Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

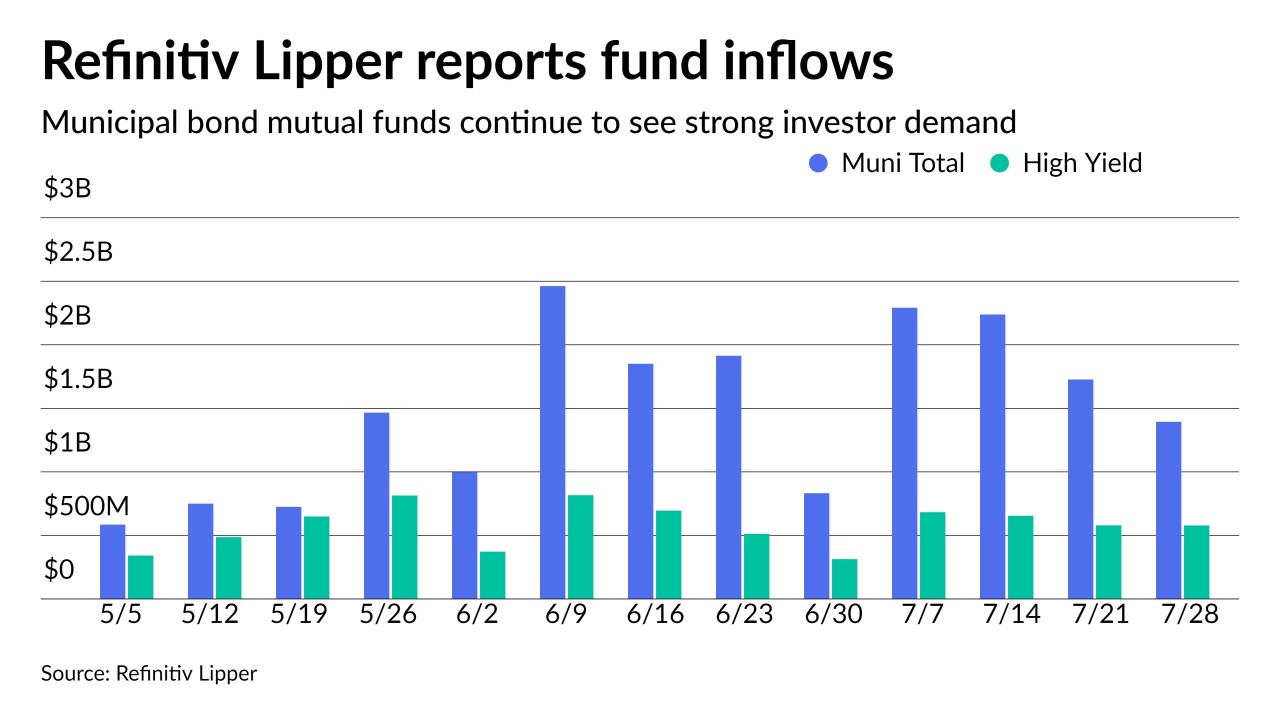

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

By Lynne FunkJuly 29 -

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

By Lynne FunkJuly 28 -

With municipal yields at exceedingly low absolute levels, the spread tightening between credits also continues.

By Lynne FunkJuly 26 -

The pilot program aims to expand its all-to-all Open Trading marketplace by allowing investor clients to select a diversity dealer to intermediate in secondary trading.

