Christine Albano is a reporter in the Investor’s & Investing beat, which she has covered for the past two decades. She has a wide range of buy side sources in the municipal market and has covered trends affecting retail investors, institutions, municipal mutual funds, tax-exempt money market funds, and the high-yield beat. She has also written about some of the industry’s biggest issues, such as historic defaults in Orange County, Calif., Puerto Rico, and Jefferson County, Ala., as well as the collapse of the variable-rate demand market. In addition, she reported on the subsequent 2008 financial crisis, and the death of municipal bond pioneer Jim Lebenthal. She provided next day coverage of the impact on the municipal bond market of the Sept. 11 terrorist attacks on the World Trade Center, and recently interviewed The Vanguard Group Inc. founder, former chief executive officer, and investment guru John C. Bogle about the best investing advice for the municipal market.

-

The Investment Company Institute reported investors pulled $7.2 billion from municipal bond mutual funds, the largest figure since the outlier months of March 2020 when investors yanked $24 billion in two weeks.

April 20 -

The significant cheapening of municipals in recent weeks continues to create headwinds for the overall tax-exempt market on a daily basis.

April 19 -

The second quarter should bring more opportunity and less volatility following the worst quarter in four decades, analysts said.

April 14 -

Independent municipal advisory firm Sycamore Advisors LLC adds veteran banker and issuer Phil Wasserman as part of its expansion.

