-

Bank of America and Wells Fargo will lead underwriting for $1.8 billion of sales tax and revenue bonds issued through the Kansas Development Finance Authority.

January 8 -

The Nashville Metropolitan Airport Authority is issuing municipal bonds to finance upgrades to an airport bulging at the seams after rapid traffic growth.

January 8 -

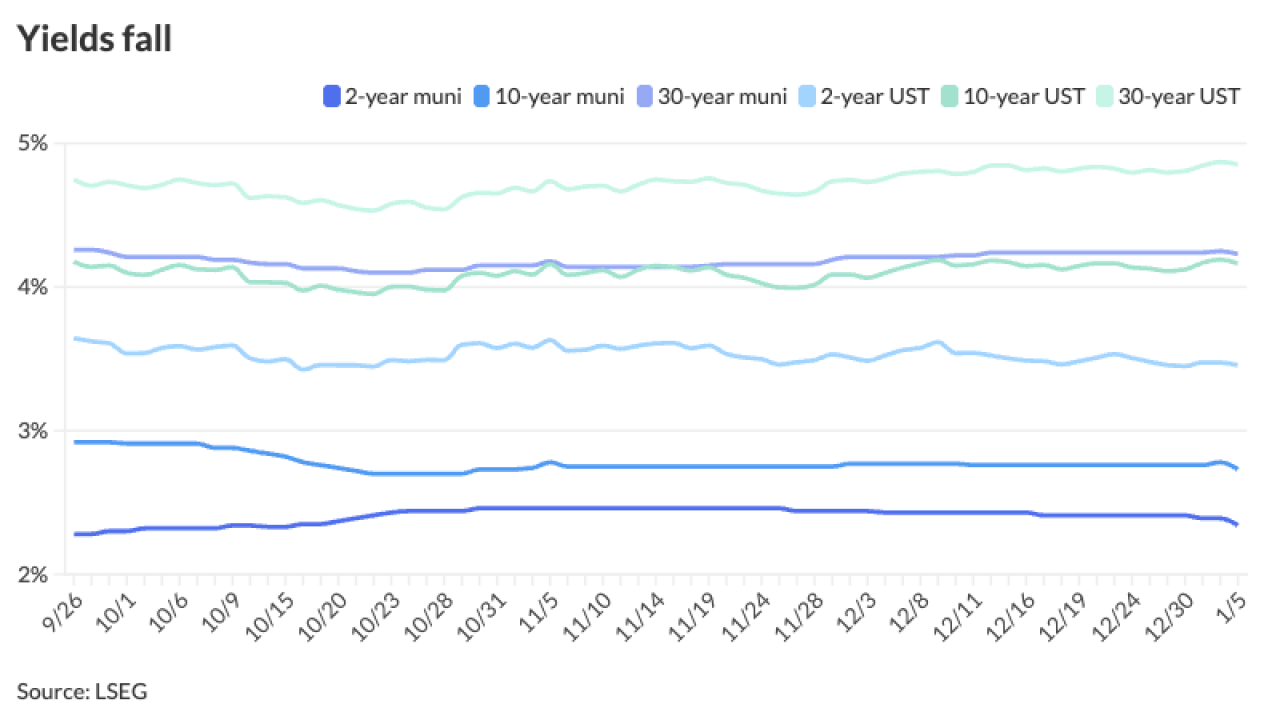

Surprisingly, the expected surge in net supply last year did not elicit a major repricing in the muni market, said Pat Luby, head of municipal strategy at CreditSights.

January 7 -

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

January 7 The Bond Buyer

The Bond Buyer -

Confidence in the muni market is "well placed," said Matt Fabian, president of Municipal Market Analytics.

January 6 -

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

January 6 The Bond Buyer

The Bond Buyer -

Improved risk sentiment after the capture of Venezuelan President Nicolás Maduro helped pull investors into all markets and munis are a "beneficiary" of that shift, said James Pruskowski, an investor and market strategist.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

With the muni calendar "heating up" ahead of another projected year of record issuance, Jeff Lipton, The Bond Buyer's market intelligence strategist, expects "investor demand to comfortably digest the new supply given reinvestment needs and compelling yield and income opportunities."

