Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

Triple-A benchmarks saw cuts of one to two basis points across the curve, but still outperformed two days of UST weakness and have outperformed UST losses since the start of the month.

By Chip BarnettAugust 9 -

Better-than-expected job gains, a rising UST complex and an increase in supply to test municipals' resolve.

By Lynne FunkAugust 6 -

Secondary trading petered off into Thursday afternoon, holding triple-A benchmarks steady as most participants await Friday's nonfarm payrolls.

By Lynne FunkAugust 5 -

The firm has brought on Kalotay Analytics' quantitative libraries to calculate certain metrics, including average life dates and cash-flow yields for taxable term bonds.

By Lynne FunkAugust 5 -

The short end of the market has little room to fall lower.

By Lynne FunkAugust 5 -

With all eyes on Friday’s employment report, since several additional strong months of gains are needed for the Federal Reserve to be comfortable announcing a tapering of its asset purchases, Wednesday’s news could signal trouble.

August 4 -

Tighter bidding on bonds 10 years and in pushed high-grade benchmark curves to bump yields.

By Lynne FunkAugust 3 -

Municipals returned 0.83% in July with a year-to-date return of 1.90%. High-yield returned 1.20% in July and 7.40% year-to-date. Taxables led July with 1.65% returns and 1.95% for the year.

By Lynne FunkAugust 2 -

That expansion wholly depends on Washington actually bringing back the taxable product and making it permanent, a diminishing scenario in 2021.

