WASHINGTON — The value of business inventories in June was up 0.1%, as expected by analysts and the MNI calculated prediction, data released by the Commerce Department Wednesday morning showed.

Retail inventories rose 0.1%, revised up from the flat reading in the advance estimate. Data from the wholesale inventory report showed a 0.1% rise in the month, which was revised up from the flat reading in the advance report, while factory inventories were also up 0.1%.

According to an MNI calculation, if a 0.1% decrease in motor vehicle inventories had been excluded, total business inventories would have been still have been up 0.1% in June. The decrease in motor vehicles was revised up to a 0.1% drop from the 0.3% decline in the advance estimate.

After excluding the decrease in motor vehicle inventories, the remaining retail categories were up 0.2%, revised down from the advance estimate for a 0.3% gain. There were decreases in every category except for a 1.5% rise in building materials and a flat reading for food and beverage stories.

However, the relatively large unpublished retail categories rose 0.3% following a 0.3% increase in May, according to an MNI calculation.

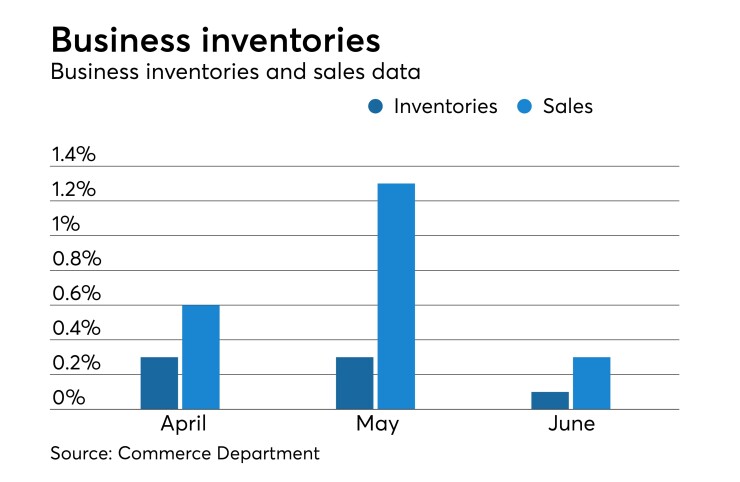

June business sales posted a 0.3% increase in the month, below the 0.4% rise forecast by MNI after the wholesale data were released, but before the large downward revision to June retail trade sales released earlier Wednesday morning.

Retail sales excluding food services were flat in June, revised down from the 0.3% gain reported last month. Factory shipments, which are equal to sales in this report, were up 1.0%, while wholesale sales rose by 0.1%.

The inventory-to-sales ratio slipped to 1.33 in June from 1.34 due to the larger gain in sales than in inventories this month. The ratio remains well below the 1.39 level seen in June 2017, as sales growth has outpaced inventory growth over the last year.

The last time the ratio was this low was November 2014, when it was also 1.33, suggesting businesses are holding stocks very tight ahead of an expected sales slowdown in the third quarter.