January 2 -

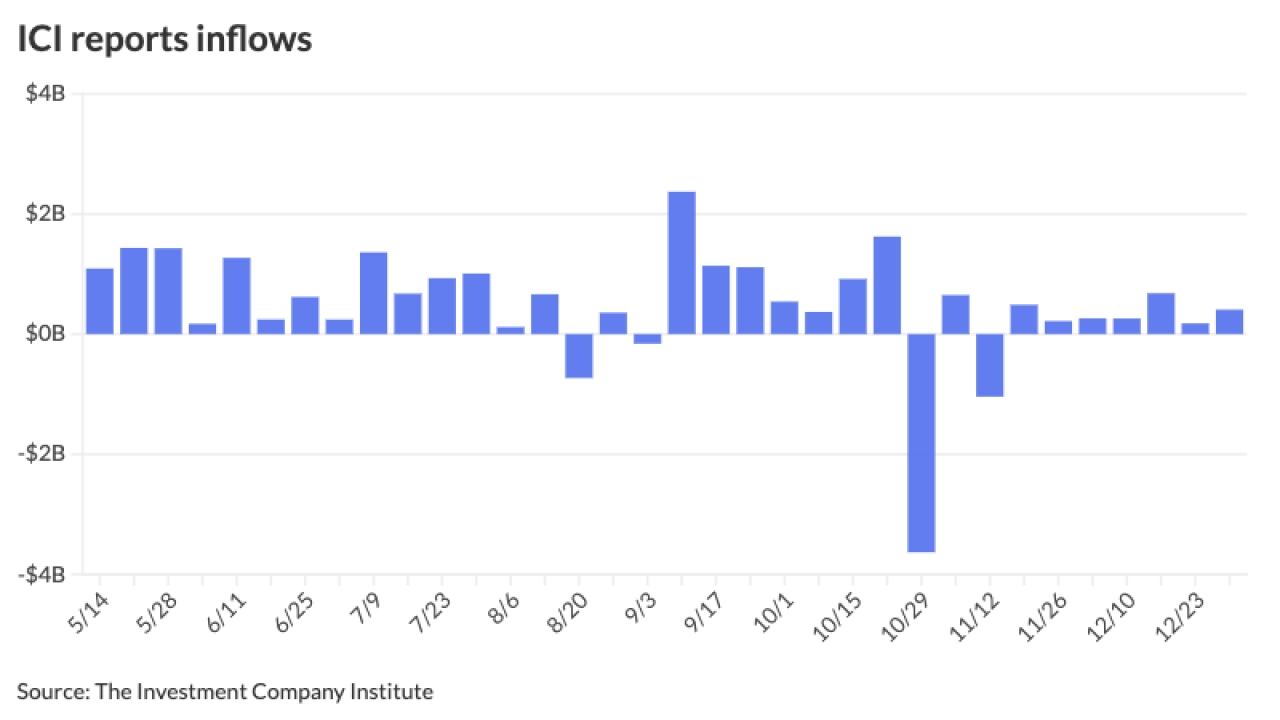

Municipal bond issuers are on tap to sell about $6 billion of new issues in early January, but there should be plenty of money from maturing issues and interest payments to easily absorb that amount, as well as volume going forward, says Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

December 31 -

Fitch Ratings downgraded Nebraska's Regional West Health Services by two notches, lowering its long-term issuer default rating to CCC from B-minus.

December 31 -

The Federal Open Market Committee meeting minutes showed the decision was closer than the vote indicated, with "a few" voters suggesting they would have supported no change at the meeting.

December 30 -

"The upgrade to Baa3 recognizes the city's fiscal stability under the current casino taxation format," as well as rapid debt defeasance, the rating agency said.

December 30 -

The Alaska IDEA's $75M notes were rated AA-plus by S&P, which cited strong financials.

