Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"The November muni rally continues as month-to-date returns are now at 4.68%, pushing us further into positive territory for the year as year-to-date returns now stand at 2.35%," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 27 -

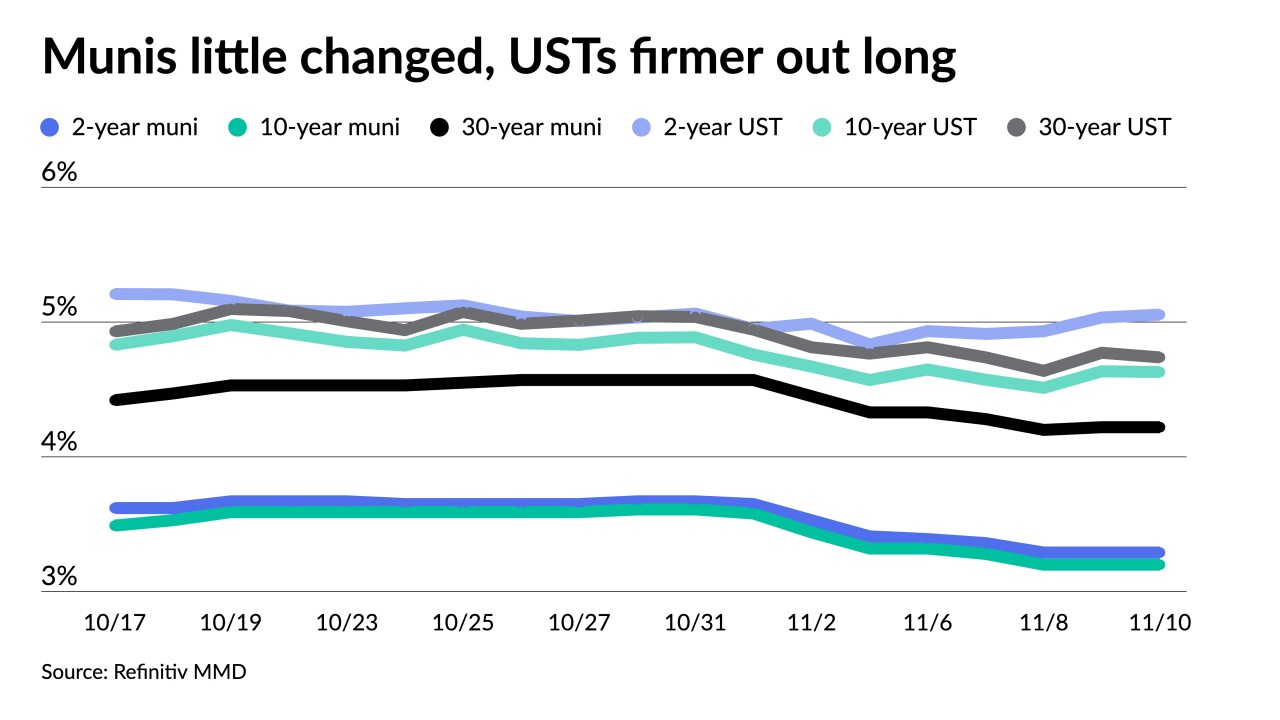

"The market has had a solid tone to it recently even with the strong rally seen this month," Roberto Roffo, managing director and portfolio manager at SWBC Investment Management, said of the Nov. 10 rally where municipal yields in 10 years fell by as much as 40 basis points.

November 22 -

There had been speculation of layoffs in Citi's municipal division as several high-profile employees had been departing the firm over the last year, but sources said they have not heard of any muni layoffs.

