Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

Munis are in the black so far this month, with the Bloomberg Municipal Index at +0.33% in December and +2.88% year-to-date, the high-yield index is at +0.27% in December and returning 8.41% in 2024, while taxable munis are returning 0.43% so far this month and 4.58% in 2024.

By Lynne FunkDecember 9 -

Investors will be greeted with a diverse new-issue slate the week of Dec. 9, led by bellwether names. If all the deals price, 2024's total should break 2020's record by the end of the week. Despite rich valuations, demand has remained strong as the year winds down.

By Lynne FunkDecember 6 -

With an estimated $13 billion calendar on tap, demand for paper will be bolstered by the $16 billion of redemptions coming Monday while mutual fund inflows, this week at about $560 million and concentrated in the long-end, signal solid investor support. Munis are returning 1.73% in November as of Friday.

By Lynne FunkNovember 29 -

The Investment Company Institute reported $1.221 billion of inflows into municipal bond mutual funds for the week ending Nov. 20. Exchange-traded funds saw inflows of $836 million.

By Lynne FunkNovember 27 - The 2024 Freda Johnson award winners Stephanie Wiggins, CEO of the LA County MTA, and Vivian Altman, head of public finance at Janney, discuss the current state of the market, implications of federal policy shifts, and their insights into addressing the growing infrastructure needs across the nation.Sponsored by Assured Guaranty

-

Supply has "declined materially, allowing dealers to take a breather, with their inventories dropping significantly, while retail investors do not seem to be spooked by rate volatility, lower taxes and possible threats to the tax-exempts, and continued putting money into tax-exempts at a brisk pace," said Mikhail Foux, managing director and head municipal research and strategy at Barclays.

By Lynne FunkNovember 22 -

Municipals are outperforming USTs to a large degree this month, with investment grade munis seeing positive 0.81% returns in November and 1.63% year-to-date. USTs are in the red at -0.40% in November with only 0.96% positive returns in 2024.

By Lynne FunkNovember 20 -

As headline risk swirls around the Fed and the transition to the Trump administration, municipals have largely stayed in their own lane. November finds the municipal market "in far better technical shape, with an attractive backdrop through at least year-end," J.P. Morgan's Peter DeGroot said.