December 30 -

The muni credit market has experienced headwinds this year, including "potential federal funding cuts, the impact of tariffs and sector-specific pressures," said Goldman Sachs strategists

December 29 -

Moody's Ratings upgraded the Rhode Island Airport Corporation's airport revenue bonds for Providence's T.F. Green International Airport to A3 from Baa1.

December 29 -

The muni bond market stands at an "inflection point," said Nuveen strategists in a 2026 market outlook.

December 26 -

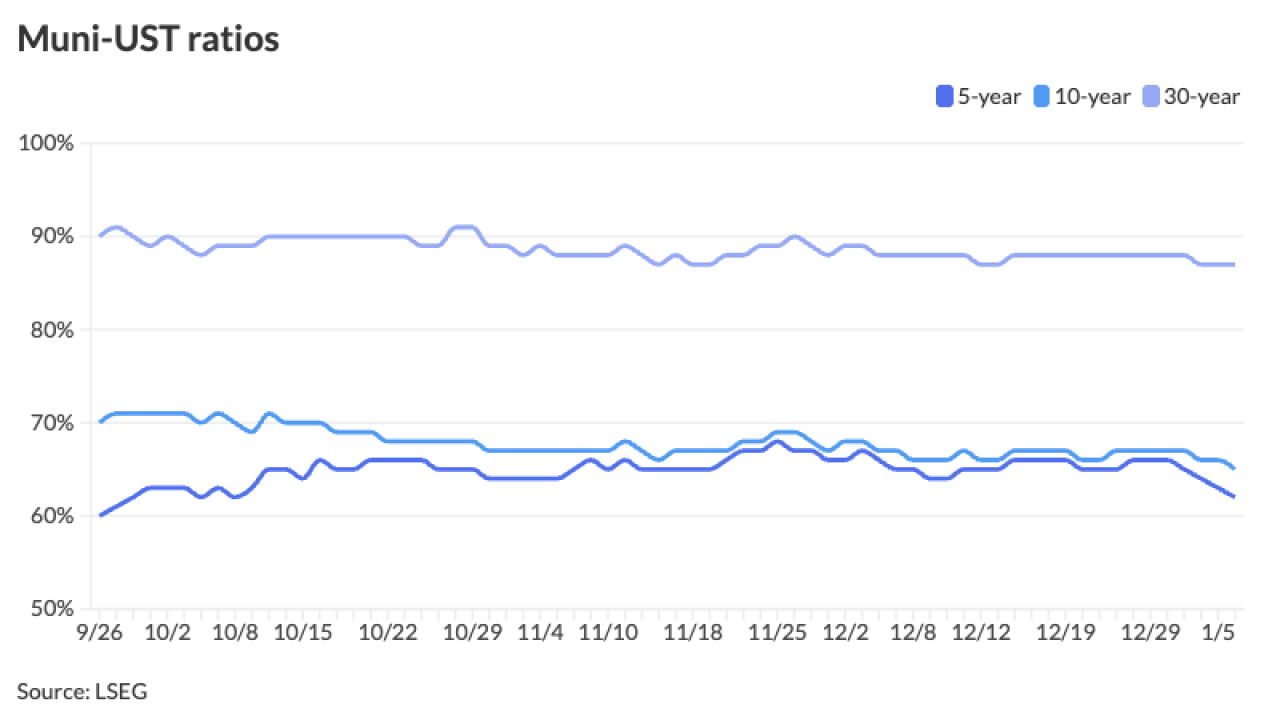

"A stagnant yield curve is resulting from supply having wound down and munis drawing steadiness from a likewise calm UST market," said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

December 24 -

Moody's Ratings upgraded the Chicago Transit Authority to Aa3 from A1 Friday, and upgraded the Chicago-area Regional Transportation Authority to Aa2 from Aa3.

December 24 -

It was a "confusing, volatile year, and the states face growing threats in 2026 and thereafter," said Matt Fabian, president of Municipal Market Analytics.

December 23