Christine Albano is a reporter in the Investor’s & Investing beat, which she has covered for the past two decades. She has a wide range of buy side sources in the municipal market and has covered trends affecting retail investors, institutions, municipal mutual funds, tax-exempt money market funds, and the high-yield beat. She has also written about some of the industry’s biggest issues, such as historic defaults in Orange County, Calif., Puerto Rico, and Jefferson County, Ala., as well as the collapse of the variable-rate demand market. In addition, she reported on the subsequent 2008 financial crisis, and the death of municipal bond pioneer Jim Lebenthal. She provided next day coverage of the impact on the municipal bond market of the Sept. 11 terrorist attacks on the World Trade Center, and recently interviewed The Vanguard Group Inc. founder, former chief executive officer, and investment guru John C. Bogle about the best investing advice for the municipal market.

-

February municipal bond activity compared to last month is brisk yet more finicky in the face of an ongoing supply shortage, according to Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co.

February 13 -

Healthy coffers, revenue growth, and strong market technicals led to declining need for short-term borrowing among municipalities last year.

February 13 -

Although there is some volatility in the municipal market, the landscape is in good shape, according to Cooper Howard, fixed income strategist at Charles Schwab.

February 8 -

Jim Link joins the asset management firm as head of institutional Outsourced Chief Investment Officer division.

February 6 -

Total volume for the month was $21.931 billion in 417 issues versus $26.292 billion in 770 issues a year earlier, according to Refinitiv data.

January 31 -

Investors will likely sit on the sidelines until after this week's Federal Reserve Board rate announcement.

January 30 -

On the buy side, lower interest rates and an extreme imbalance between supply and demand is supporting the municipal market's positive tone, according to JB Golden, executive director and portfolio manager at Advisors Asset Management.

January 26 -

After "carnage" in 2022, a munis should see a "positive environment" this year, according to analysts.

January 25 -

Three municipal veterans will add to Ramirez' public finance operations in New York and Texas.

January 25 -

The primary "pumped new life into an already-firm market with a lower yield range being established," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

January 19 -

Volume for the upcoming week is estimated at $8.34 billion, consisting of $6.30 billion of negotiated deals and $2.04 billion of competitive sales.

By Chip BarnettJanuary 13 -

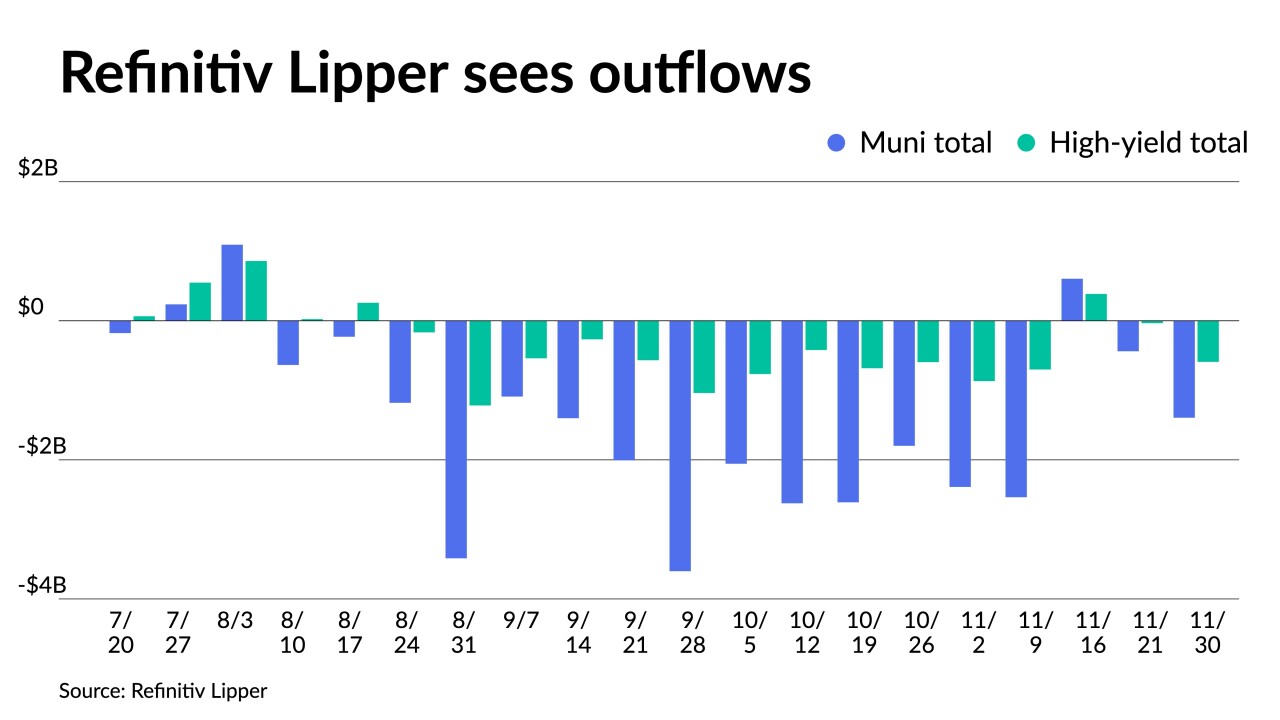

Inflows returned as Refinitiv Lipper reported $1.981 billion was added to municipal bond mutual funds in the week ending Wednesday after $2.477 billion of outflows the week prior.

January 12 -

Outflows lessened, with the Investment Company Institute reporting investors pulled $3.157 billion from mutual funds in the week ending Jan. 4, after $3.402 billion of outflows the previous week.

January 11 -

"There was strong demand for the Pennsylvania Housing Finance Authority deal, which was three times oversubscribed," said a New York trader.

January 10 -

This week's "manageable" calendar will continue what has been a quiet start to the new year in the municipal market, according to John Mousseau, president and chief executive officer and director of fixed income at Cumberland Advisors.

January 9 -

Jon Ballan will head the firm's new infrastructure and public-private partnerships practice.

January 6 -

2022 saw rising rates, low issuance, massive fund outflows and overall volatility.

December 29 -

The CPI report showed inflation had slowed to 7.1%, giving investors confidence the Federal Open Market Committee will hike rates 50 basis points as expected following Wednesday's much-anticipated meeting.

December 13 -

Despite the volatility in equities and Treasuries, the backdrop for munis is very positive.

December 6 -

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1