Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

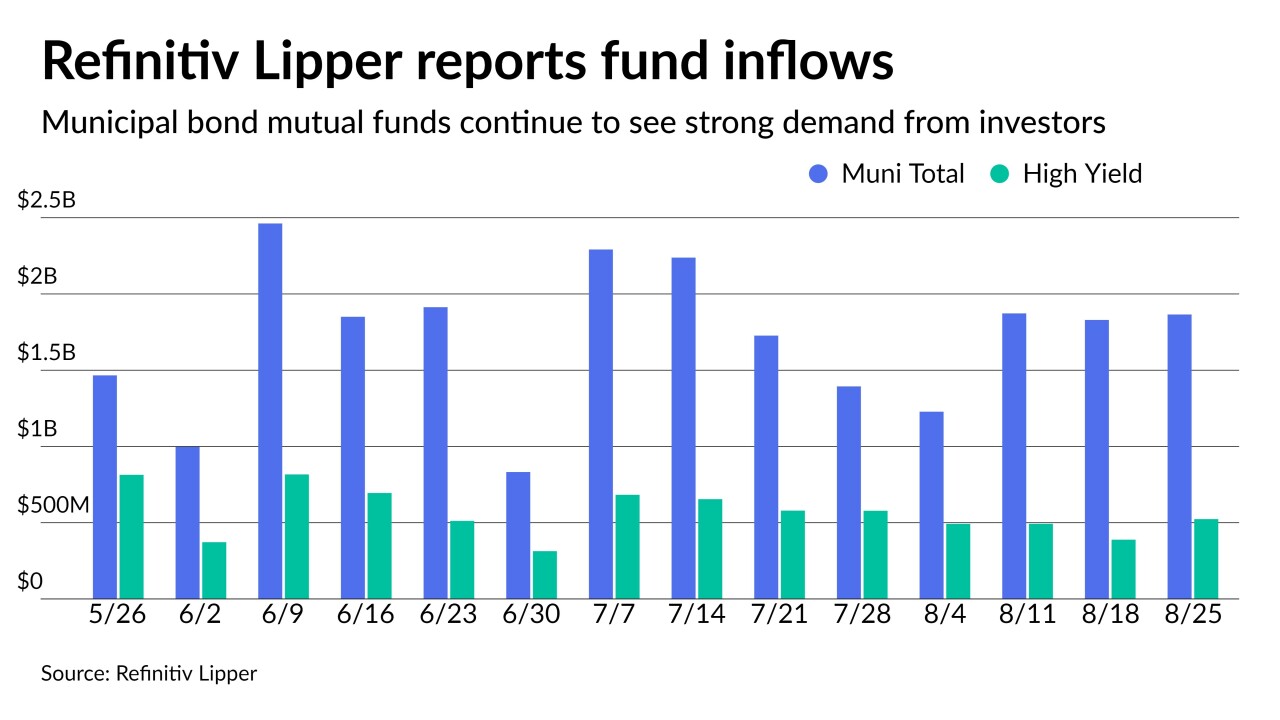

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

By Lynne FunkAugust 26 -

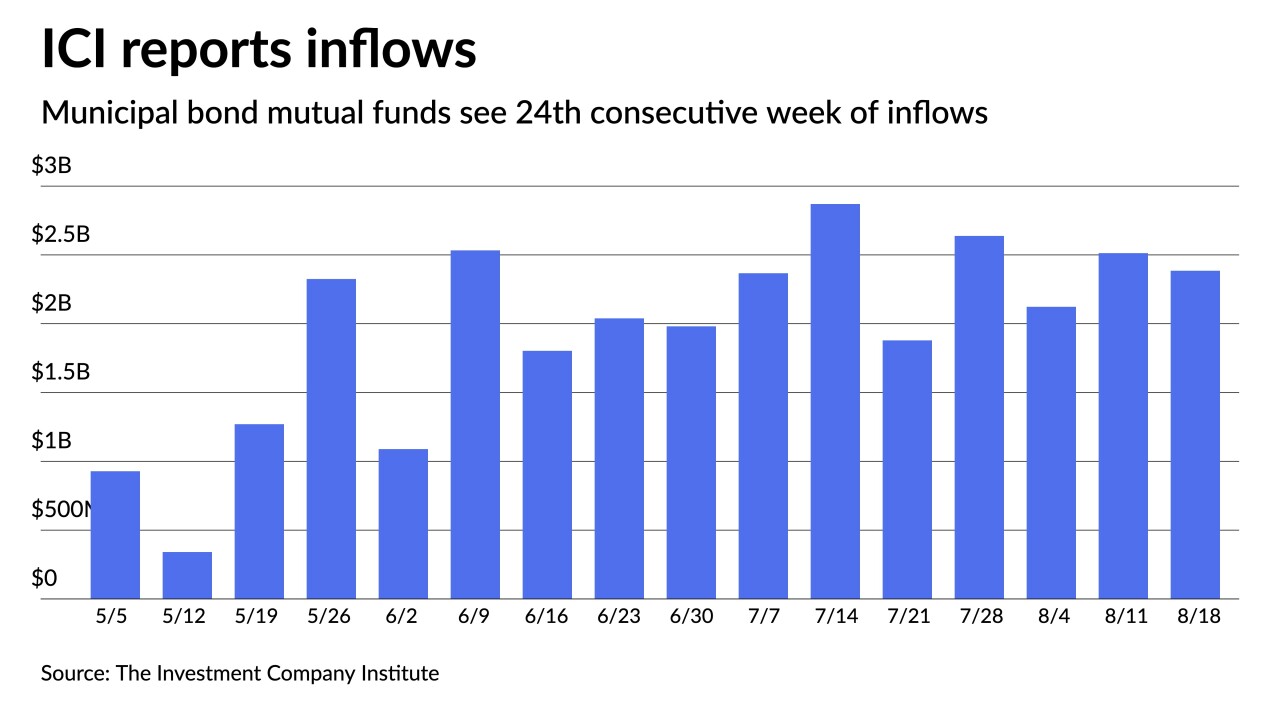

