-

The new-issue calendar is led by Washington with $1.3 billion of GOs selling by competitive bid in three series.

4h ago -

Longer-term bonds could ease financial pressure for Sound Transit's $54 billion long-range plans.

February 6 -

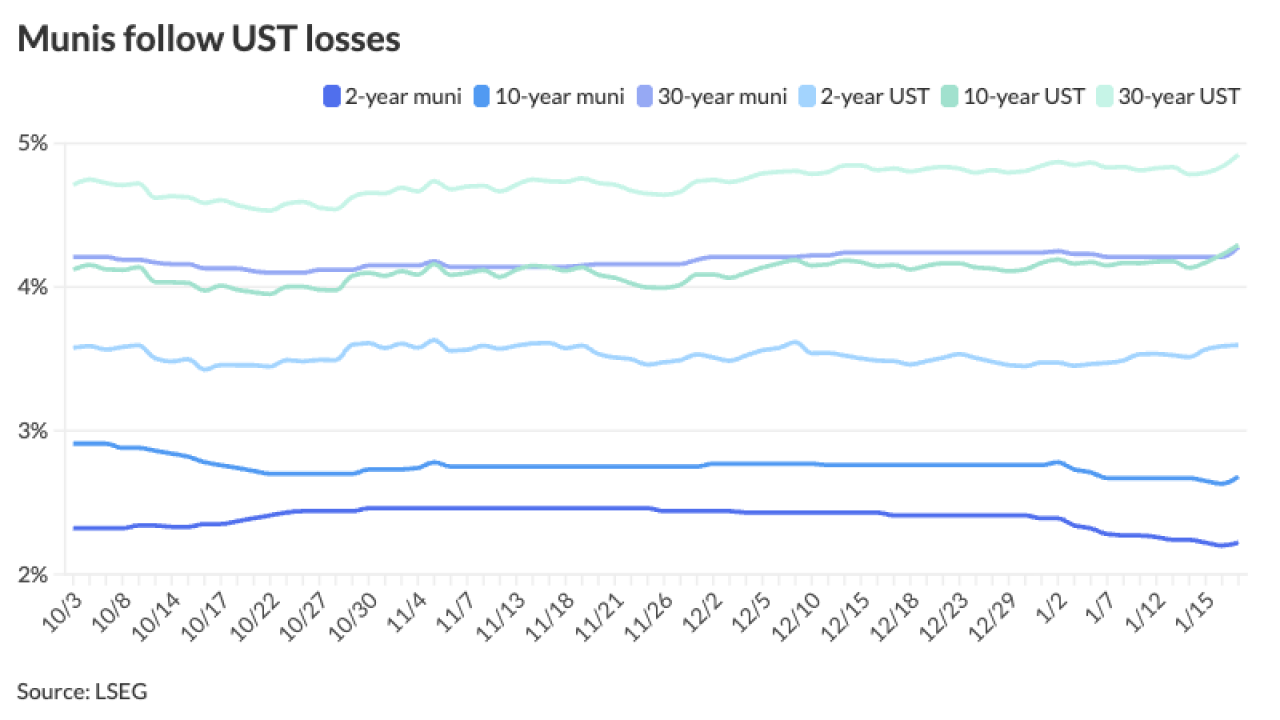

Munis enter this year with "strong credit fundamentals, elevated tax-equivalent yields, and a steeper curve that supports duration extension," said James Welch, municipal portfolio manager at Principal Asset Management.

February 5 -

Yields have seen "intermittent volatility from broader macro and geopolitical crosscurrents, keeping sentiment cautious despite relatively muted headline moves," said James Pruskowski, managing director at Hennion & Walsh.