April 11 -

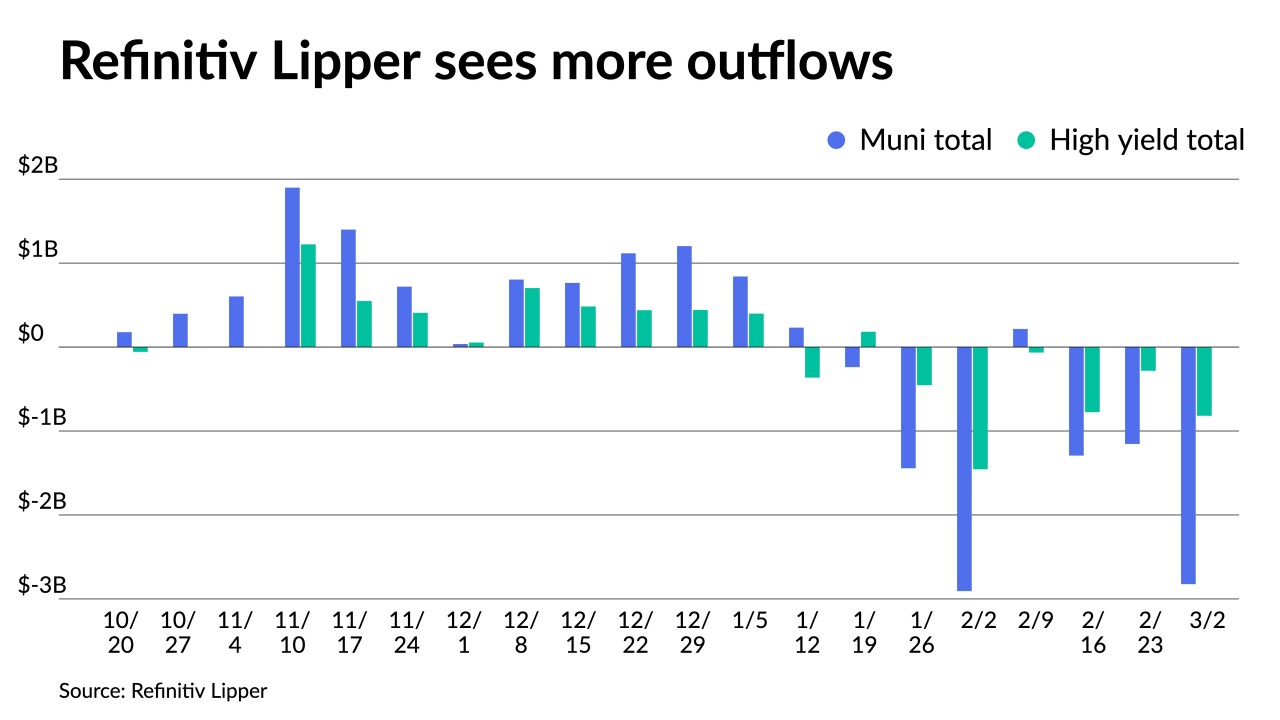

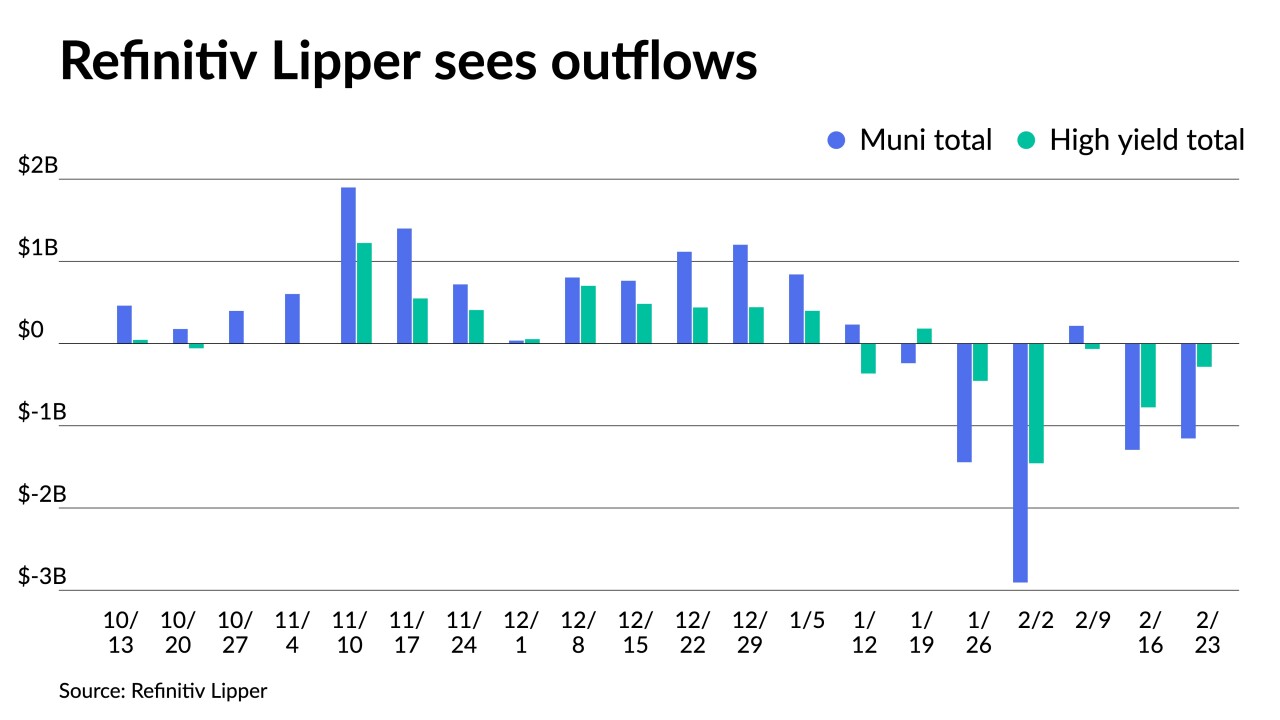

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.038 billion of outflows, up from $1.503 billion of outflows in the previous week.

March 31 -

The Investment Company Institute on Wednesday reported $2.728 billion of outflows in the week ending March 23, down from $3.615 billion of outflows in the previous week.

March 30 -

Without a reversal in UST or municipal bond mutual fund outflows, munis will continue to be pressured.

March 29 -

Outflows continued, with Refinitiv Lipper reporting investors shed $1.503 billion from municipal bond mutual funds in the week, following outflows of $2.136 billion in the previous week. High-yield saw small inflows.

March 24 -

The Memphis-based investment bank launches a new office with two municipal professionals on board.

March 24 -

For investors who want a customized portfolio and a greater ability to control taxable events, SMAs may be the product they're searching for.

March 23 -

Outflows continued, rising significantly in the latest week, with Refinitiv Lipper reporting $2.136 billion coming out of municipal bond mutual funds, following outflows of $661.675 billion in the previous week.

March 17 -

Outflows continue but dropped significantly in the latest week with Refinitiv Lipper reporting $662 million of outflows from municipal bond mutual funds following $2.823 billion the week prior.

March 10 -

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

The Russian invasion of Ukraine could slow interest rate hikes and has led the market to pull back on the chances of a 50-basis-point liftoff.

March 1 -

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24 -

Federal aid propped up municipalities’ already strong revenue and credit conditions, making them less apt to need short-term funding in 2021.

February 22 -

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

Arent Fox and Schiff Hardin are poised to expand their public finance operations, creating a firm with more than 600 attorneys and public finance practices in four major U.S. cities.

February 15 -

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

Jim Burton, a municipal bond specialist with three decades of industry experience, will lead the national municipal sales team at financial services network StoneX Group.

February 9