By Lynne FunkAugust 2 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

By Lynne FunkJuly 30 -

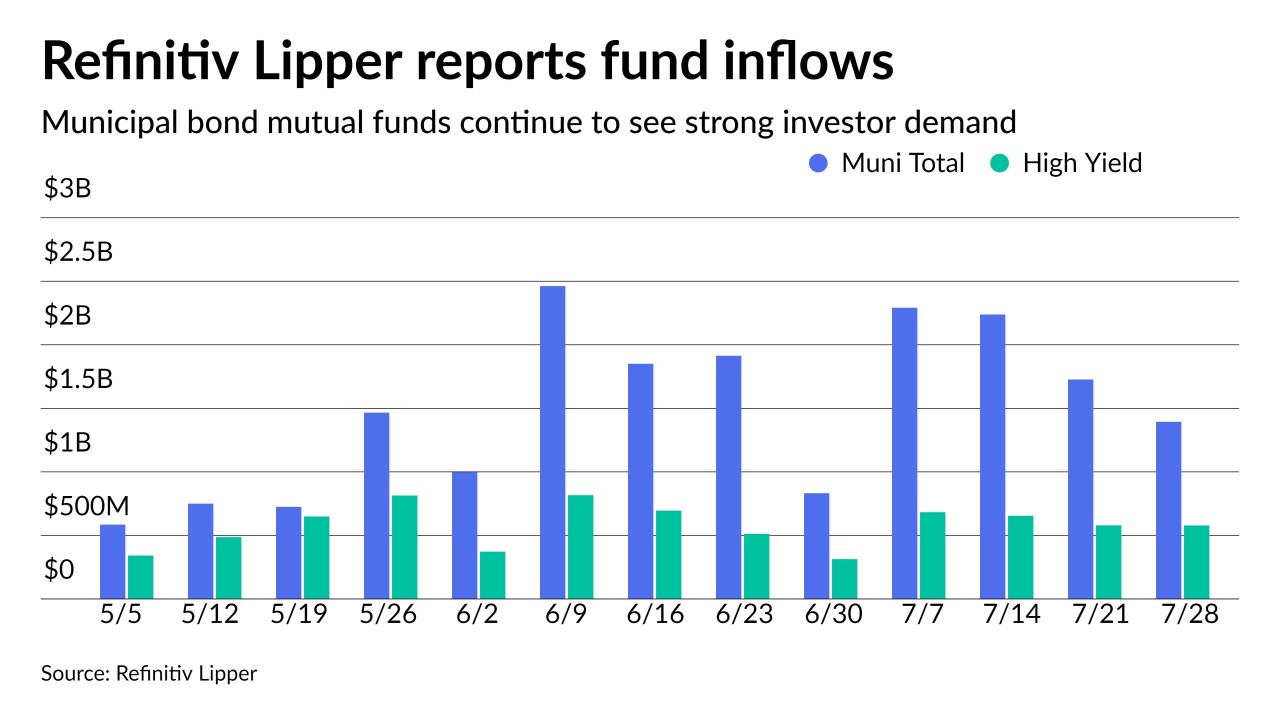

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

By Lynne FunkJuly 29 -

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

By Lynne FunkJuly 28 -

With municipal yields at exceedingly low absolute levels, the spread tightening between credits also continues.

By Lynne FunkJuly 26 -

The pilot program aims to expand its all-to-all Open Trading marketplace by allowing investor clients to select a diversity dealer to intermediate in secondary trading.

By Lynne FunkJuly 26 -

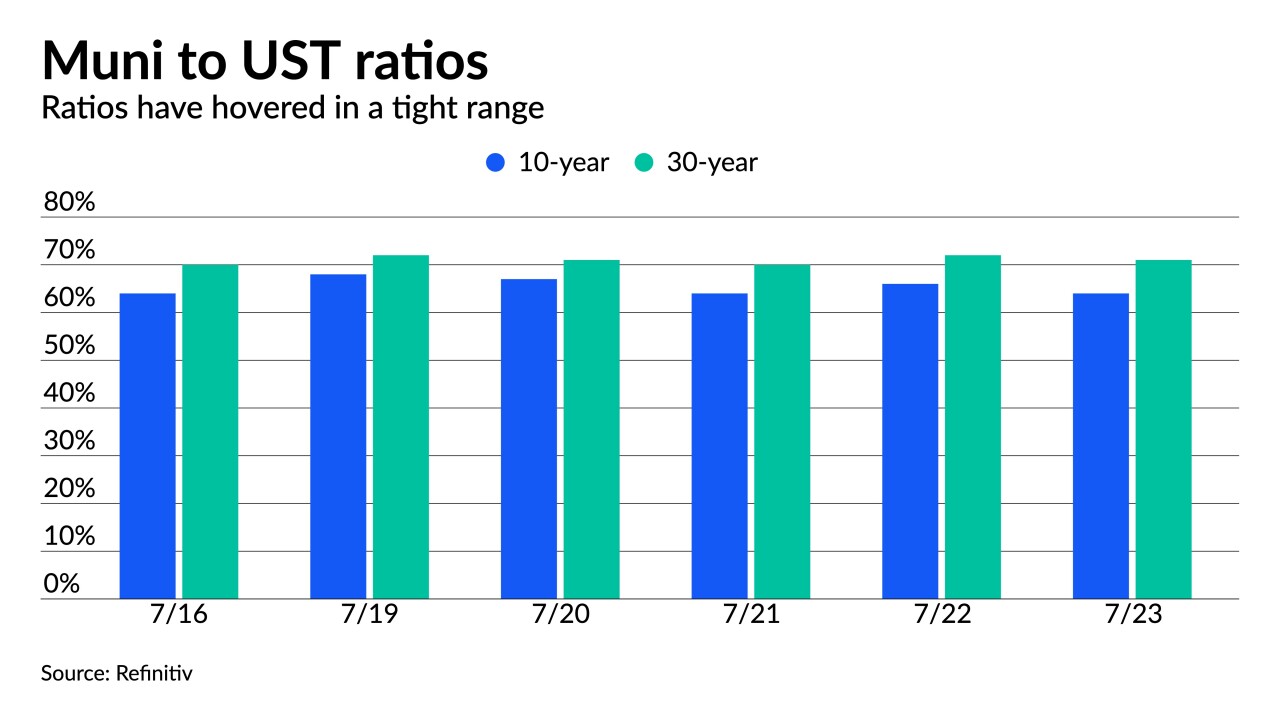

The last week of July marks a lighter calendar while August redemptions are huge compared to the expected supply. Investors need to get in line and likely accept lower yields and continued historically low ratios.