February 4 -

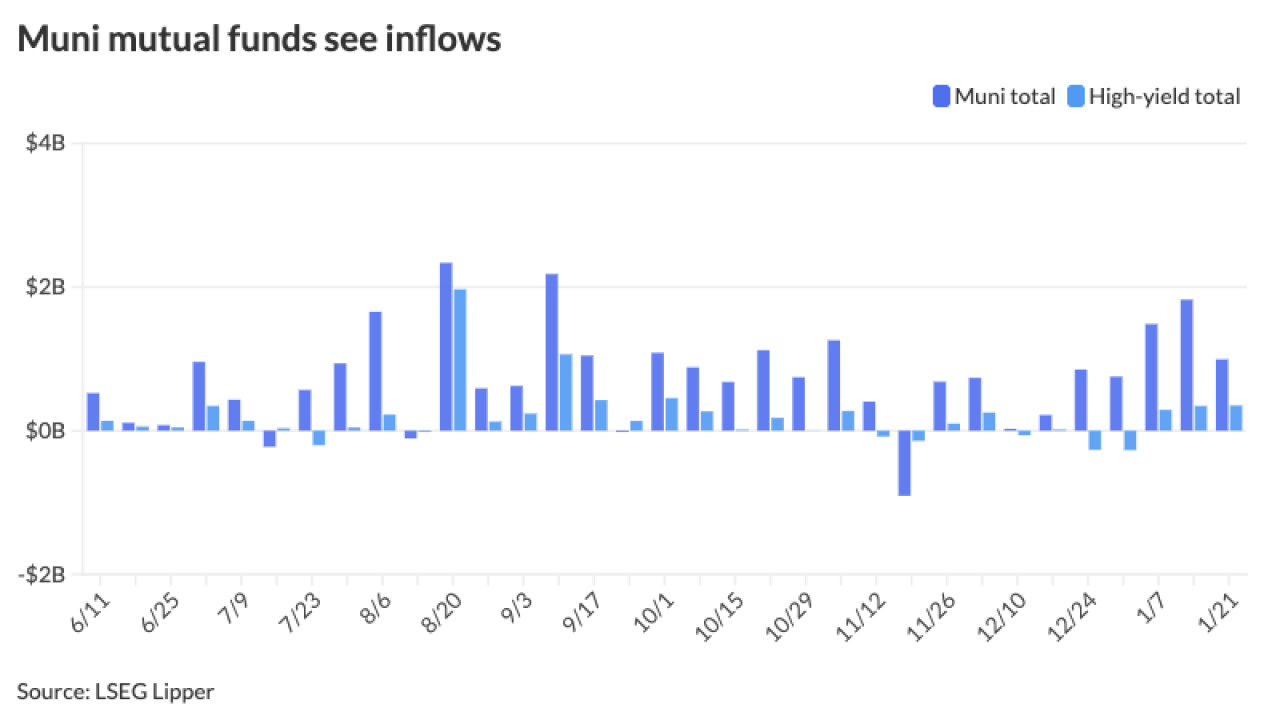

Supply should be "well-received, given strong inflows and the increase in reinvestment capital for the new month," said Chris Brigati, managing director and CIO at SWBC, and Ryan Riffe, senior vice president of capital markets at the firm.

February 3 -

Market Intelligence analyst Jeff Lipton analyzes how varied state funding priorities and overall charter school support, shifting enrollment patterns, policy uncertainty, charter renewal risk, and varied pension practices affect charter school bond security—and outlines what issuers, advisors and investors should be communicating to the market.

February 3 -

Moody's Ratings downgraded Parkview Health System's revenue bond rating one notch, to A1 from Aa3, on Friday. It also revised the outlook to stable.

