Election 2024

Municipal finance professionals are preparing for an important election in November, on which hinge key questions for the community. Where is tax policy headed? Who will set the tone on regulation and enforcement? Will infrastructure investment be a major priority?

The Bond Buyer will be following developments closely in the months ahead, to make sure muni market participants have the information they need about the future of their work.

What public finance professionals think about the election

According to exclusive research from The Bond Buyer, 56% of municipal finance professionals said high interest rates should be an urgent priority for the next administration and Congress. Political preference among those surveyed broke 44%-33% in favor of Democrats, with 5% saying they planned to vote Libertarian and another 18% answering that they were either undecided or preferred not to say.

The high-grade issue is expected to be well received by the market. D.C. joins a growing list of issuers refunding outstanding BABs amid lower rates.

Multimedia

Vivian Altman, Head of Public Finance at Janney, sits down with Bond Buyer Executive Editor Lynne Funk to discuss the state of the muni market, how the new-issue market is faring and where risks and opportunities exist in the space.

Barclays' Mikhail Foux talks shifting demand, BABs refundings, election effects and what it means for the asset class in a volatile market.

-

House Republicans are hoping to jam through a voter eligibility bill as part of the upcoming continuing resolution in order to avert a shutdown before Sept. 30.

September 4 -

California and Texas have received the most amount of federal investment to date, according to a pair of reports tracking the climate law's investments.

September 3 -

Rep. Steven Horsford will likely replace the late Rep. Bill Pascrell.

September 3 -

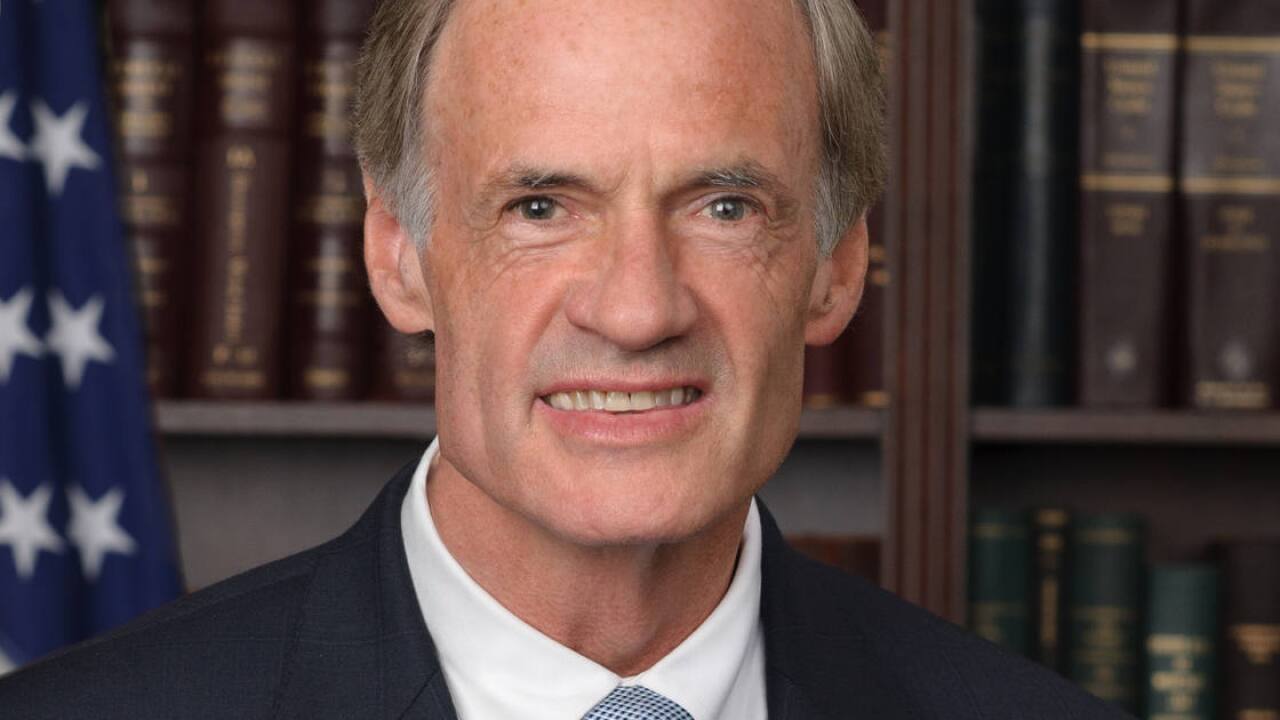

With Chairman Tom Carper retiring, the key committee will be under new leadership regardless of the election outcome.

August 29 -

The House bill supported by the coalition would allow municipal bond holders to transfer the securities to the bank in exchange for stock.

August 28