November 22 -

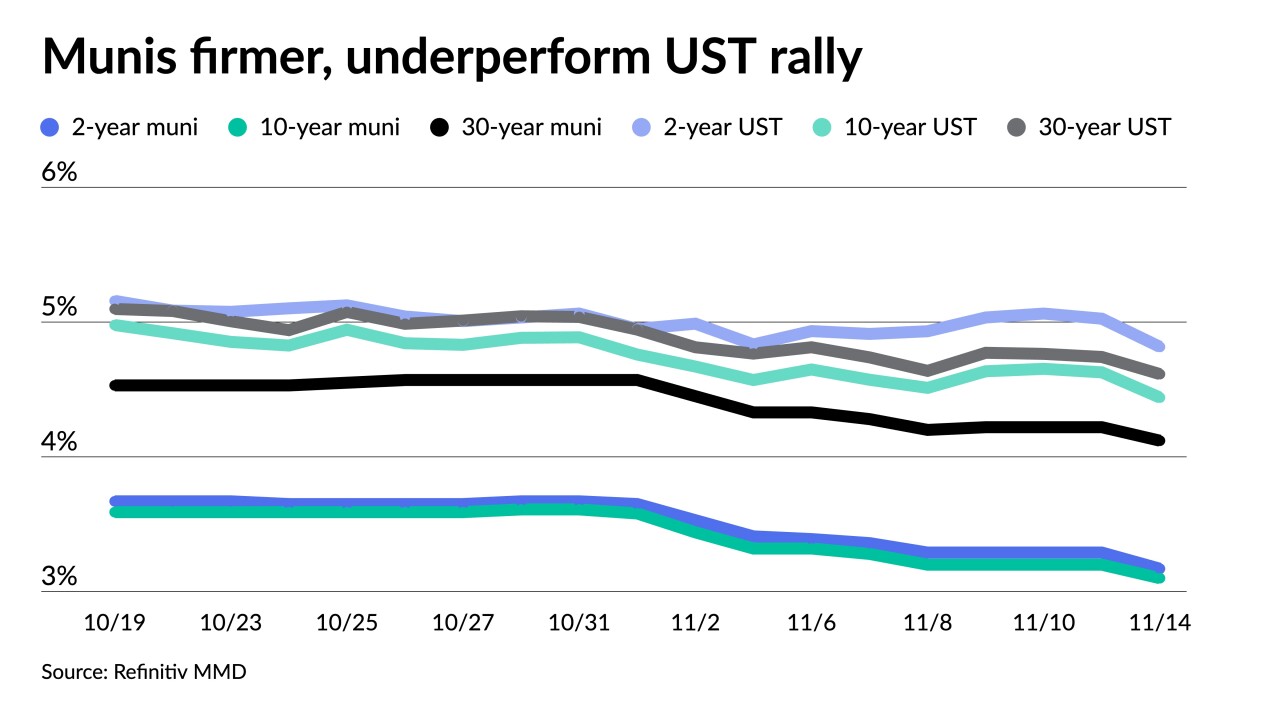

The large drop in yields since the end of October can be reflected in sentiment that investors expect a potentially dovish Fed next year, and that a soft landing narrative gives them "permission to finally purchase the bonds they've been admiring," said MMA's Matt Fabian.

