Christine Albano is a reporter in the Investor’s & Investing beat, which she has covered for the past two decades. She has a wide range of buy side sources in the municipal market and has covered trends affecting retail investors, institutions, municipal mutual funds, tax-exempt money market funds, and the high-yield beat. She has also written about some of the industry’s biggest issues, such as historic defaults in Orange County, Calif., Puerto Rico, and Jefferson County, Ala., as well as the collapse of the variable-rate demand market. In addition, she reported on the subsequent 2008 financial crisis, and the death of municipal bond pioneer Jim Lebenthal. She provided next day coverage of the impact on the municipal bond market of the Sept. 11 terrorist attacks on the World Trade Center, and recently interviewed The Vanguard Group Inc. founder, former chief executive officer, and investment guru John C. Bogle about the best investing advice for the municipal market.

-

Volume for the upcoming week is estimated at $8.34 billion, consisting of $6.30 billion of negotiated deals and $2.04 billion of competitive sales.

By Chip BarnettJanuary 13 -

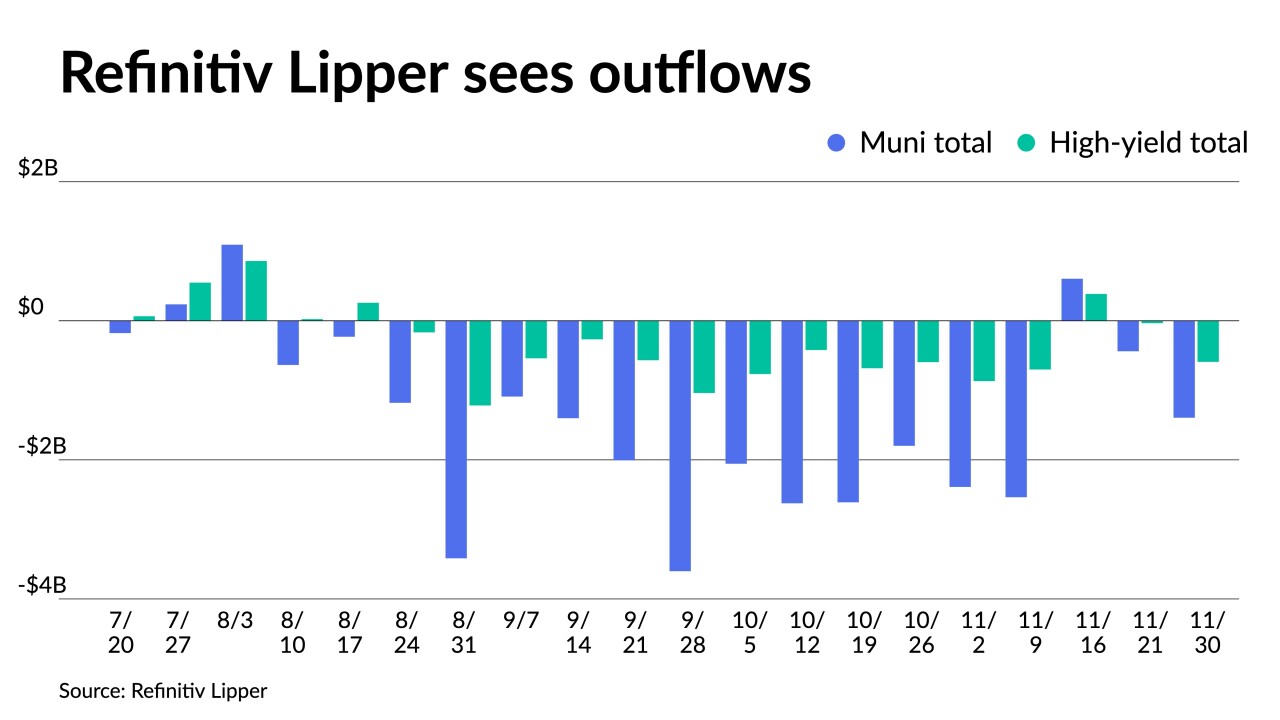

Inflows returned as Refinitiv Lipper reported $1.981 billion was added to municipal bond mutual funds in the week ending Wednesday after $2.477 billion of outflows the week prior.

