Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

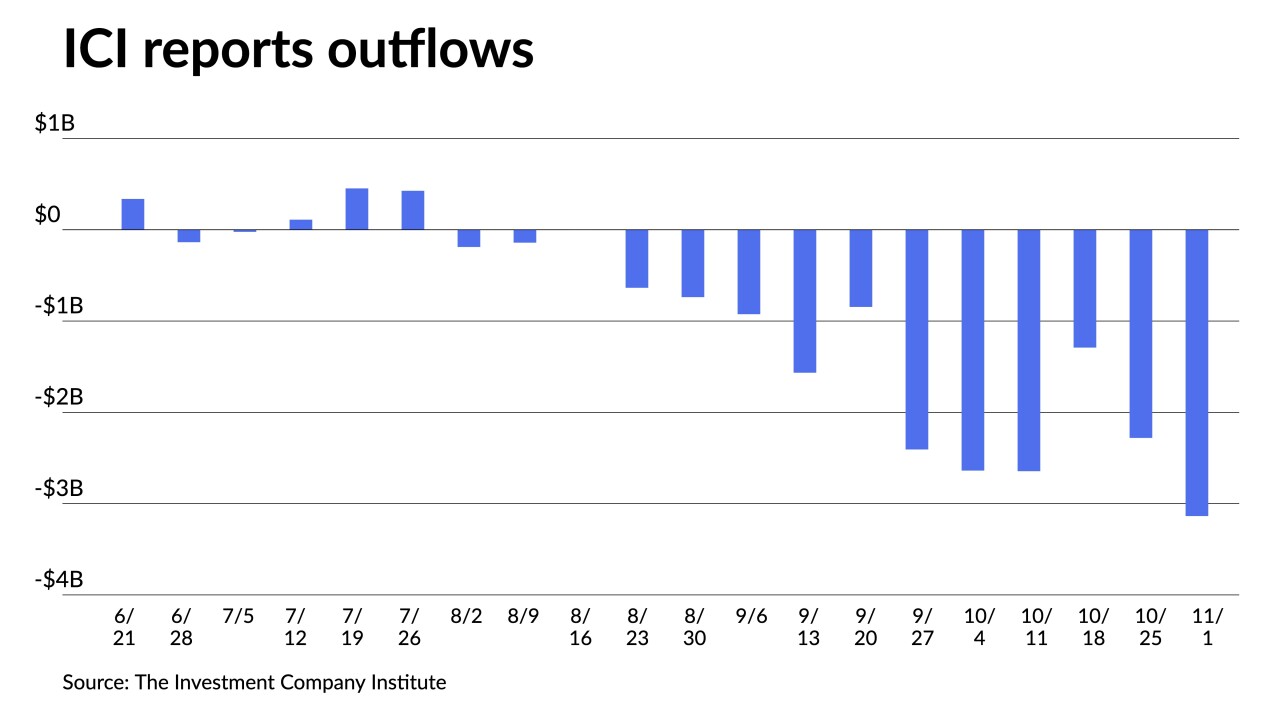

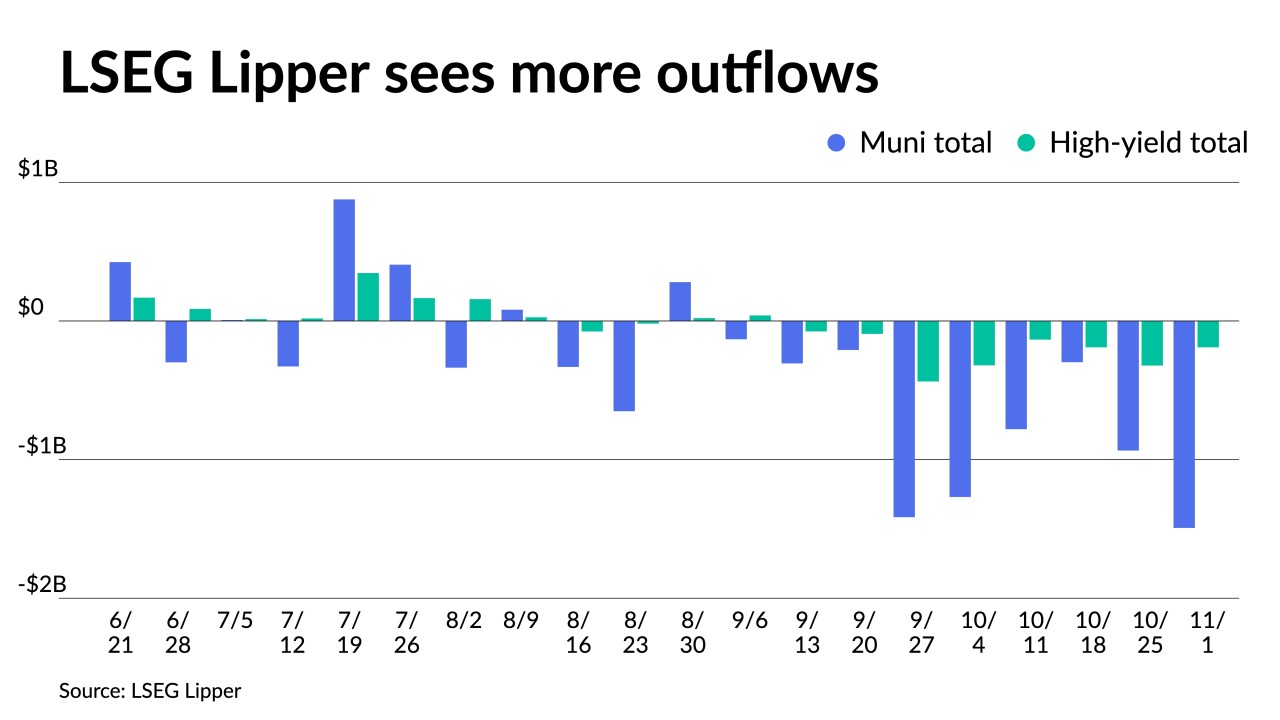

Outflows slowed from muni mutual funds with LSEG Lipper reporting investors pulled $151.1 million for the week ending Wednesday while high-yield saw inflows of $190 million.

November 9 -

A constructive trading session in the secondary aided a busy primary once again as investors appear to be more engaged in the asset class.

November 8 -

California and Washington sold four large refunding GO deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million for Arizona's Salt River Project. A constructive secondary led yields to fall three to five basis points.

November 7 -

The recent rally is good news for munis, which have "posted a total-negative return loss for three straight months," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 6 -