November 21 -

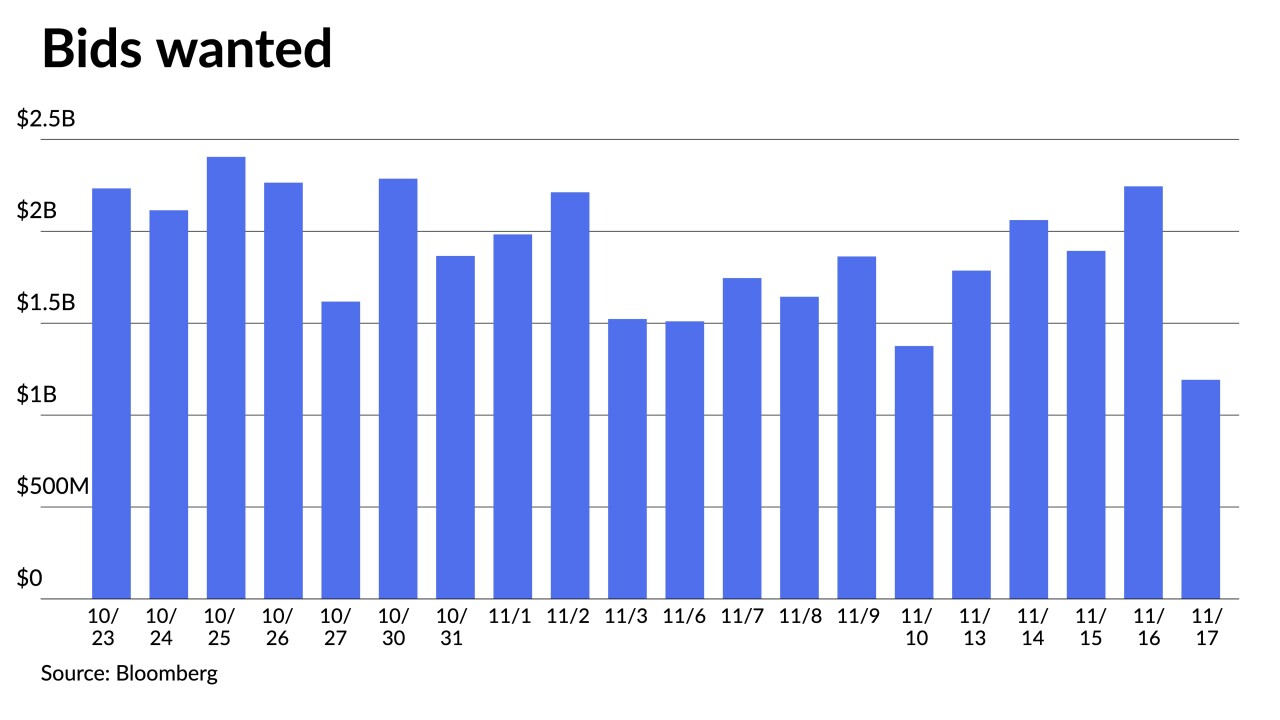

This year has seen an increase in and an earlier start to tax loss harvesting amid rapidly rising interest rates and stronger equity market performance.

November 21 -

The rally in munis over the last three weeks has "pushed ratios to levels that we have not seen since the start of the year," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 20 -

Tradeweb created a model that examines outstanding municipal securities, both tax-exempts and taxables, and it looks for similarities in bond features, such as maturities, call dates, use of proceeds and coupon structures.

November 20 -

BofA Global Research strategists said they believe peak muni yields in this Fed tightening cycle were attained in October 2023 and "the bull market for munis is underway."

November 17 -

The municipal dashboard solves three challenges: bond linkage, pricing and spread aggregation.

November 17 -

The process of turning the data into a usable form takes time and can be compounded by the difficulty of extracting what data there is and the format used by issuers in documents, like official statements, disclosures and other financials.

November 17 -

"Demand is firming up. Interest rates have moved off the recent highs. Intermediate muni yields are about 50 basis points off from those highs," said Stephen Shutz, head of tax-exempt fixed income and a portfolio manager at Brown Advisory.

November 16 -

Buying technology can be a relatively safe bet, especially if it comes from an established brand, and it comes with support, maintenance and expertise from vendors. Internally building it allows for exclusivity and a potential competitive advantage.

November 16 -

"Everyone is reevaluating and taking a breather after the numbers [on Tuesday]," a New York trader said.