By Lynne FunkJuly 26 -

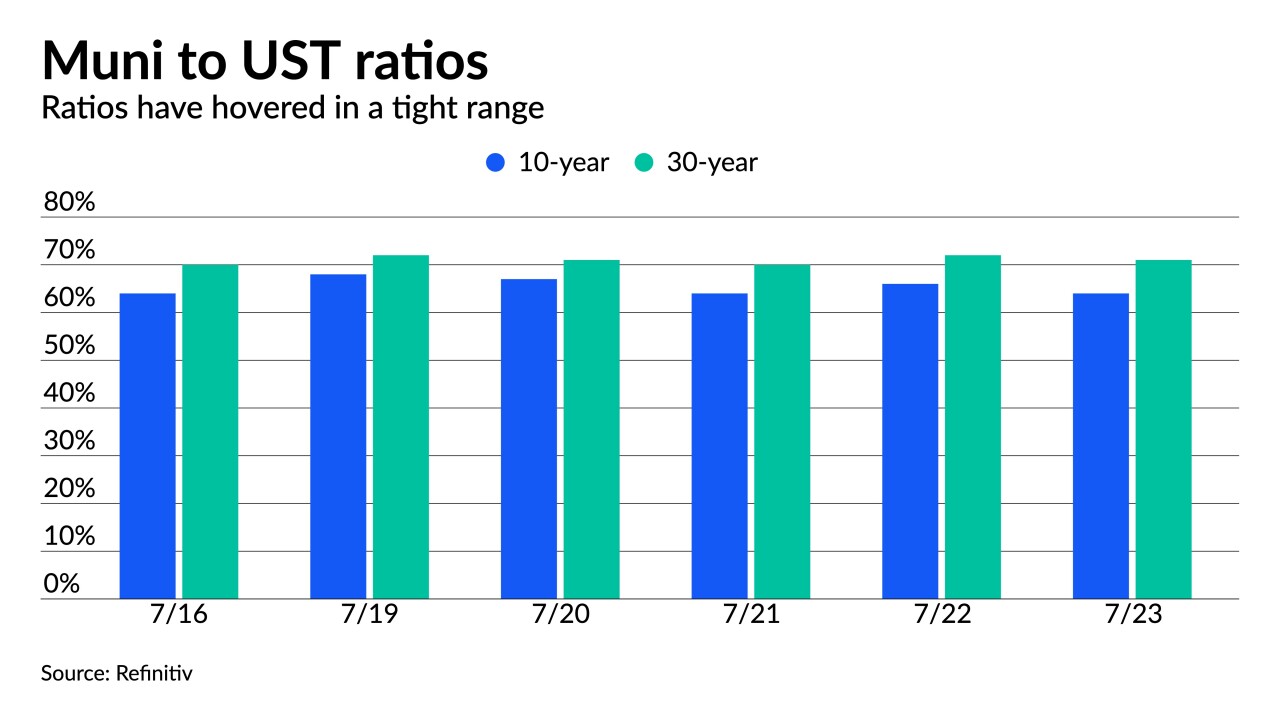

The last week of July marks a lighter calendar while August redemptions are huge compared to the expected supply. Investors need to get in line and likely accept lower yields and continued historically low ratios.

By Lynne FunkJuly 23 -

Whether a BABs-like program could make it into actual law in Washington is still highly uncertain. What is certain: Some form of infrastructure spending is must-pass legislation because federal-aid highway funding is set to expire in October.

By Lynne FunkJuly 22 -

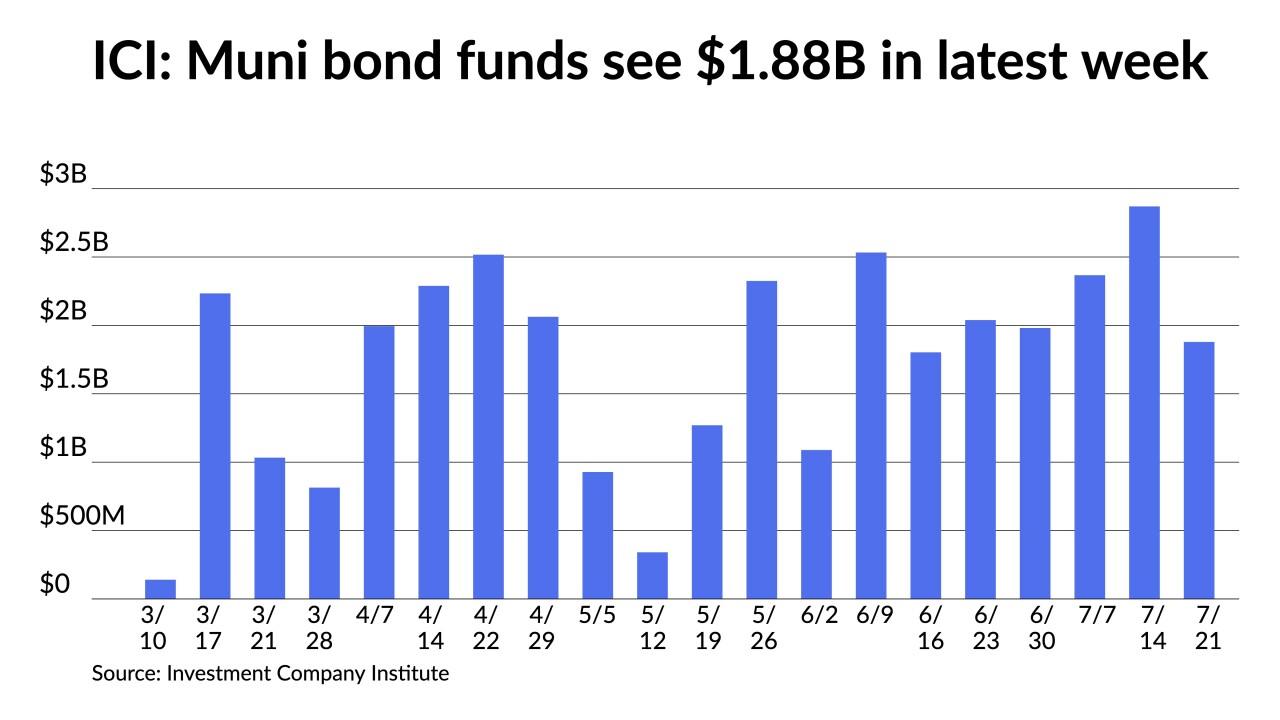

The larger new issues and aggressive swings in taxables had investors on guard as triple-A curves were pressured outside 10-years, but the asset class still vastly outperformed UST while ICI reports nearly $3 billion more inflows.

By Lynne FunkJuly 21 -

The agency withdrew its ratings on the commonwealth and all of its authorities for its own business reasons.

By Lynne FunkJuly 20 -

Negotiated deals were repriced to lower yields while competitive deals saw levels coming in through triple-A benchmarks. High-grade benchmarks were little changed.

By Lynne FunkJuly 20 -

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

By Lynne FunkJuly 19