January 12 -

Outflows lessened, with the Investment Company Institute reporting investors pulled $3.157 billion from mutual funds in the week ending Jan. 4, after $3.402 billion of outflows the previous week.

January 11 -

"There was strong demand for the Pennsylvania Housing Finance Authority deal, which was three times oversubscribed," said a New York trader.

January 10 -

This week's "manageable" calendar will continue what has been a quiet start to the new year in the municipal market, according to John Mousseau, president and chief executive officer and director of fixed income at Cumberland Advisors.

January 9 -

Jon Ballan will head the firm's new infrastructure and public-private partnerships practice.

January 6 -

2022 saw rising rates, low issuance, massive fund outflows and overall volatility.

December 29 -

The CPI report showed inflation had slowed to 7.1%, giving investors confidence the Federal Open Market Committee will hike rates 50 basis points as expected following Wednesday's much-anticipated meeting.

December 13 -

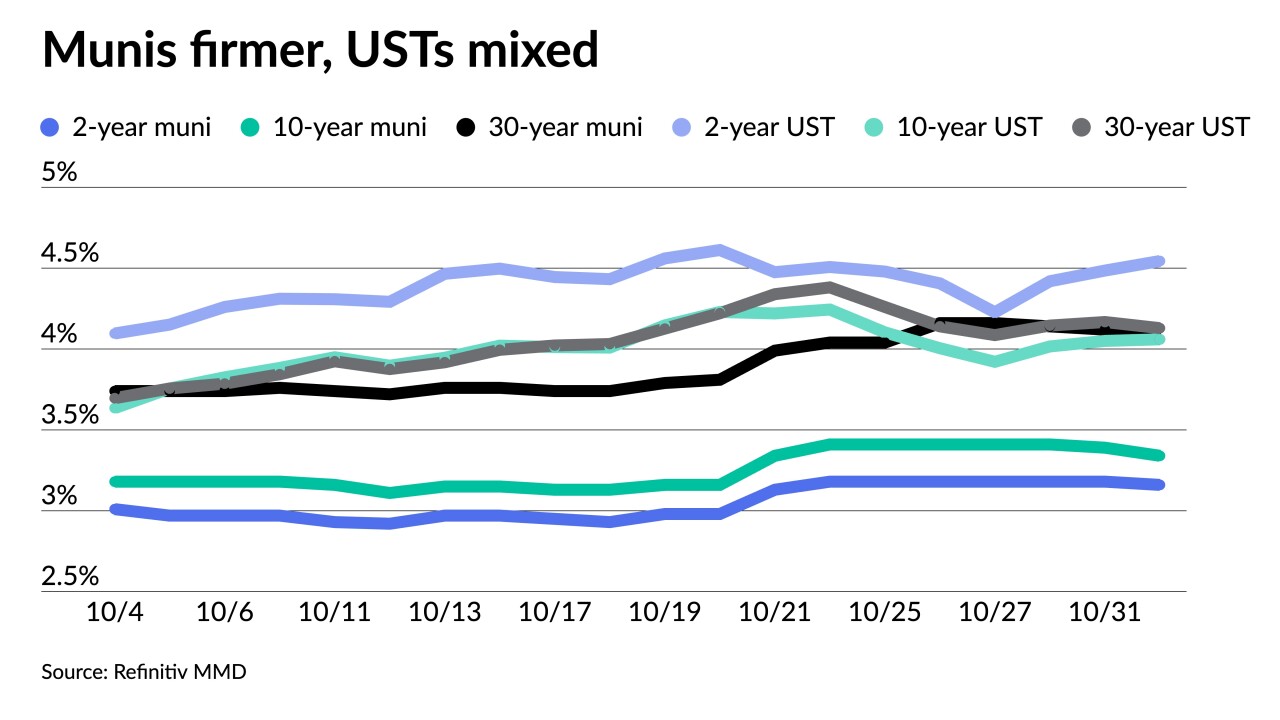

Despite the volatility in equities and Treasuries, the backdrop for munis is very positive.

December 6 -

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30 -

The Missouri-based firms say they will boost client relationships and expand capabilities with the pending merger, which will retain the L.J. Hart & Co. brand.