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

By Lynne FunkAugust 25 -

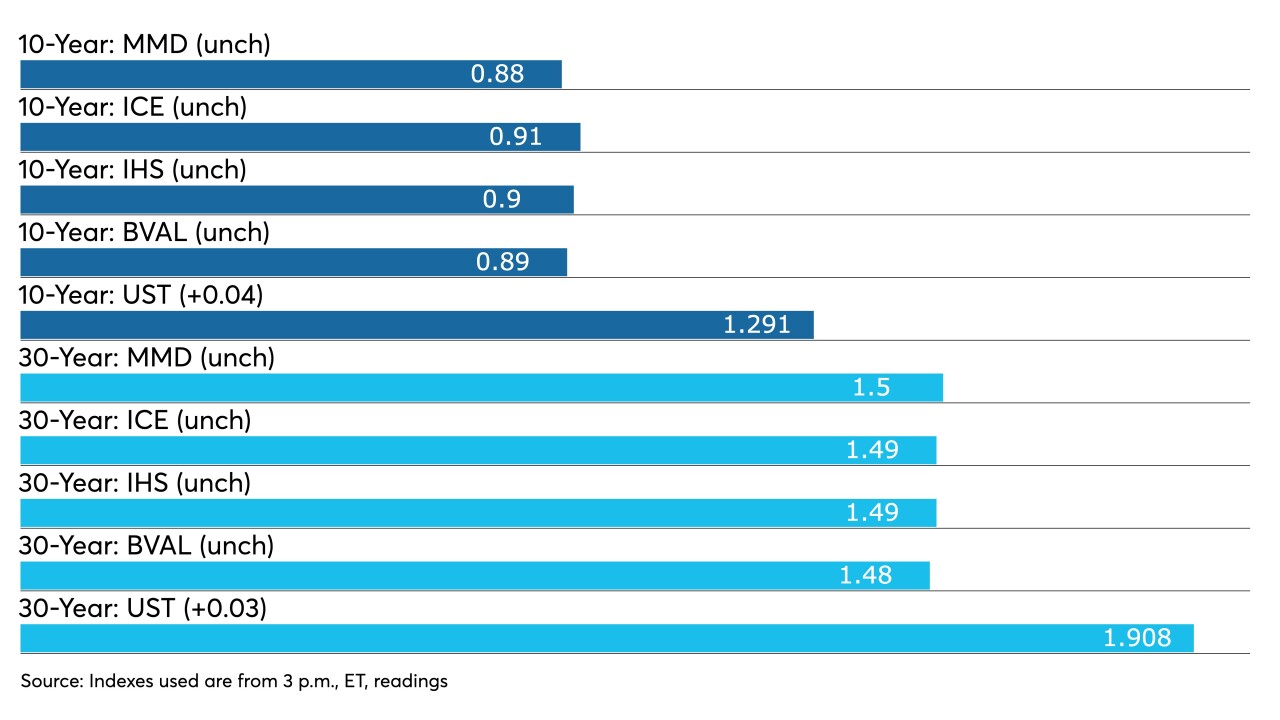

While municipals were little changed, broader markets remain focused on Jackson Hole and speculating what will be said about tapering.