While it's been a tough year across fixed-income generally, a Wall Street muni retrenchment marks an opportunity for regional and middle-market firms to gain more of a foothold, market participants said.

November 6 -

Friday's employment report was good news for the Federal Reserve, with fewer jobs created and a smaller rise in earnings, leading analysts to cautiously increase expectations that the hiking cycle is over.

November 3 -

"The lack of standardization is a very real problem that impacts all facets," said Ted Chapman, managing director and investment banker at Hilltop Securities.

November 3 -

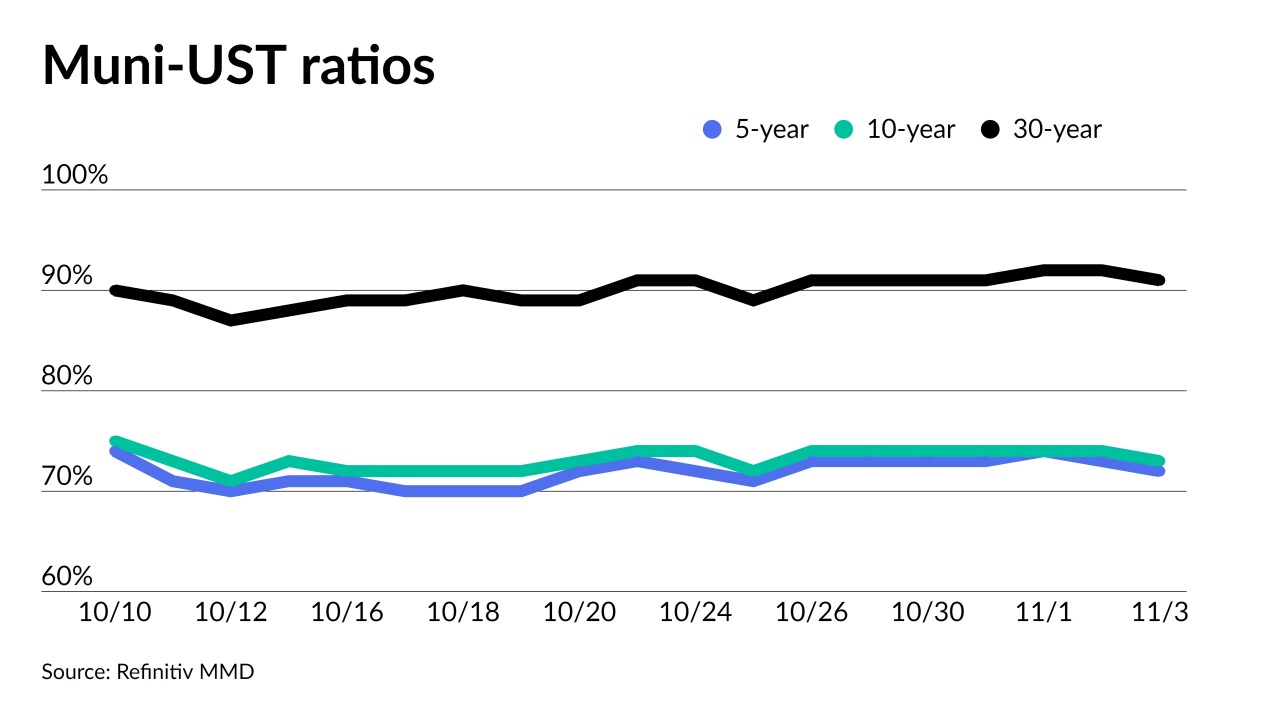

Triple-A muni yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long as market participants consider a potential end to Fed rate hikes.

November 2 -

"The big question is: who's next? I don't think UBS is the end," said a veteran sellside market participant.

November 2 -

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1