By Lynne FunkNovember 15 -

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

By Lynne FunkOctober 31 -

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

By Lynne FunkOctober 29 -

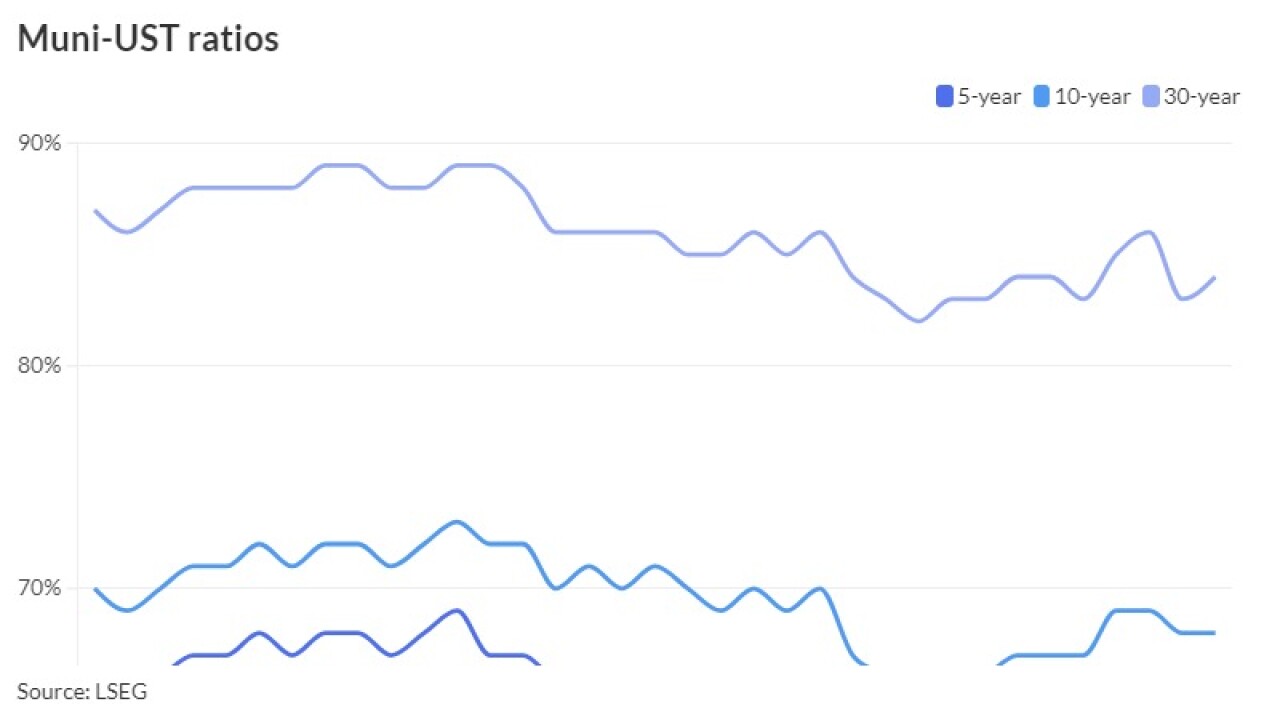

The correction to the municipal market has improved muni to UST ratios while uncertainty hangs over ahead of the election. J.P. Morgan's Peter DeGroot said the firm expects the end of next week "will mark the end of the difficult technical period in 2024 and believe that net supply in November will lead to better valuations broadly in the municipal market."

By Lynne FunkOctober 25 -

Several macro trends have converged to drive growth in municipal bond issuance, said participants at The Bond Buyer's California Public Finance conference.

By Lynne FunkOctober 25 -

Despite this week's underperformance, exempt investment-grade munis continue to outperform taxable sectors.

By Lynne FunkOctober 18 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

By Lynne FunkOctober 11 -

Municipal investors can expect just shy of $10 billion of new issues from which to choose the first full week of October and the fourth quarter, led by a $1.5 billion taxable general obligation bond offering from New York City. Connecticut is bringing $935 million of general obligation bonds.

By Lynne FunkOctober 4 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

By Lynne FunkOctober 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

By Lynne FunkOctober 2 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

By Lynne FunkOctober 1 -

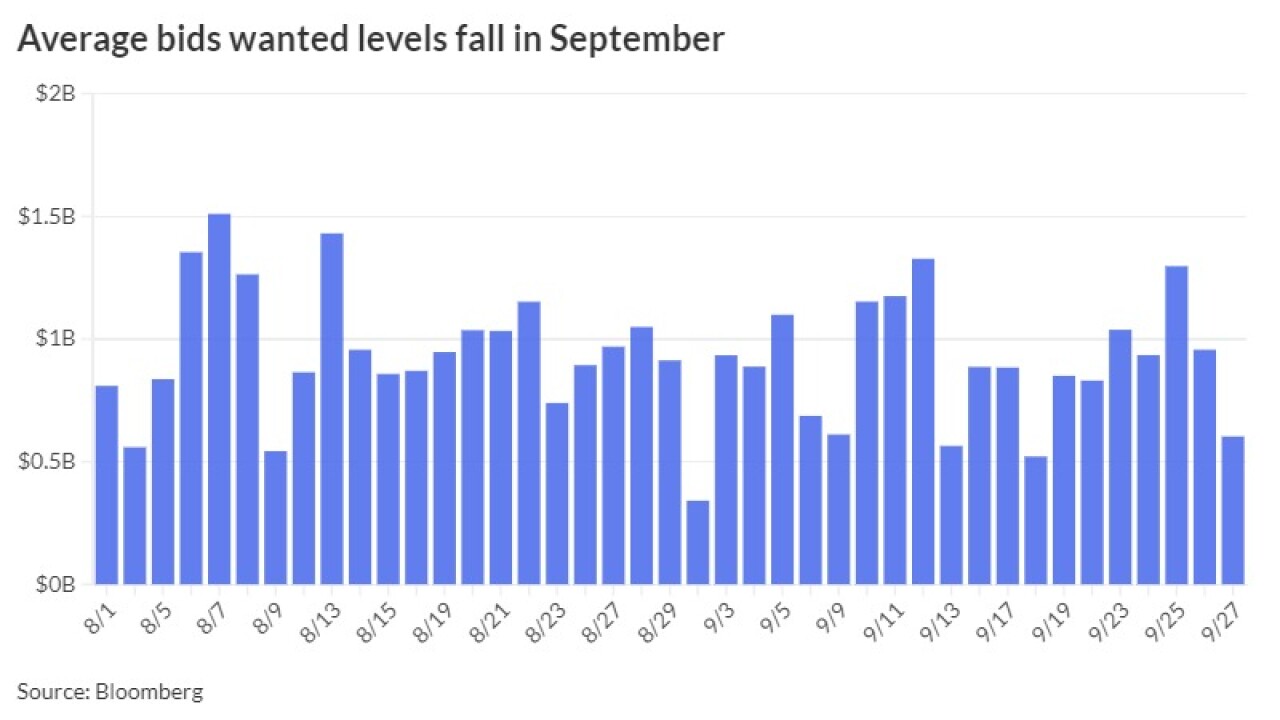

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

By Lynne FunkSeptember 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

By Lynne FunkSeptember 27