By Lynne FunkJuly 23 -

Whether a BABs-like program could make it into actual law in Washington is still highly uncertain. What is certain: Some form of infrastructure spending is must-pass legislation because federal-aid highway funding is set to expire in October.

By Lynne FunkJuly 22 -

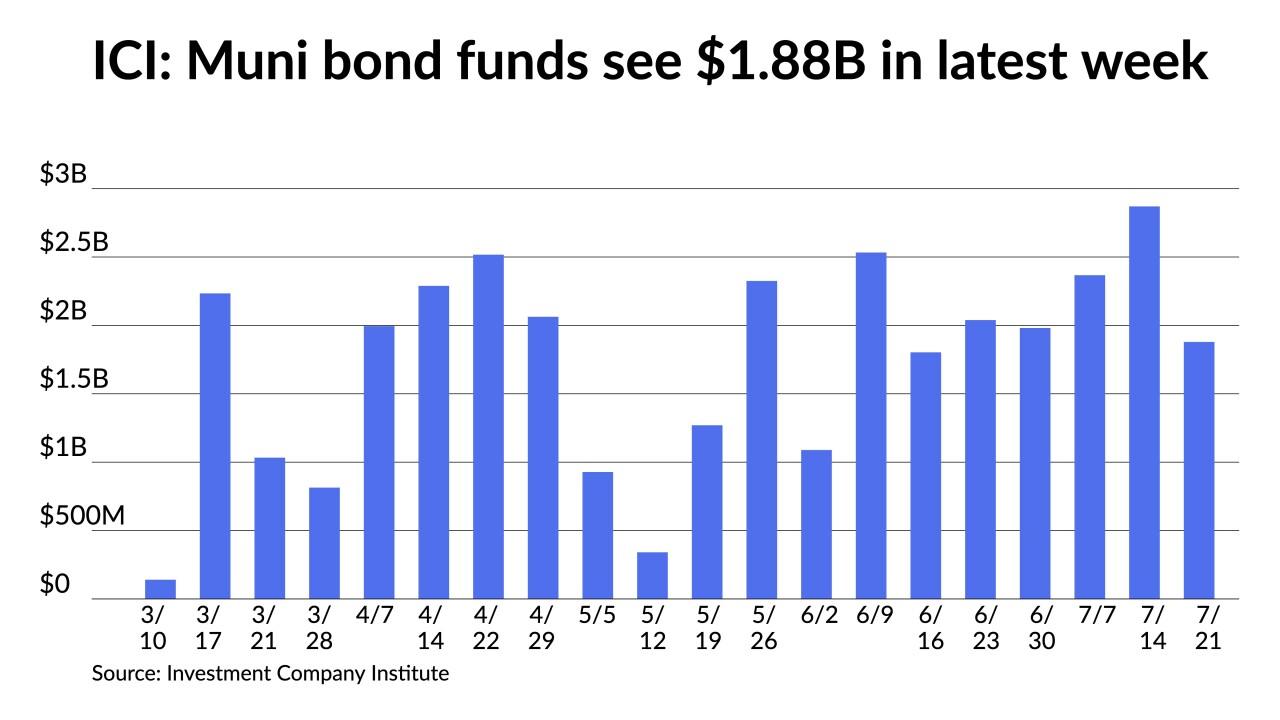

The larger new issues and aggressive swings in taxables had investors on guard as triple-A curves were pressured outside 10-years, but the asset class still vastly outperformed UST while ICI reports nearly $3 billion more inflows.

By Lynne FunkJuly 21 -

The agency withdrew its ratings on the commonwealth and all of its authorities for its own business reasons.

By Lynne FunkJuly 20 -

Negotiated deals were repriced to lower yields while competitive deals saw levels coming in through triple-A benchmarks. High-grade benchmarks were little changed.

By Lynne FunkJuly 20 -

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

By Lynne FunkJuly 19