Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

In her role as senior vice president of credit for municipal and corporate bonds, Urtz is overseeing a redesign of FHN's primary website for fixed-income transactions.

By Lynne FunkMay 5 -

Pennsylvania's competitive GO deal saw its yields fall further from recent trading while the North Texas Tollway Authority benefited from positive credit news on the transportation sector and repriced 25 basis points lower. ICI reported another round of $2-billion-plus inflows.

By Lynne FunkMay 5 -

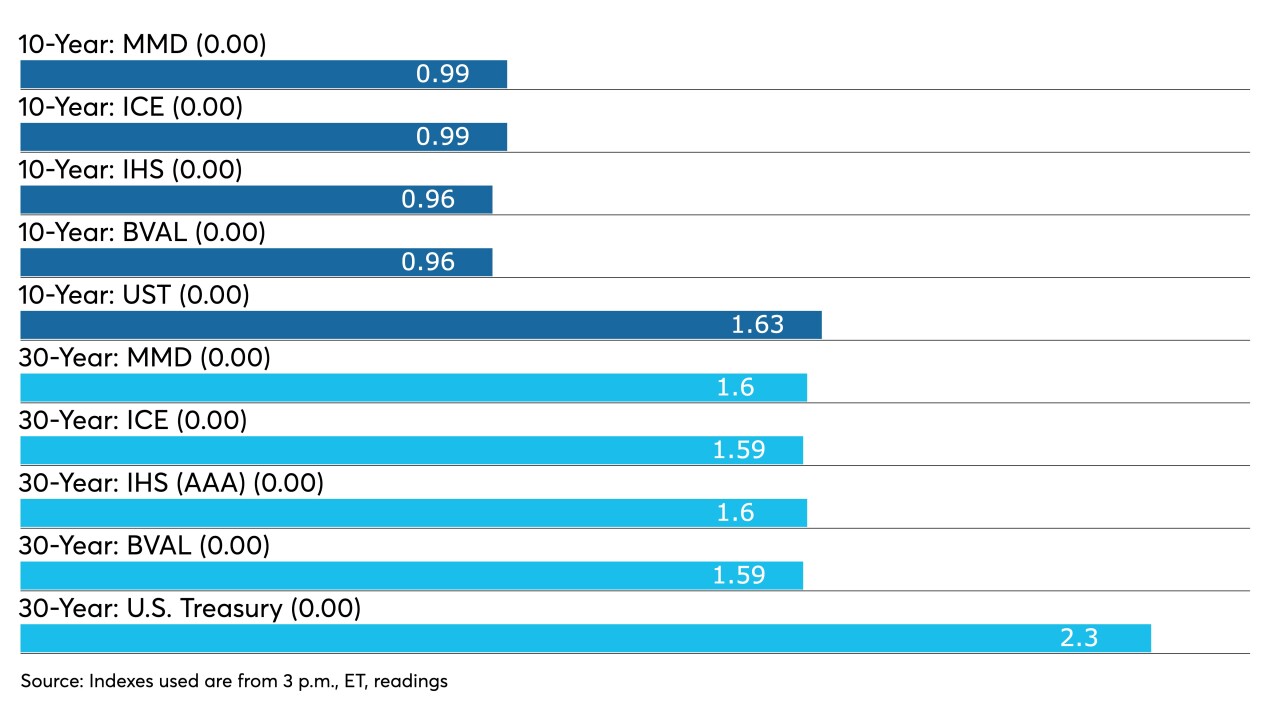

After just one session, the 10-year muni is back below 1% with ICE Data Services and Refinitiv MMD at 0.99% while Bloomberg BVAL is at 0.96% and IHS Markit at 0.95%.

By Lynne FunkMay 4 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

By Lynne FunkMay 3 -

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

By Lynne FunkApril 30 -

Refinitiv Lipper reported another week of inflows at $1.64 billion, with $630 million headed into to high-yield. Benchmark yields rose as much as four basis points following weaker U.S. Treasuries, resistance to ultra-low yields.

By Lynne FunkApril 29 -

The dearth of supply will likely hold down rates and keep certain investors out of the muni market. High-yield municipal bonds, still the most in-demand sector, tightened again.

By Lynne FunkApril 26 -

Refinitiv Lipper reported $1.889 billion of inflows, with $641 million in high-yield. Negotiated deals repriced to lower yields while competitive loan yields were compelling from New Jersey and Los Angeles USD.

By Lynne FunkApril 22 -

Municipal triple-A benchmarks held steady as the focus was on the primary in which large new issues repriced to lower yields while secondary trading was light.

By Lynne FunkApril 20 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

By Lynne Funk -

Sub-1% 10-year municipals and low ratios may test investor appetite for the asset class but it is hard to ignore the strong fundamentals and substantial fund flows in the backdrop.

By Lynne FunkApril 16 -

The economy grew faster from late February through early April while consumer spending increased, with a possible rise in inflation in the near term, according to the Federal Reserve’s Beige Book released on Wednesday.

By Lynne FunkApril 14 -

One-year municipal debt has fallen to record lows with benchmark yield curves at 0.05% and the 10-year muni has fallen below 1% while 30-year muni benchmark yields at or less than 10-year UST.

By Lynne FunkApril 13 -

Rating agency moves on credits across the spectrum are pushing spread-tightening in munis, but the broader economy is still two years away from pre-pandemic levels, according to Federal Reserve Bank of Boston President Eric Rosengren.

April 12 -

The Investment Company Institute reported another week of inflows, $800-plus million, as participants focus on that part of the market as an indicator of how munis will fare during tax season.

By Lynne FunkApril 7 -

The theme of low supply, positive inflows and the anticipation of higher tax rates led triple-A benchmarks firmer by one to two basis points.

April 6 -

The municipal bond industry faces many obstacles and opportunities from the pandemic. But 83% of surveyed participants think munis have made it through the worst.

By Lynne FunkApril 1 -

Susan Courtney, head of the Municipal Bond Team at PGIM Fixed Income, talks inflation, muni credit in COVID times and infrastructure. (27 Minutes) Lynne Funk hosts.

By Lynne FunkApril 1 -

Both personal income and expenditures dropped in February, while personal consumption expenditures also came in weaker than expected, meaning inflation remains in check for now.

By Lynne FunkMarch 26 -

ICI reported another week of inflows at $2.23 billion. U.S. Treasuries strengthened further as COVID-19 concerns linger with shutdowns in Germany and spreads elsewhere. Equities were mixed.

By Lynne FunkMarch 24