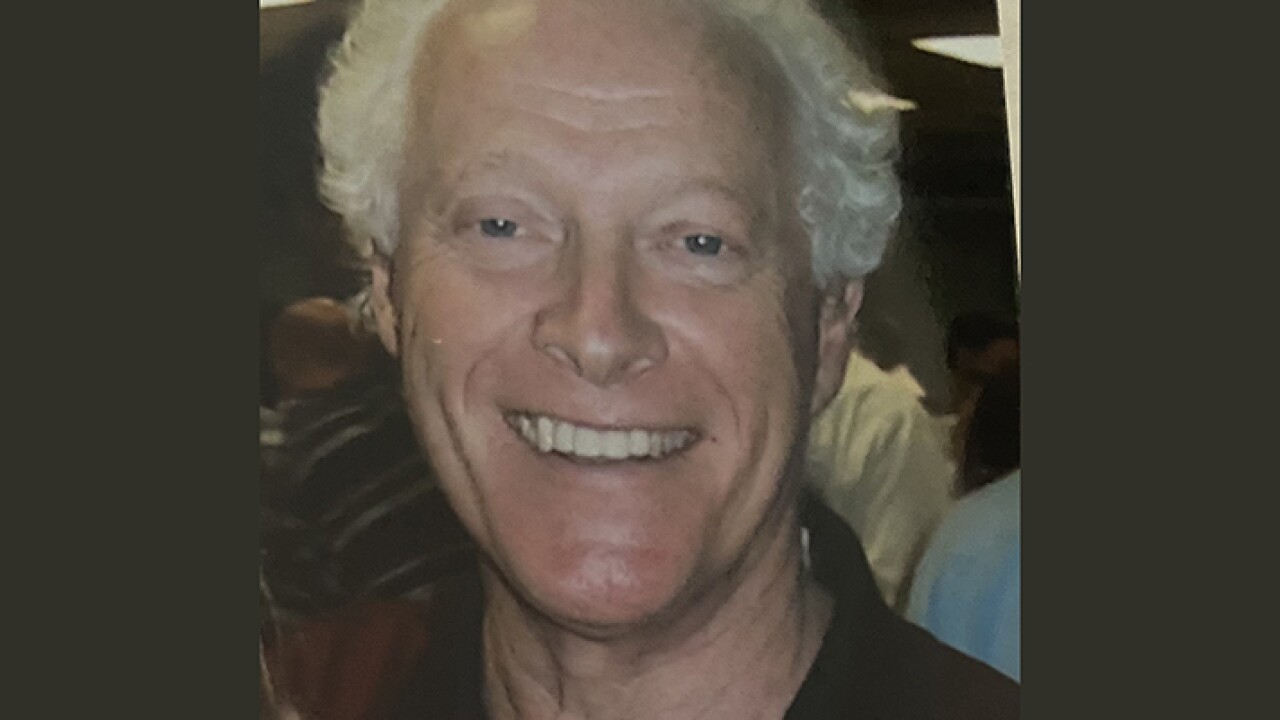

Williams, a former salesman and founder of A. H. Williams & Co., became a "giant" in the Pennsylvania muni world through relationships built on trust.

January 13