November 30 -

Municipal underwriting fixture, Jaime Durando, announced his retirement from the industry after more than 30 years.

November 28 -

Investment bank expands with three former Citigroup muni veterans at the helm.

November 17 -

"There's always a new issue you might not be aware of; with 50 states you are constantly learning something new," Cooper Howard said. "It's not a homogenized market."

November 14 -

"I always looked up to my dad and was amazed by the amount of time he spent at the office," Russell Feldman said. "I became a lot more intimately aware of the challenges in fixed income when I joined the industry years later."

November 14 -

Voters will decide on more than $60 billion of bond ballot measures Tuesday with New York voters faced with the largest amount at $4.2 billion.

November 7 -

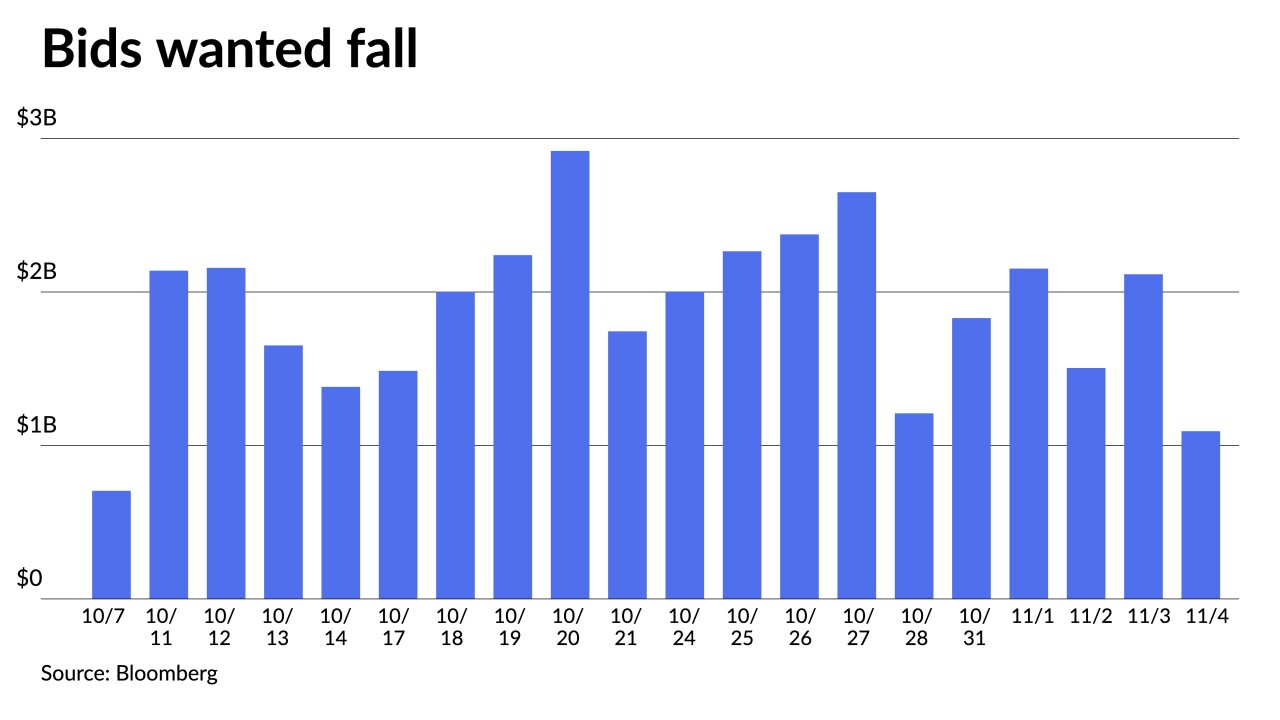

October returns were in the red with the Bloomberg Municipal Index showing a loss of 0.83% for the month, bringing total losses in 2022 to 12.86%. Only May and July saw positive returns for the asset class.

November 1 -

Cohen was a pioneer, a mentor and a role model to countless industry analysts and helped shape many of the credit approaches that continue to be used today.

October 31 -

The Investment Company Institute reported $5.128 billion of outflows for the week ending Oct. 5 after $5.374 billion of outflows the previous week.

October 12