Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Hallam will handle high-yield muni sales and trading, focusing on large institutional accounts at the firm.

March 22 -

The Washington refunding deal is built on an extraordinary optional redemption of Build America Bonds despite criticism from investors who hold them.

March 22 -

The extraordinary redemptions being used to call Build America Bonds "are based on a creative but flawed legal argument driven by the current change in interest rates," said Kramer Levin partner Amy Caton.

March 21 -

Citi's exit comes amid the larger trend of broker-dealers downsizing balance sheets, which can hurt secondary market liquidity, particularly in times of stress. Other market players are coming into the fold.

March 21 -

"The balance of March may continue to be better-than-expected, particularly given existing demand and decent reinvestment needs over the next 30 days," according to Oppenheimer's Jeff Lipton.

March 20 -

The New York MTA has not sold fixed-rate transportation revenue bonds since February 2021. The first maturity of that deal (4% 11/15/44) priced at +81 and was evaluated at +78 as of Wednesday by BVAL, according to CreditSights strategists. The same maturity but with a 5% coupon was priced at +59 to BVAL.

March 18 -

Marc Livolsi was promoted to lead U.S. Public Finance New Issue Marketing and Business Development, and Evan Boulukos will lead Assured's Secondary Markets desk, both of whom will report to Chris Chafizadeh, senior managing director and co-head of Public Finance.

March 18 -

Inflows continued for the third consecutive week as LSEG Lipper report fund inflows of $295.5 million for the week ending Wednesday with high-yield hitting the 10th consecutive week of positive flows.

March 14 -

BofA Securities is the latest firm to scoop up former employees from Citi, which decided to shutter its muni division late last year.

