Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

As municipals continue to underperform the moves in U.S. Treasuries, current ratios are attractive and present a buying opportunity.

March 7 -

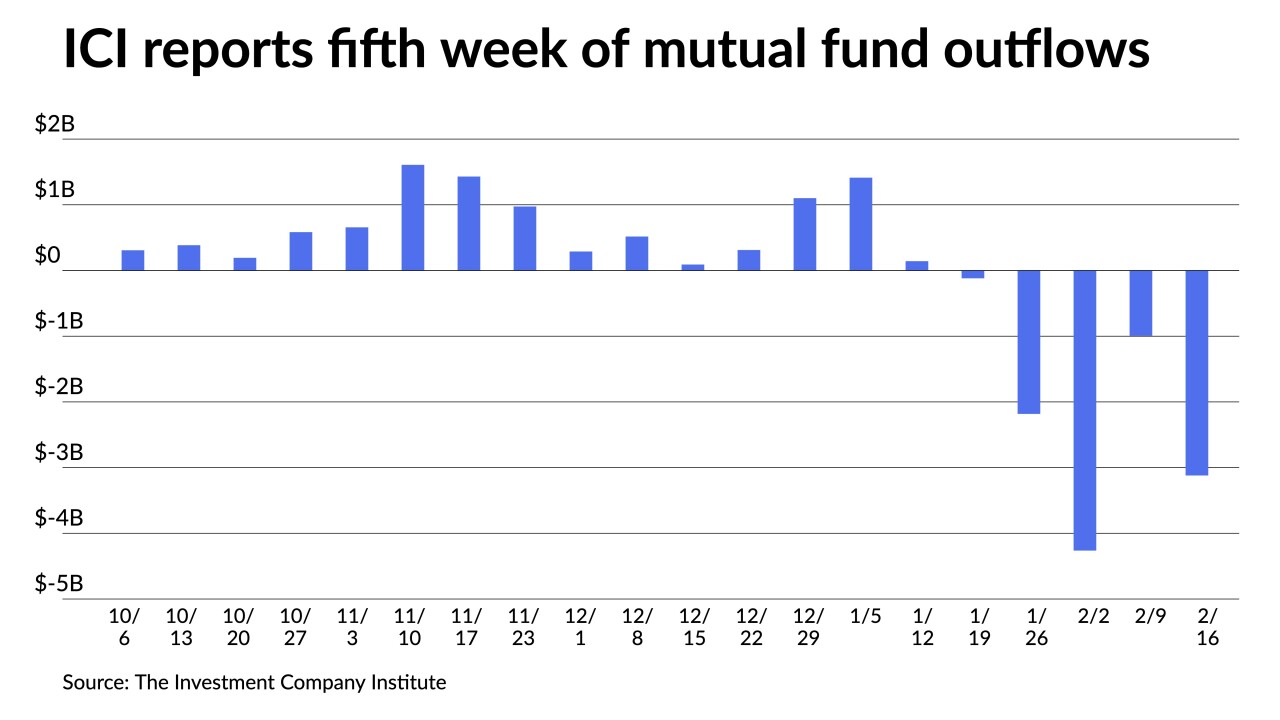

The Investment Company Institute on Wednesday reported $2.637 billion of outflows in the week ending Feb. 23, down from $3.120 billion of outflows in the previous week.

By Lynne FunkMarch 2 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

By Gary SiegelFebruary 28 -

The new-issue calendar is $5.45 billion while 30-day visible supply sits at $11.14 billion. The largest deal of the week comes from the New York City Municipal Water Finance Authority with $793.83 million.

February 25 -

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

Municipals have been resilient throughout the pandemic — with the help of federal aid — keeping the Golden Age for public finance alive.

By Lynne FunkFebruary 22 -

From fund flows to Fed policy, investing in munis requires a more thoughtful strategy.

By Lynne FunkFebruary 15 -

Refinitiv Lipper reported the first inflows into municipal bond mutual funds at $216 million after three weeks of large outflows while high-yield saw small outflows. Exchange-traded funds reported $755 million of inflows.

By Lynne FunkFebruary 10 -

Buyers appeared to return to the market the past two sessions after the January correction moved yields and ratios higher. Secondary trading was up again on Wednesday and new deals were well-received.

February 2 -

The platform allows advisors to tailor portfolios that have characteristics including state-specific credits, ESG considerations, duration targets and other criteria.

By Lynne FunkJanuary 28