By Lynne FunkAugust 24 -

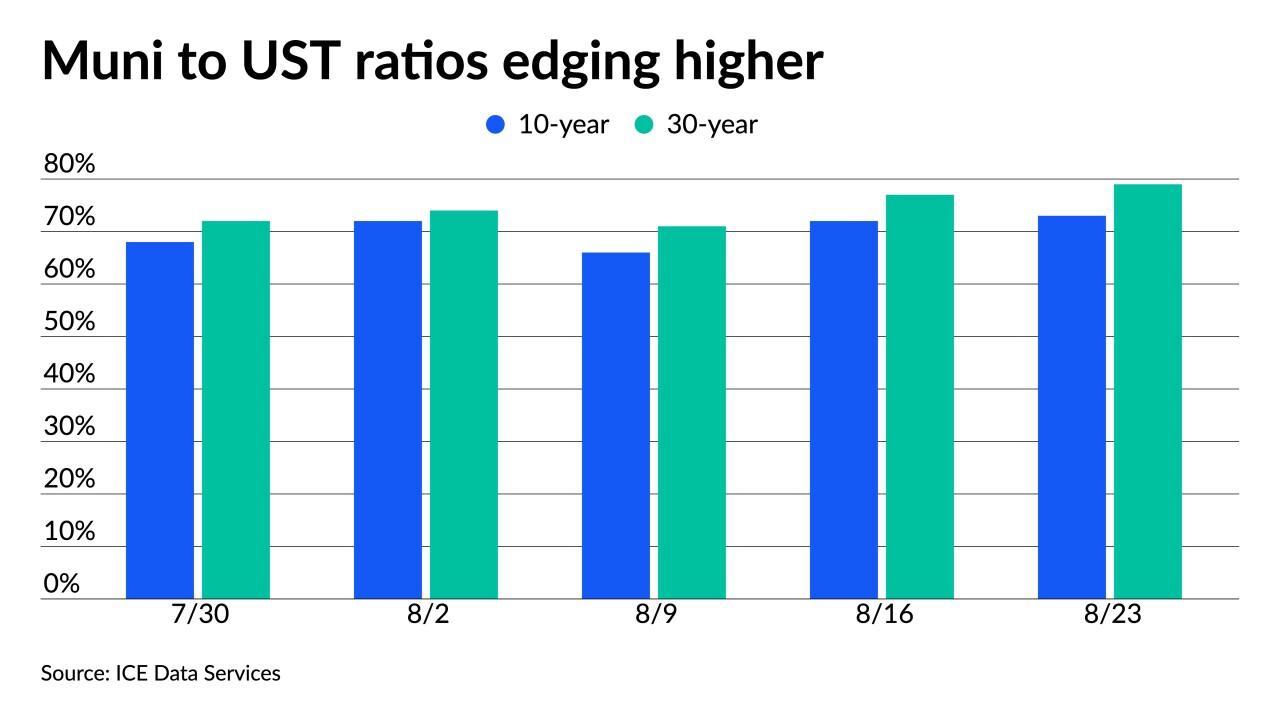

U.S. Treasuries gave little direction Monday, holding ratios and yields steady, leading most participants to argue both are satisfactory to ride out the summer.

By Lynne FunkAugust 23 -

The short end of the muni market saw trading of larger blocks at or below benchmarks but yield curves were little changed on a summer Friday.

By Lynne FunkAugust 13 -

Another replacement for exempt advance refundings, forward delivery bonds are attractive to issuers looking for savings and investors seeking incremental yield.

By Lynne FunkAugust 13 -

Refinitiv Lipper reported $1.87 billion inflows. A solid demand component for the market, but some suggest the move into bonds from equities is more an asset reallocation than investors keen on fixed income.

By Lynne FunkAugust 12 -

Another $2 billion-plus was reported flowing into municipal bond mutual funds in the latest week, continuing to be a supportive demand component for munis.

By Lynne FunkAugust 11 -

The increasing influence of institutional market participants is even stronger in the taxable muni sector, a Municipal Securities Rulemaking Board report finds.

By Lynne FunkAugust 11 -

Municipals are tethered to Treasuries, more so in recent sessions, and have cheapened, but strong technicals — $18.5 billion of net negative supply and large reinvestment needs — still hang overhead.

By Lynne FunkAugust 10