March 14 -

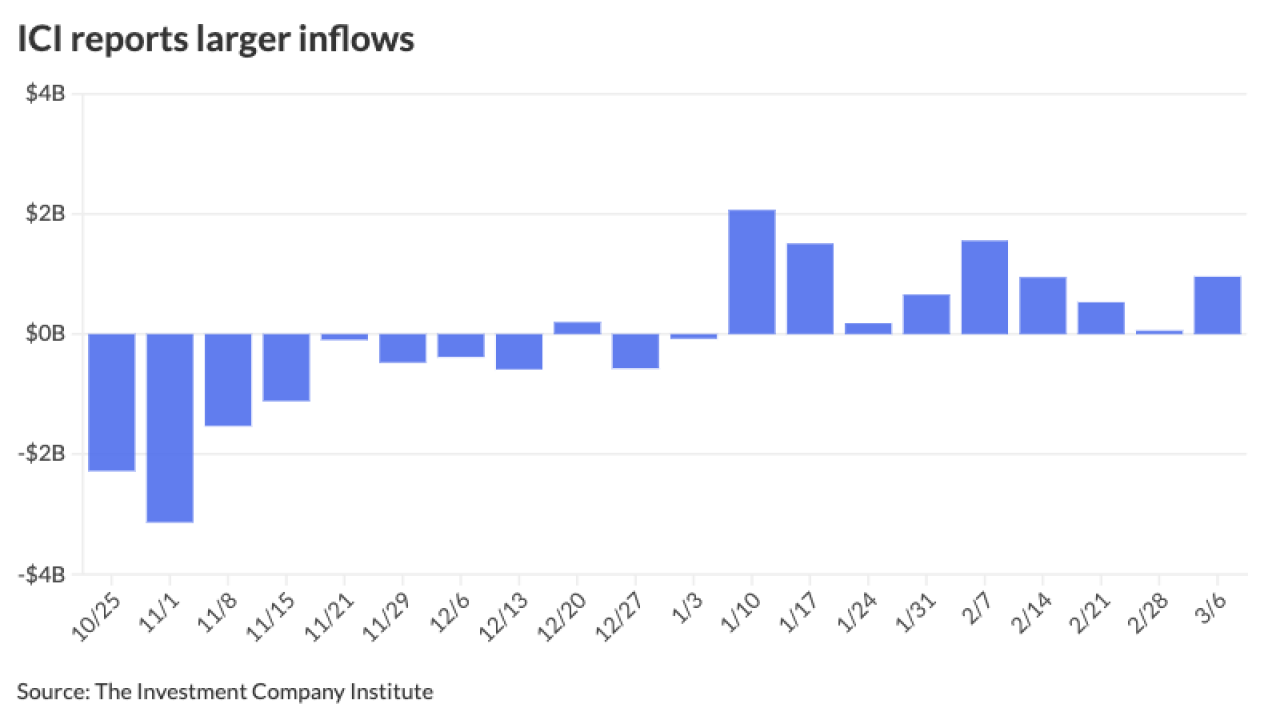

The Investment Company Institute reported larger inflows into municipal bond mutual funds for the week ending March 6, with investors adding $956 million to funds following $57 million the week prior.

March 13 -

Narens' hiring complements Stifel's public finance practice and the types of deals the firm is doing, said Betsy Kiehn, managing director and head of Stifel's Municipal Capital Markets Group.

March 13 -

"The muni AAA [high grade] curve has been relatively steady thus far in March, but lags relative to the broader fixed income market after sizable muni outperformance in February," said J.P. Morgan strategists.

March 12 -

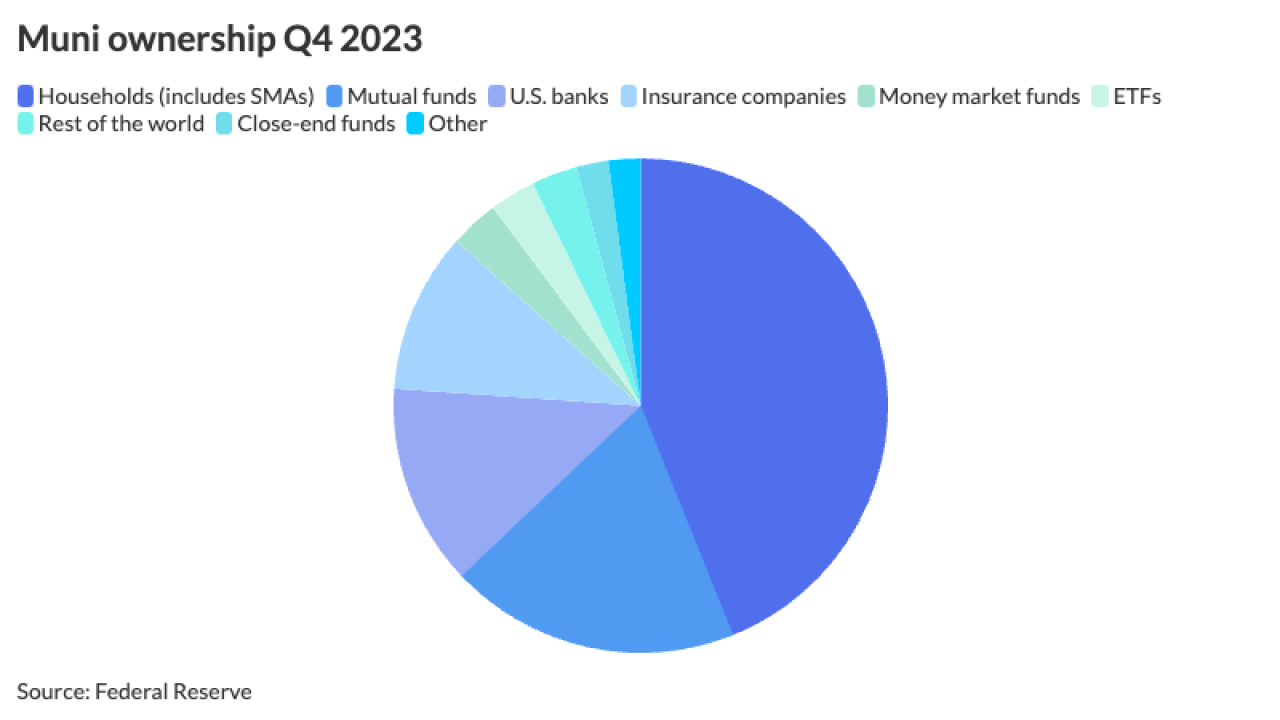

Over the past few years, retail has been a growing portion of the muni market, starting when the reduction of corporate taxes made it less advantageous for insurance companies and banks to own munis, said David Litvack, a tax-exempt strategist and chief investment officer at BofA.

