-

July volume was $31.9 billion keeping the annual pace ahead of last year's record-breaking total. Issuance still lags demand by a large amount — $60 billion by many accounts for August alone — as redemptions coupon payments pile up.

July 30 -

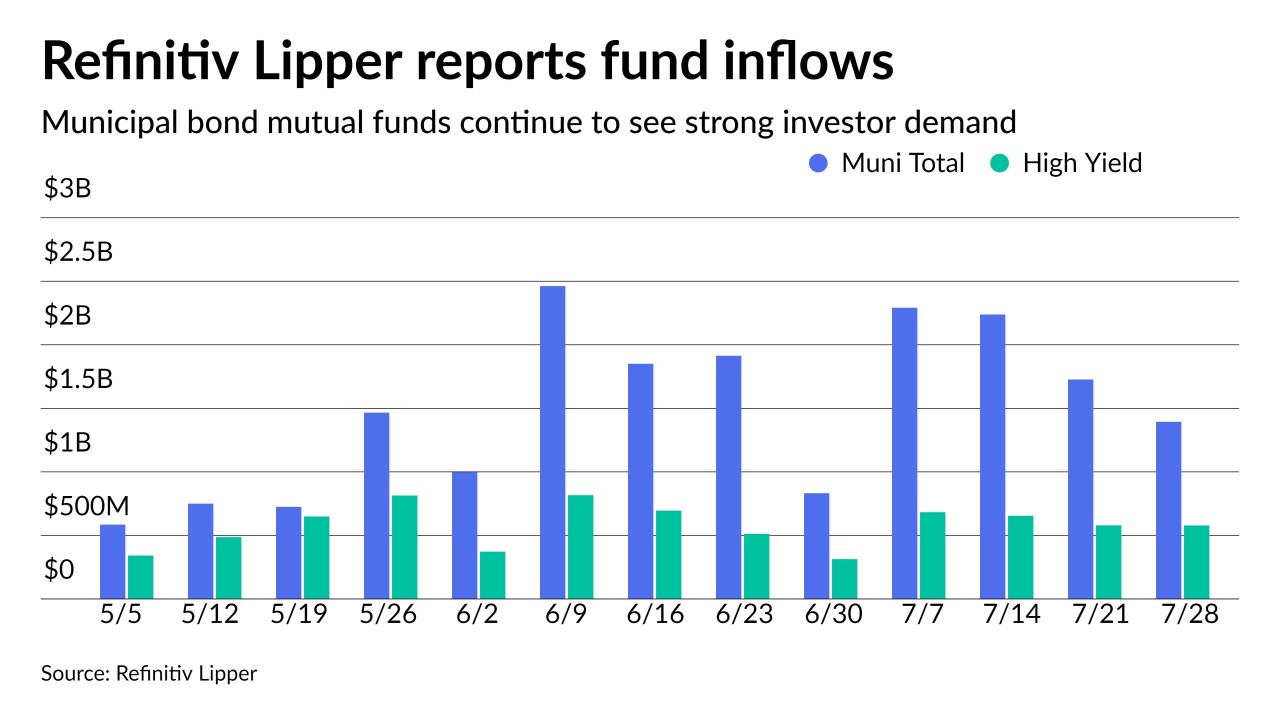

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

July 29 -

The question looms as to what point heightened wildfire activity becomes a significant risk for municipal debt.

July 29 -

The rating agencies affirmed two AA-plus and one triple-A rating ahead of the deal.

July 22 -

Moody's revised the outlook on Nevada's GOs and COPs to stable from negative.

July 20 -

Honolulu plans to price $725.4 million of double-A-plus GOs next week; a significant chunk of the deal will support Oahu's troubled rail transit project.

July 15 -

A double-digit return will trigger a reduction in the California Public Employees’ Retirement System's discount rate under a risk mitigation policy.

July 14 -

Hawaii lawmakers made changes to the budget this week in response to a flurry of vetoes from Gov. David Ige.

July 9 -

The Fitch Ratings upgrade applies only to GO debt — the city's issuer default rating remains AA-plus. The GOs benefit from California’s 2016 statutory lien law.

July 8 -

Hawaii lawmakers approved the budget before Treasury guidance banned the use of federal funds for debt payments or reserves.

July 7