Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

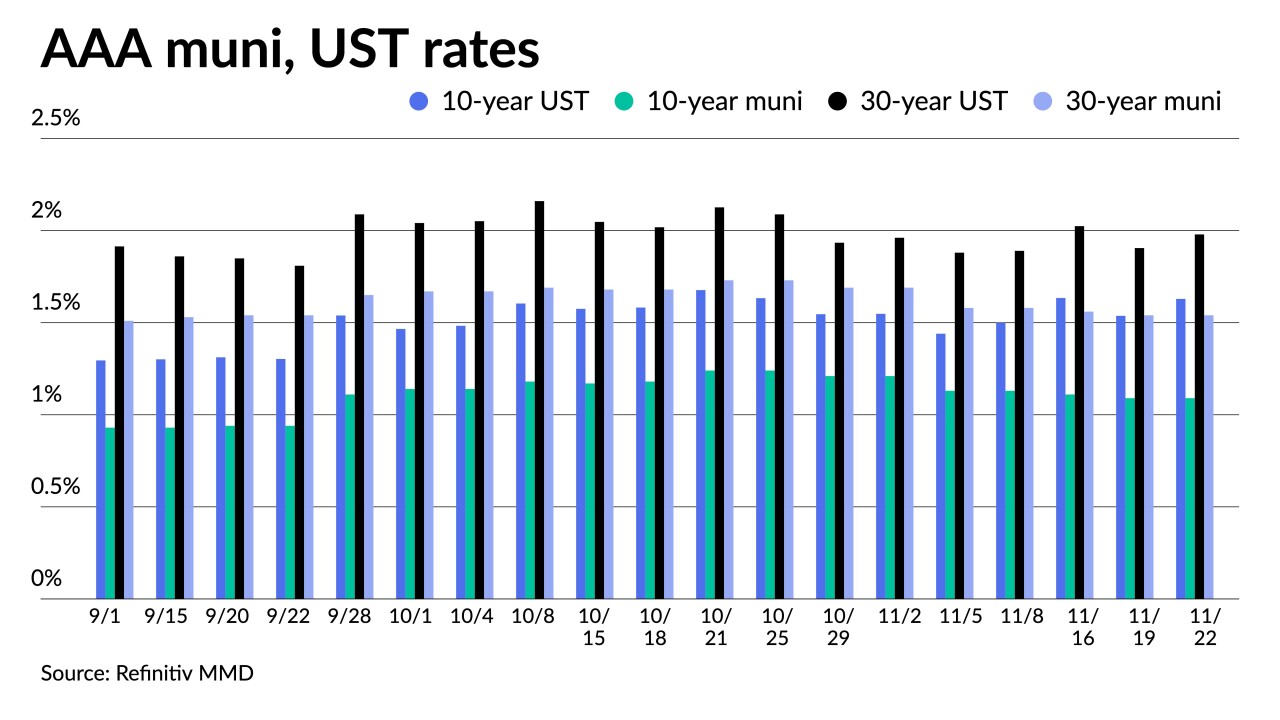

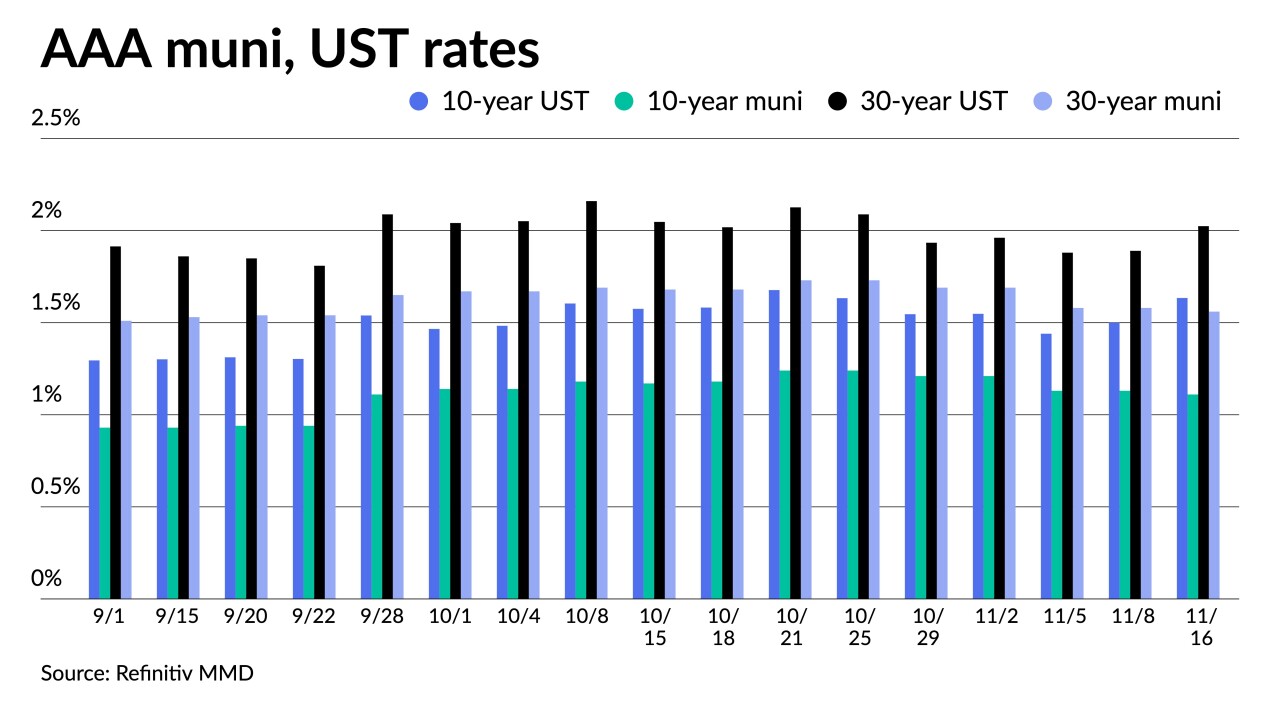

Municipal yield curves were little changed for the seventh straight session while Refinitiv Lipper reported the 40th week of inflows into municipal bond mutual funds, with high-yield seeing a large increase week over week.

By Lynne FunkDecember 9 -

Intercontinental Exchange has acquired climate-change technology data providers risQ and Level 11 to further its alternative data capabilities.

By Lynne FunkDecember 9 -

The Investment Company Institute reported $289 million of inflows into municipal bond mutual funds in the week ending Dec. 1, down from $965 million in the previous week.

By Lynne FunkDecember 8 -

Thirty-day visible supply drops to $13.54 billion with still a large chunk of new issues to be priced Wednesday and Thursday.

By Lynne FunkDecember 7 -

The municipal market is poised to absorb the late-year burst of supply as market technicals are expected to remain positive through year end.

By Lynne FunkDecember 6 -

The weaker-than-expected employment report sent U.S. Treasury yields lower and equities sold off. Munis did what they've been doing — mostly ignored it.

By Lynne FunkDecember 3 -

Refinitiv Lipper reported a significant drop in municipal bond mutual fund inflows at $36 million in the latest week, a signal the volatility of other markets may be creeping in. High-yield saw $53 million of inflows.

By Gary SiegelDecember 2 -

The Investment Company Institute reported $974 million of inflows into municipal bond mutual funds in the week ending Nov. 23, down from $1.430 billion in the previous week.

By Lynne FunkDecember 1 -

Powell says the FOMC will consider ramping up tapering when more information about Omicron and its impacts are known, further flattening the UST yield curve.

By Lynne FunkNovember 30 -

Economists appear to be less concerned about Omicron, with some saying that even if the variant causes another pandemic wave, it is more likely to "slow rather than interrupt" the global economic recovery.

By Lynne FunkNovember 29 -

A majority of firms anticipate less volume in 2022 than the record hit in 2020, but how policies from Washington and the path of overall economic activity in a still-recovering global economy with COVID overhang make predicting volume more difficult.