February 2 -

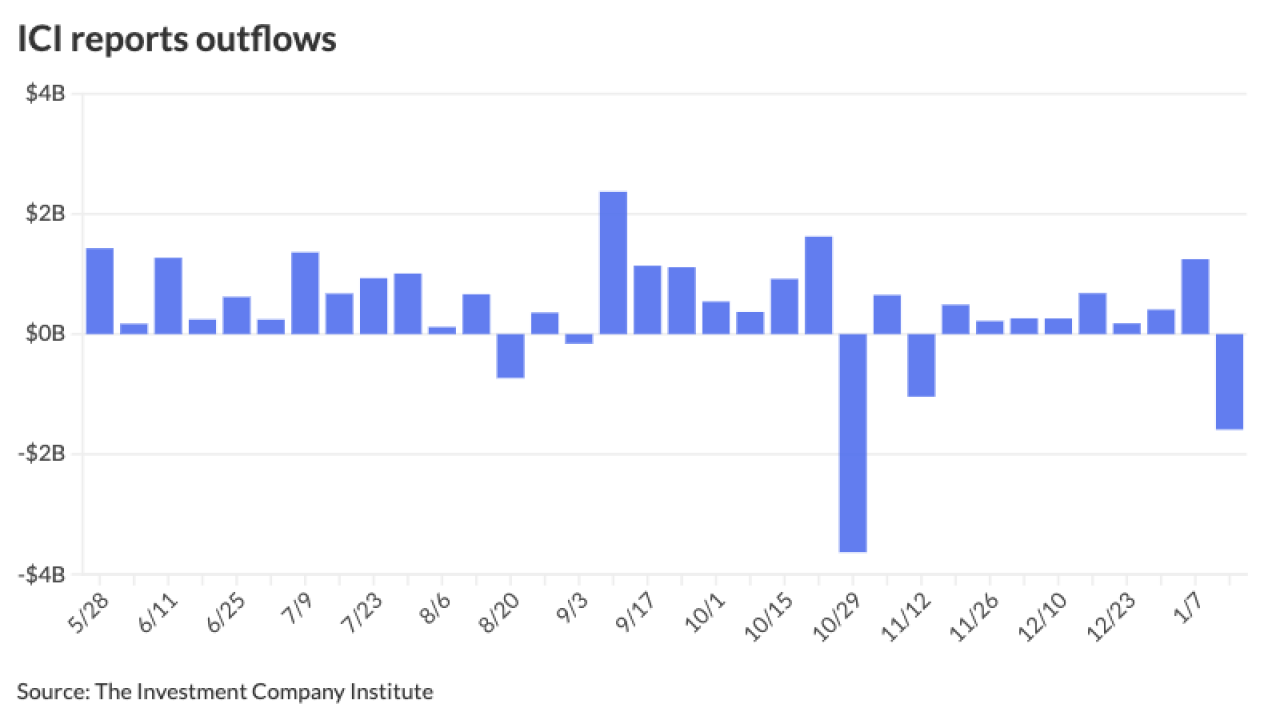

The market is well-positioned for February, after January's near-record tax-exempt supply, said J.P. Morgan strategists led by Peter DeGroot.

February 2 -

Munis were largely unchanged this week and tax-exempts continue to be "quite unattractive" at current levels, said Barclays strategists led by Mikhail Foux.

January 30 -

Over the past five years, January has seen a relatively stable market tone, said Jeff Timlin, managing partner and head of municipal bond investing at Sage Advisory.

January 29 -

"Markets are reading this as a strategic pause, not a policy shift," said Gina Bolvin, president of Bolvin Wealth Management Group.

January 28 -

Downgrades of three private universities in the Northeast reflect enrollment pressures facing the higher education sector, particularly in that region.

January 28 -

The muni market has rebounded from the technical pressures of the first half of last year — a result of surging issuance — said John Miller, head and CIO of First Eagle's municipal credit team.

January 27 -

Chicago general obligation bond prices have dropped sharply since the start of the year, according to the Center for Municipal Finance's muni indices.

January 27 -

After Ken Paxton's opinion said giving preferences based on sex or race is unconstitutional, his office set a new certification requirement for bond issuers.

January 27 -

Munis were steady Monday following the large cuts the asset class saw last week, specifically on Tuesday, Jan. 20.

January 26 -

Munis were the best-performing U.S. fixed-income asset class through the first three weeks of January, but the strong performance has created some problems, Barclays strategists said.

January 23 -

"Of all these headlines, there's no direct concern for the muni market or municipal issuers. It's just tangential concerns of what this does for the economy and rates," said Brad Libby, fixed income credit analyst at Wellington Management and a fixed income portfolio manager with Hartford Funds.

January 22 -

Current events and financial developments outside of the muni sector mean that investors should hold off buying munis until rates correct, said Matt Fabian, president of Municipal Market Analytics.

January 21 -

The rates market is "on edge" as global fiscal and geopolitical pressures collide, said James Pruskowski, managing director at Hennion & Walsh.

January 20