November 15 -

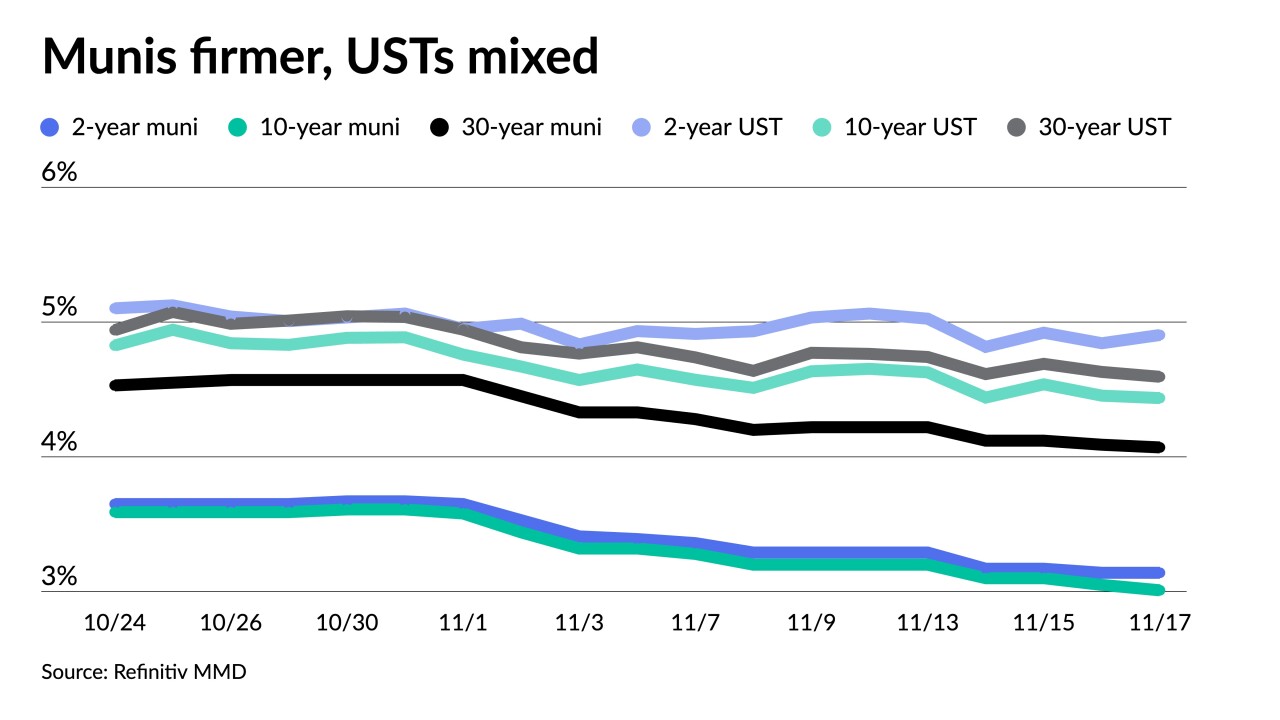

Munis yields fell nine to 12 basis points, depending on the curve, but underperformed larger gains along the UST curve. Large new-issues began pricing.

November 14 -

November "continues to be off to a strong start as yields have fallen an average of 34 basis points across the curve since the start of the month," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 13 -

"As with most fast rallies there are sessions when the market pauses to assess where fair value should play out," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