By Lynne FunkNovember 29 -

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

By Lynne FunkNovember 23 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

By Lynne FunkNovember 22 -

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

By Lynne FunkNovember 19 -

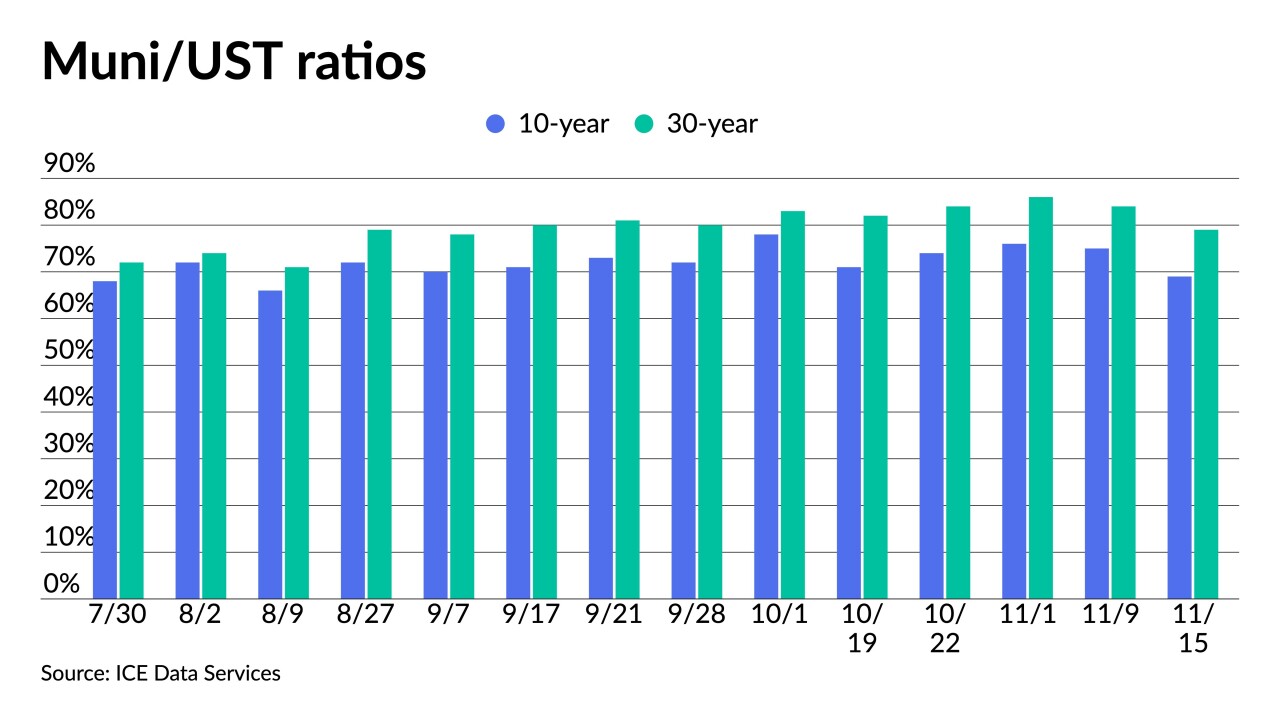

Month over month, the municipal market is in a much better position, as heavy demand and flows continue to drive it.

