Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

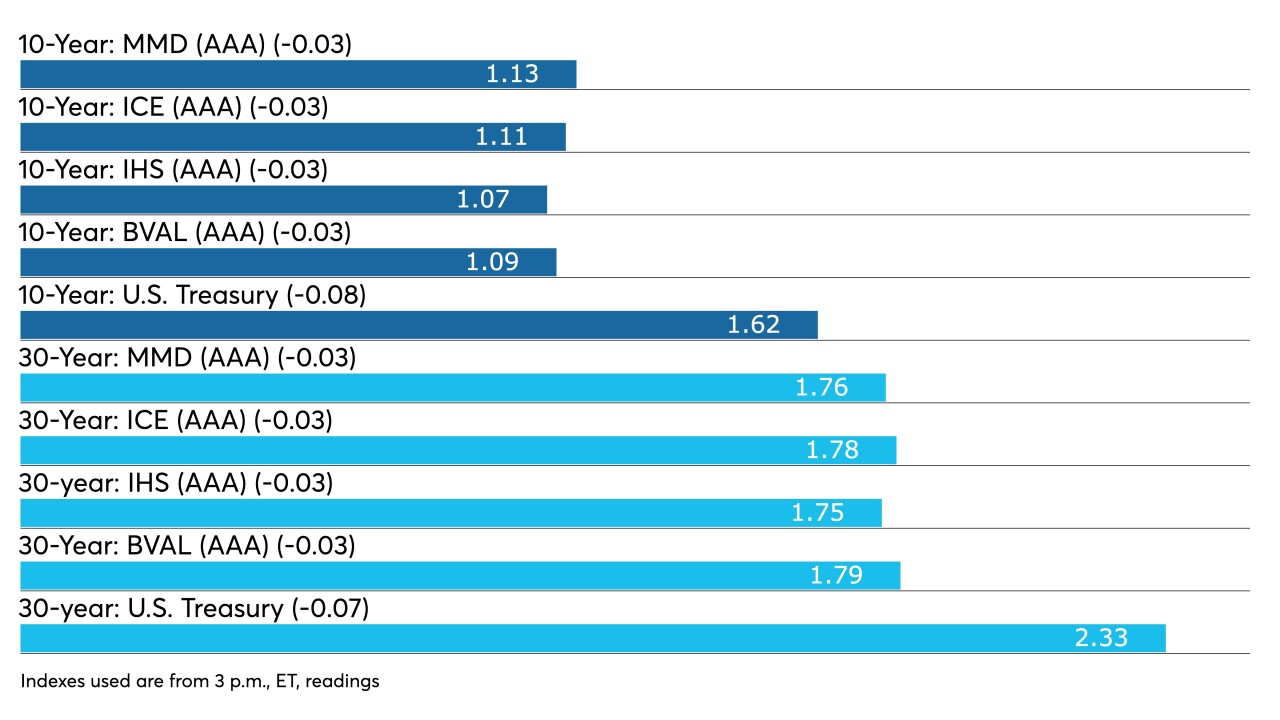

The primary led the secondary to lower yields as UST 10-year fell to lows last seen a week ago. Regional service sector surveys released Tuesday showed improvement, which feeds into the belief that inflation will rise in the near term.

By Lynne FunkMarch 23 -

How the industry weathered the worst public health crisis in over 100 years to bring to market the amount of bonds it did, and to recover as it did, is a testament to its resiliency and its necessity for the state and local governments it serves. Join us for perspectives from industry experts on March 31.

By Lynne FunkMarch 22 -

Exactly one year after record billions were pulled from municipal bond mutual funds and the market was in free fall, municipals followed U.S. Treasuries this week as the markets continued to dismiss the Fed's outlook on inflation and rates.

By Lynne FunkMarch 19 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

By Lynne FunkMarch 18 -

The rise of machine learning. Continued growth of electronic trading. Intensifying automation. Stephanie Sparvero, Global Head of BVAL Evaluated Pricing at Bloomberg, talks about these issues and more in how the muni market is charting a changing muni landscape. Lynne Funk hosts. (30 minutes)

By Lynne FunkMarch 18 -

The Fed remains dovish, although it raised inflation projections and lowered expected unemployment rates, but most participants still see rates at the zero lower bound in 2023.

By Lynne FunkMarch 17 -

A repricing of Illinois GOs saw the bonds bumped by 12 to 20 basis points from Tuesday's preliminary pricing wires and 17 to 25 basis points from Monday's price talk.

By Lynne FunkMarch 16 -

Municipals largely ignored the moves to higher yields in U.S. Treasuries as participants await the largest new-issue calendar of 2021 and big-name deals out of New York and Illinois.

March 12 -

Inflows return, stimulus set, new deals on fire — the municipal market reaped all the benefits. Initial jobless claims dropped more than expected in the week, as reopening continued slowly, but the total remains higher than any week before the COVID crisis hit.

By Lynne FunkMarch 11 -

Munis were stronger across the curve as secondary trading was constructive and bellwether credits moved yields lower.

March 9