November 10 -

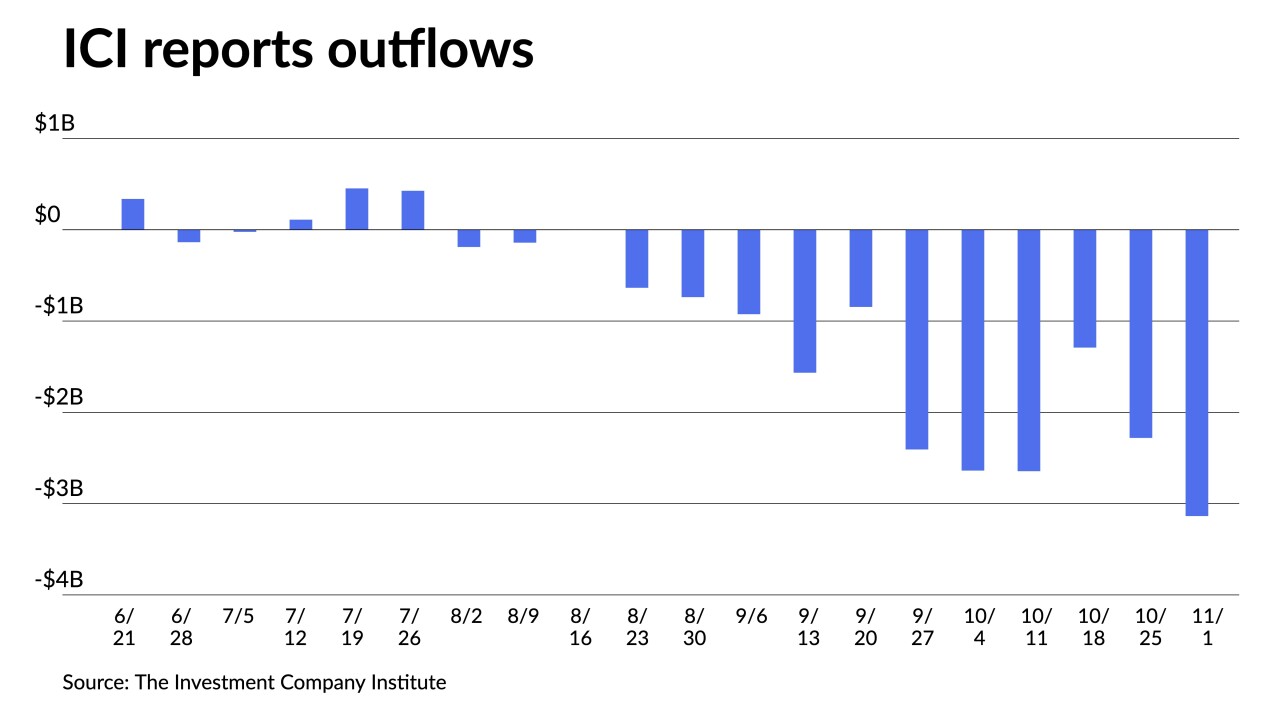

Outflows slowed from muni mutual funds with LSEG Lipper reporting investors pulled $151.1 million for the week ending Wednesday while high-yield saw inflows of $190 million.

