Chip Barnett is a journalist with almost 50 years of professional experience. He started his career at the Gannett Newspapers in Westchester County, N.Y., working his way up from back-shop compositor to Senior News Editor. Barnett later worked for Thomson Reuters in Manhattan, covering state and local government finance as a Reporter and later Executive Editor for TM3.com and as Editor in Charge of Municipal Finance for Reuters News. Later, he was the Editor of Municipal Finance Today at SourceMedia. Barnett has also worked for DebtWire/Municipals and has written about commercial real estate in South Florida and the Midwest for both The Real Deal and Globe Street. Barnett is currently a Reporter at The Bond Buyer.

-

New York City sold $950 million of general obligation bonds on Tuesday after retail buyers flocked to the deal a changes to the tax laws loomed in Washington.

By Chip BarnettDecember 5 -

New York City’s general obligation bond offering was raised by $100 million to $950 million after a record number of retail buyers expressed interest in the deal.

By Chip BarnettDecember 5 -

Retail buyers grabbed New York City’s big general obligation bond offering while several large negotiated and competitive deals hit the market on Tuesday.

By Chip BarnettDecember 5 -

The municipal bond market will face a second busy day as more supply is set to hit the screens on Tuesday.

By Chip BarnettDecember 5 -

New York City offered $850 million of general obligation bonds to retail buyers while the Metropolitan St. Louis Sewer District, Mo., presented a $317 million refunding deal to retail investors and the Pennsylvania Turnpike’s $260 million of bonds priced.

By Chip BarnettDecember 4 -

New York City offered $850 million of general obligation bonds and the Metropolitan St. Louis Sewer District, Mo., offered a $317 million refunding deal to retail investors on Monday as the Pennsylvania Turnpike came to market with its bonds.

By Chip BarnettDecember 4 -

The Pennsylvania Higher Educational Facilities Authority and the state of Wisconsin are coming to market on Tuesday as municipal bond traders eye tax reform developments in Washington.

By Chip BarnettNovember 28 -

The municipal bond market focused on the burgeoning new issue calendar as participants waited for a U.S. Senate vote on tax reform, which may come before the end of this week.

By Chip BarnettNovember 27 -

The municipal bond market this week will keep an eye on the building new issue calendar as traders wait for the U.S. Senate to vote on a tax reform proposal which could come as early as Thursday.

By Chip BarnettNovember 27 -

The rush to market is set to begin as the municipal bond market will see a hefty new issue slate for the upcoming week at a time of year when it is usually rather sleepy.

By Chip BarnettNovember 27 -

The rush to market ahead of tax reform is set to begin, as a $11.743 billion new issue slate looms for the upcoming week.

By Chip BarnettNovember 22 -

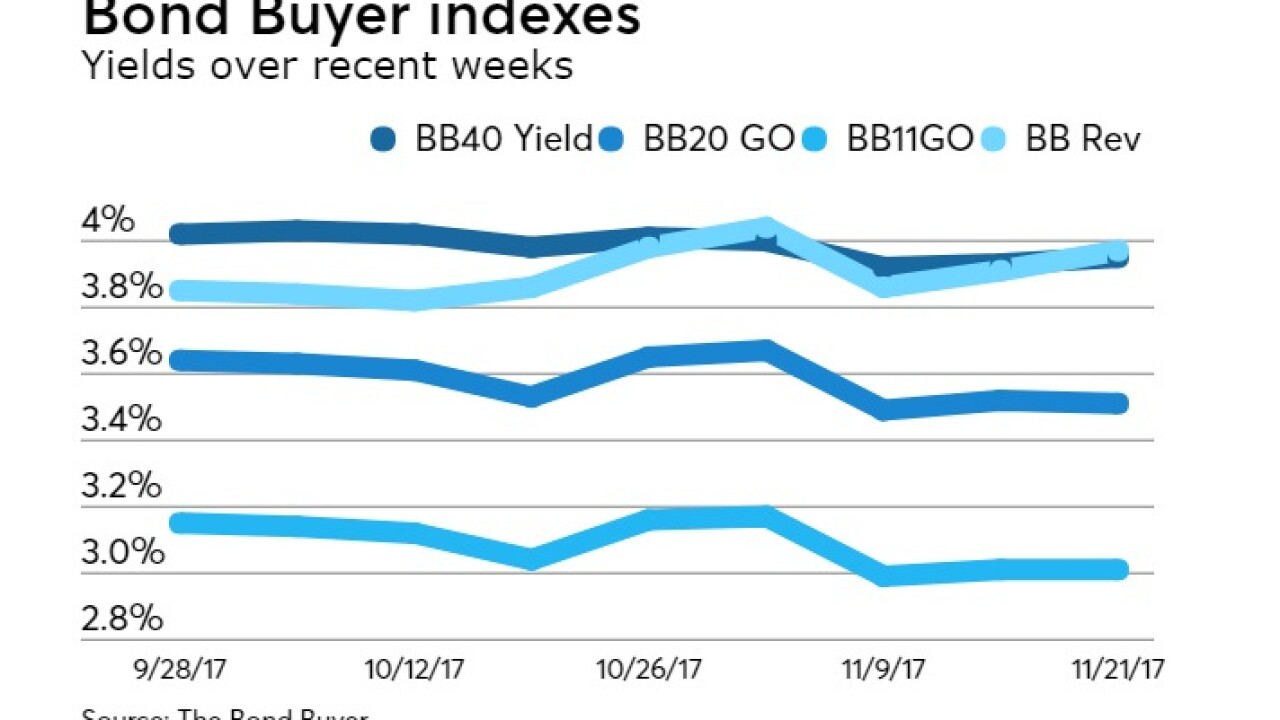

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index rose two basis points to 3.95% from 3.93% in the prior week.

By Chip BarnettNovember 21 -

Underwriters priced the New York Metropolitan Transportation Authority’s $2 billion advance refunding deal for institutions on Tuesday, the last big offering of the week.

By Chip BarnettNovember 21 -

The MTA tapped a transportation professional with experience in Toronto and London to spearhead the modernization of New York's subway and bus system.

By Chip BarnettNovember 21 -

Underwriters priced the New York Metropolitan Transportation Authority’s $2.2 billion advance refunding deal for institutions on Tuesday. In secondary trading, municipals turned weaker.

By Chip BarnettNovember 21 -

Underwriters priced the New York Metropolitan Transportation Authority’s $2.2 billion advance refunding deal for institutions on Tuesday. The green bonds were offered to retail buyers on Monday, who ordered about $770 million of the bonds, according to a market source.

By Chip BarnettNovember 21 -

The New York Metropolitan Transportation Authority’s $2.2 billion deal was offered to retail buyers. In secondary trading, municipals were trading mixed at mid-session.

By Chip BarnettNovember 20 -

The New York Metropolitan Transportation Authority heads to market on Monday with the week’s biggest deal — a $2 billion green bond offering.

By Chip BarnettNovember 20 -

Muni volume gets a boost during the Thanksgiving holiday week as one of the nation's biggest issuers comes to market with a type of deal that may be banned after this year under pending tax reform legislation.

November 17 -

The municipal bond market is looking ahead to the Thanksgiving week’s $4.2 billion new issue calendar, which is headlined by the New York Metropolitan Transportation Authority’s $2 billion green bond offering.

By Chip BarnettNovember 17