March 12 -

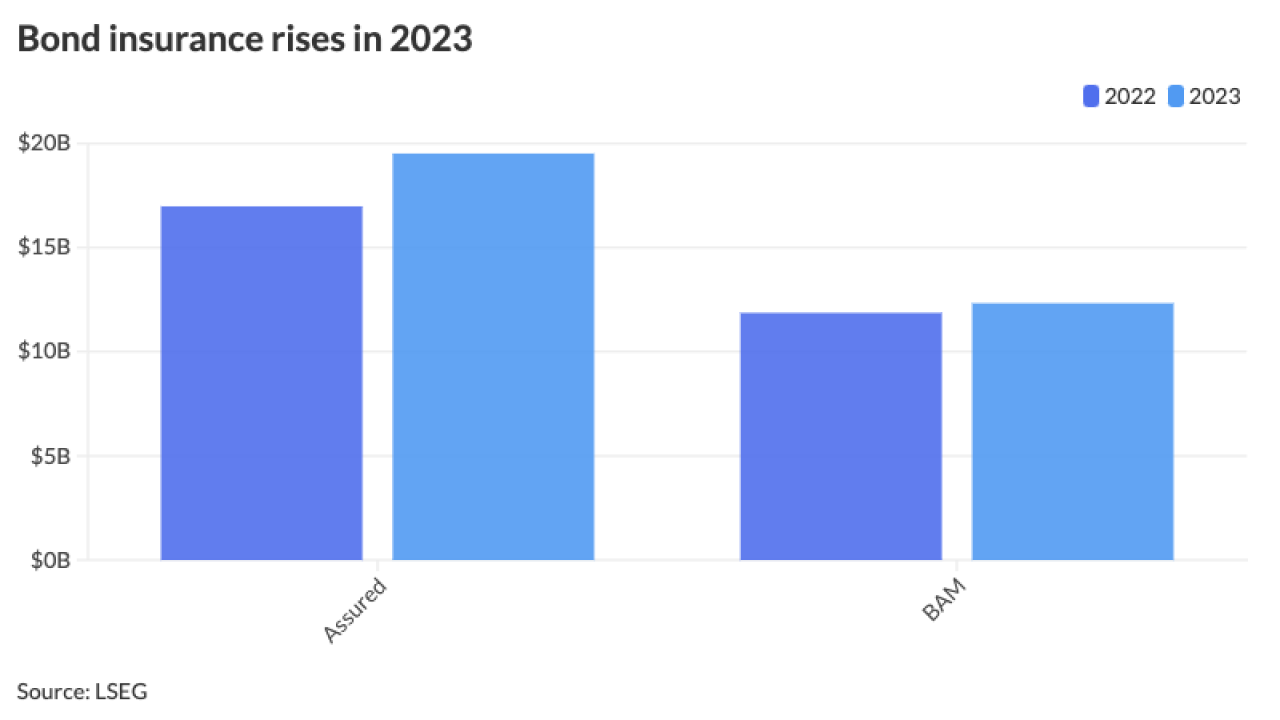

Issuers have increased their debt sale in recent weeks, as issuance has come in above $70 billion year-to-date, according to LSEG data

March 11 -

Market participants said it is yet to be seen whether issuers will pull back their BABs refundings due to concerns after several bondholders sent a letter to the trustee on a Regents of the University of California deal, saying it was "prohibited" from executing the redemption.

March 11 -

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

Several investors in a challenge to a University of California Regents Build America Bonds redemption "may give issuers additional reason for pause when vetting similar refundings," J.P. Morgan strategists said.

March 7 -

It was a good day for munis with larger deals clearing the primary and secondary trading showing a more constructive tone with triple-A yields falling a few basis points amid a stronger session for all markets.

March 6 -

Harvard and Princeton coming to market is a "huge sign of confidence," said Clare Pickering, a Barclays strategist.

March 6 -

Large deals were repriced to lower yields while the secondary market was lightly traded, leading to little changed triple-A yield curves and underperformance to Treasury market gains. Despite a growing calendar, the supply demand imbalance remains with much cash on the sidelines.

March 5