November 9 -

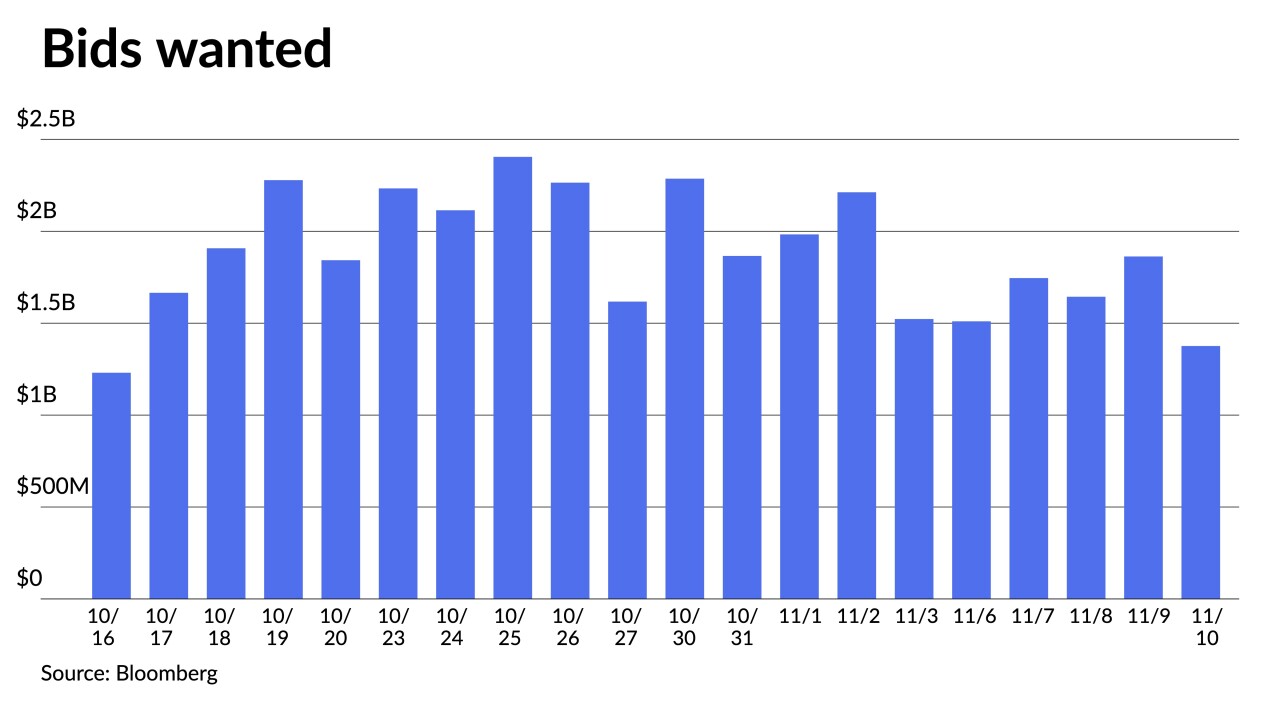

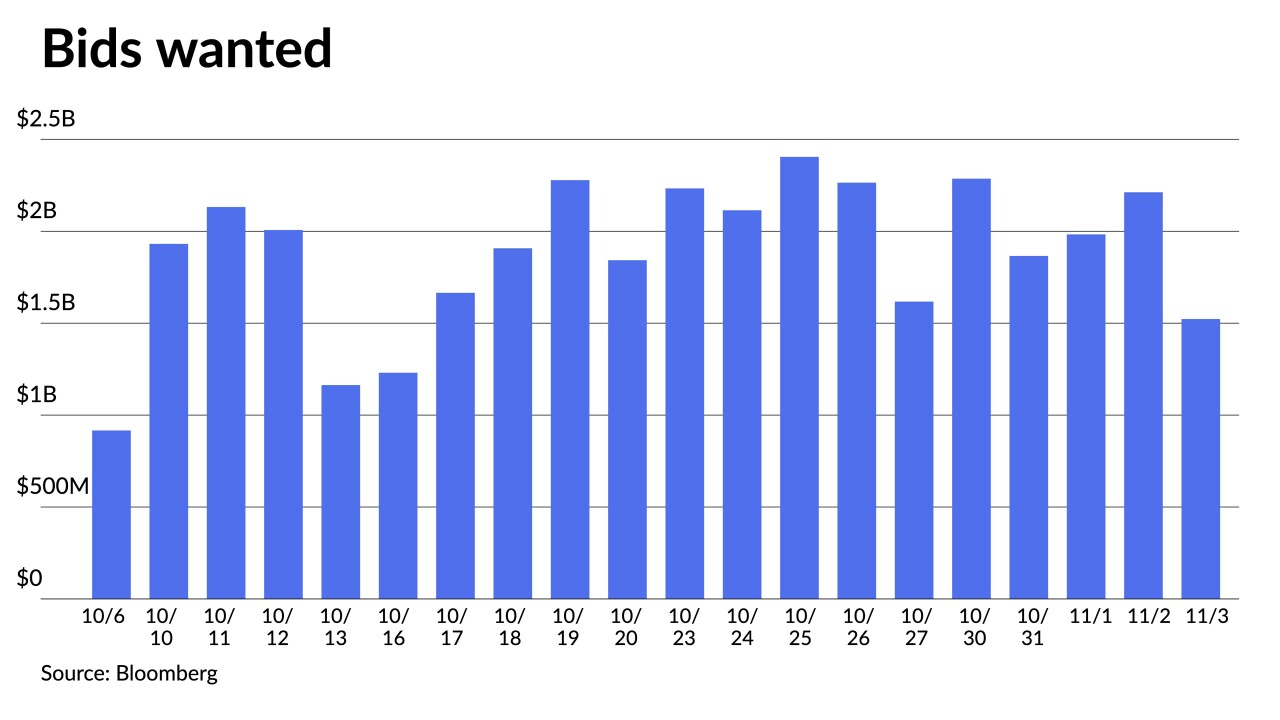

A constructive trading session in the secondary aided a busy primary once again as investors appear to be more engaged in the asset class.

November 8 -

California and Washington sold four large refunding GO deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million for Arizona's Salt River Project. A constructive secondary led yields to fall three to five basis points.

November 7 -

The recent rally is good news for munis, which have "posted a total-negative return loss for three straight months," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 6