Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Analysts are confident the Fed will lower rates at this week's meeting, but their views on what next year holds don't share the same consensus.

By Gary SiegelDecember 17 -

Voters were asked to consider at least $148.912 billion of bonds this year in 908 ballot referendums, according to data compiled by Bond Buyer.

By Gary SiegelNovember 6 -

While this meeting is a slam dunk, the election and data makes the December meeting more of a question, some analysts said.

By Gary SiegelNovember 5 -

Given the Fed's reluctance to "surprise markets or take actions that could be perceived as overtly political," Interactive Brokers Chief Strategist Steve Sosnick said, "we find it hard to believe that anything other than 25 bp is the likely outcome for the upcoming FOMC meeting."

By Gary SiegelSeptember 16 -

"The numbers are weak, but not cusp of recession weak," Chris Low, chief economist at FHN Financial, said.

By Gary SiegelSeptember 6 -

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

By Gary SiegelAugust 21 -

Economists expect the FOMC to hold rates, although some say there's a case to be made for a July cut, with Fed Chair Powell setting the table for September.

By Gary SiegelJuly 30 -

The Philadelphia Fed president said there can be as few as no cuts or as many as two this year, but if his projections are accurate, one decrease would be appropriate this year.

By Gary SiegelJune 17 -

With no change in rates expected, analysts are interested in the dot plot and Fed Chair Jerome Powell's press conference.

By Gary SiegelJune 11 -

"The Fed is certainly not going to be overly concerned about the growth backdrop" at this week's Federal Open Market Committee meeting, said BMO Chief Economist Douglas Porter.

By Gary SiegelApril 29 -

Analysts ponder what the Fed will do this year with a March cut ruled out amid recent reports of higher-than-expected inflation.

By Gary SiegelMarch 18 -

The discussion of rate cuts, both timing and amount, has analysts offering varying estimates.

By Gary SiegelJanuary 30 -

Musalem, an economist, is a former executive vice president of the Federal Reserve Bank of New York.

By Gary SiegelJanuary 4 -

COVID made predicting the economic future even more difficult. While calls for a recession and rate cuts for this year didn't pan out, here's what experts see for 2024.

By Gary SiegelDecember 22 -

The Federal Open Market Committee's Summary of Economic Projections probably won't offer the 130 basis points of cuts next year that the market expects.

By Gary SiegelDecember 12 -

Voters approved several billion-dollar-plus bond referedums before them.

By Gary SiegelNovember 8 -

This could be the first time the bond market has posted three consecutive negative total return years, according to John Hancock Investment Management Co-Chief Investment Strategist Matt Miskin.

By Gary SiegelOctober 30 -

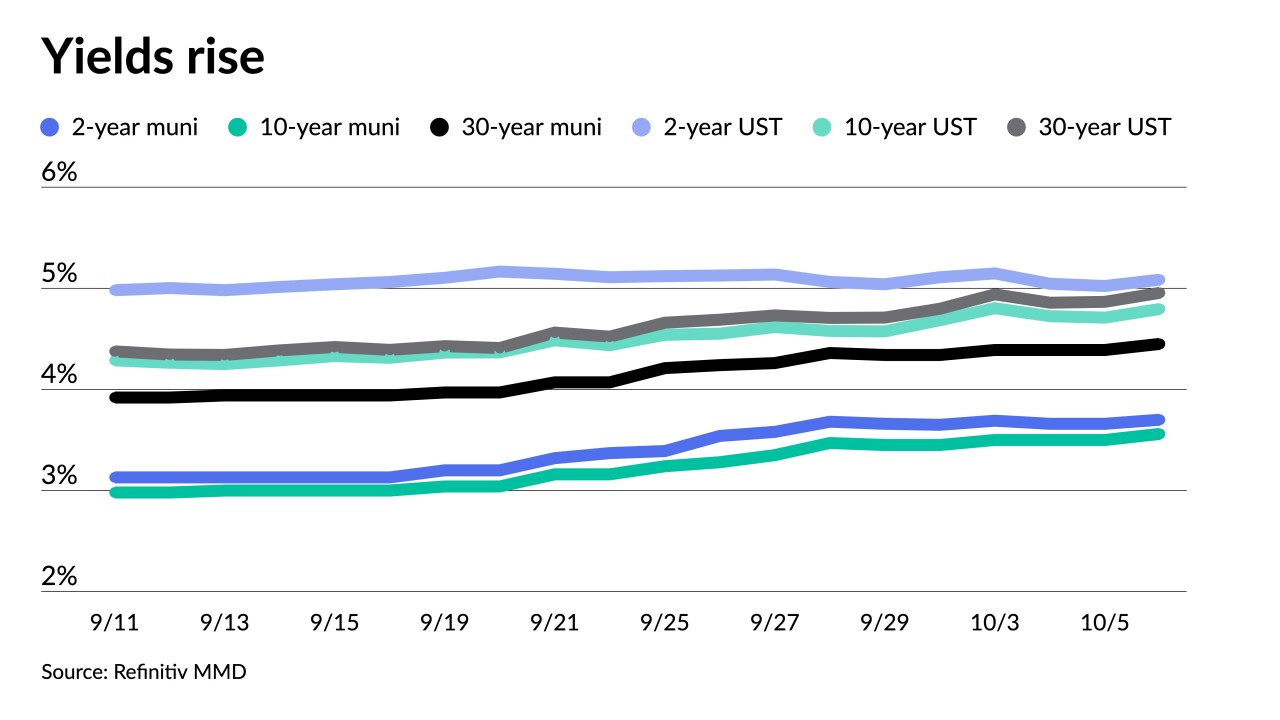

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

By Lynne FunkOctober 6 -

With the Federal Open Market Committee expected to skip an interest rate hike, all eyes turn to the Summary of Economic Projections and Chair Powell's remarks.

By Gary SiegelSeptember 18 -

"Part of the mission of the New York Fed is making the U.S. economy stronger and the financial system more stable for all segments of society," Timothy Little said, "and I really feel the municipal market is a critical component of that."

By Gary SiegelSeptember 13