By Lynne FunkNovember 18 -

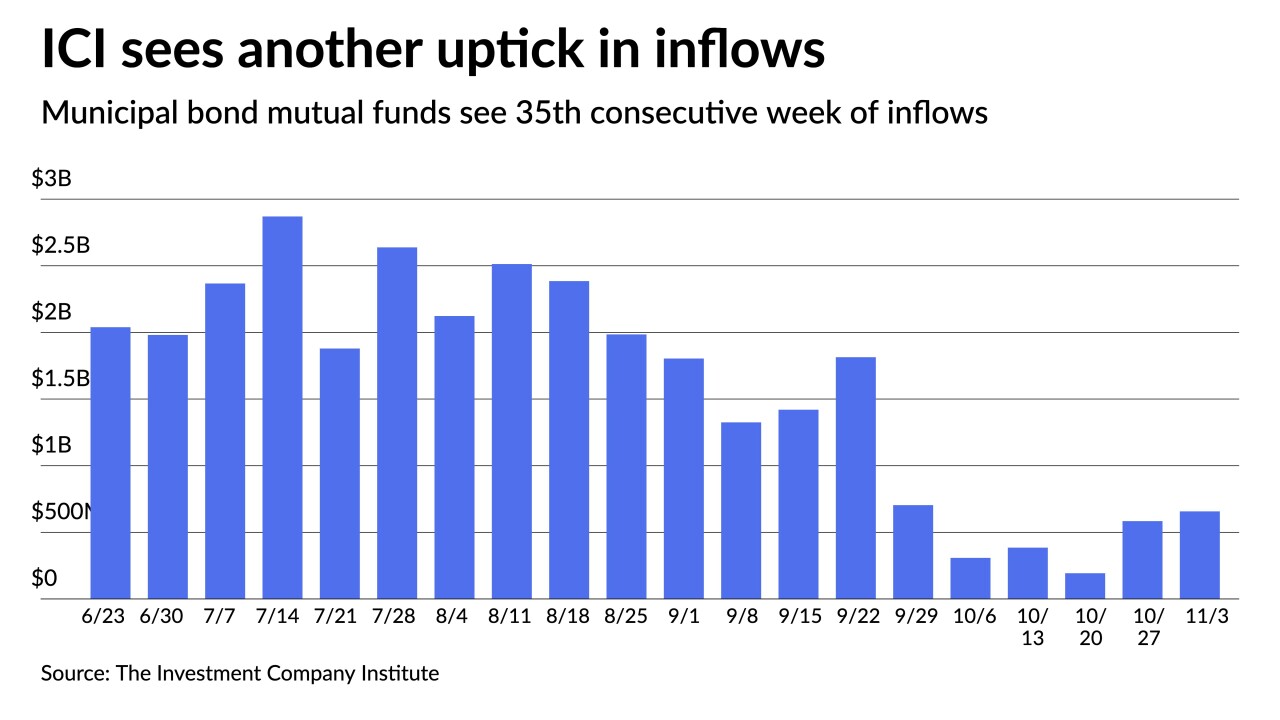

The Investment Company Institute reported $1.608 billion of inflows into municipal bond mutual funds for the week ending Nov. 10, up from $657 million a week prior.

By Lynne FunkNovember 17 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

By Lynne FunkNovember 16 -

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

By Lynne FunkNovember 15 -

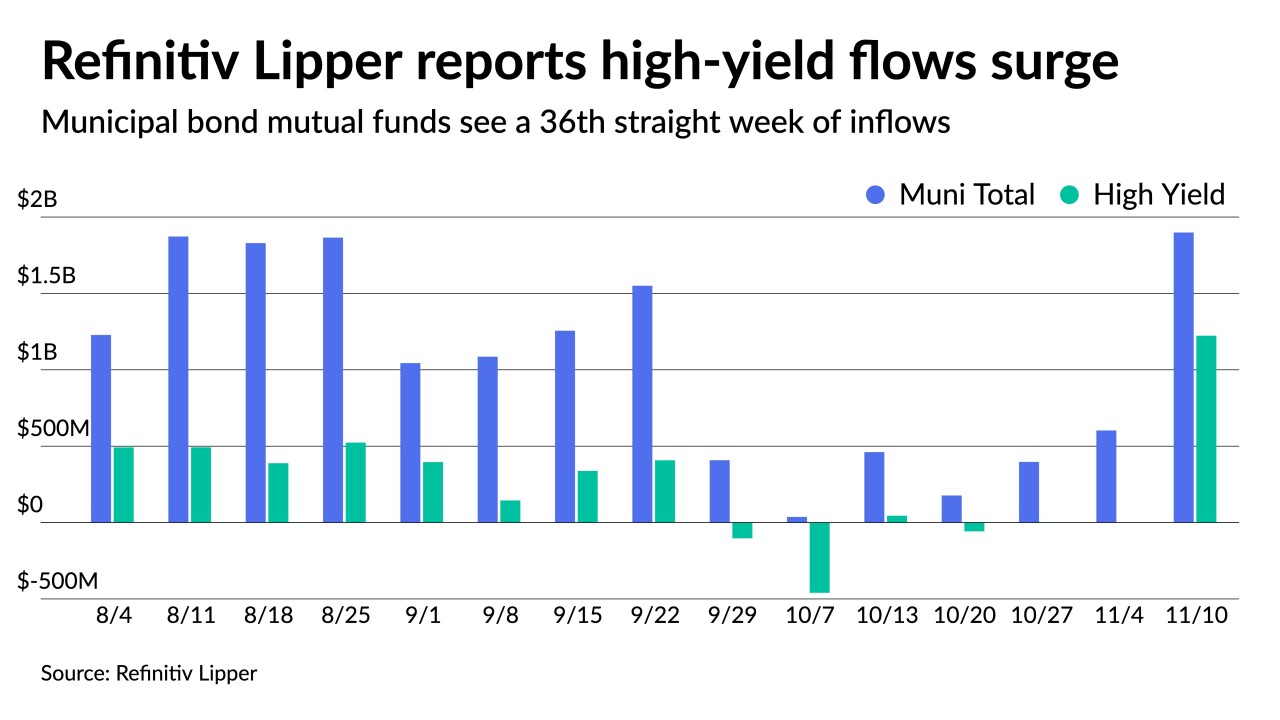

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

By Lynne FunkNovember 12 -

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

By Lynne FunkNovember 10