WASHINGTON -- A flurry of Republican bills and resolutions were introduced during the opening week of the 115th Congress, several of which aim to abolish the Internal Revenue Service and require a balanced federal budget.

The IRS, seen by most Republicans as an inefficient agency that spends irresponsibly and unfairly goes after right-leaning groups, was also the target of several of the 274 bills -- 254 in the House and 20 in the Senate -- introduced on Tuesday.

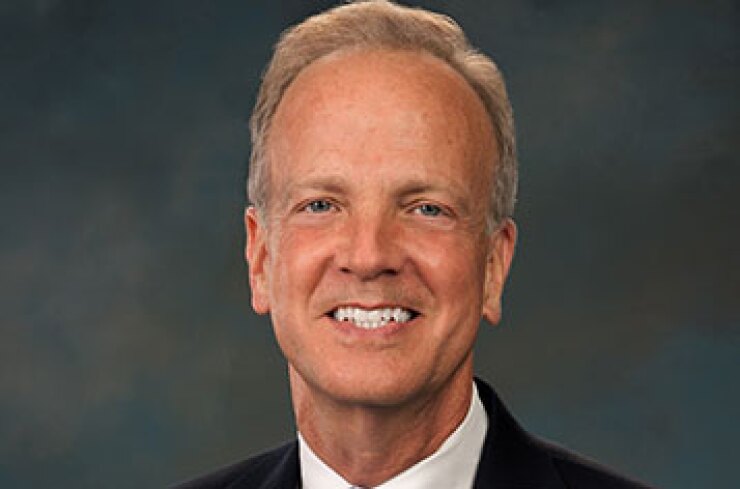

The Fair Tax Act of 2017 (S.18), introduced by Sen. Jerry Moran, R-Kan., would not only abolish the IRS, but would also repeal the income tax, payroll taxes, and estate and gift taxes.

The bill, cosponsored by Sen. David Purdue, R-Ga., would also enact a national sales tax to be administered by states.

The measure would nix appropriations after fiscal 2021 for any IRS expenses, including those for processing tax returns for years prior to the repeal of the targeted taxes as well as revenue accounting, management, and transfer of payroll and wage data to the Social Security Administration.

The Moran bill was referred to the Senate Finance Committee.

A similar bill, H.R. 25, was also introduced in the House Tuesday by Rep. Rob Woodall, R-Ga. The House bill, which has 34 Republican cosponsors, was referred to the House Ways and Means Committee.

It was referred to the House Appropriations Committee.

Rep. Bob Goodlatte, R-Va., an outspoken critic of the current tax code and chairman of the House Judiciary Committee, introduced H.R. 29 on Tuesday, which would terminate the Internal Revenue Code of 1986.

His bill, which has 38 cosponsors, was referred to the House Rules Committee.

Last year, Goodlatte introduced the Tax Code Termination Act, which would have repealed the current tax code at the end of 2019 and required Congress to adopt a new one by July of that year.

The text of Goodlatte's latest bill was not available Tuesday.

Goodlatte also introduced two House joint resolutions proposing amendments to the Constitution that would require a balanced federal budget and limit Congressional spending.

He described H.J. Res. 1, saying it would require a balanced annual federal budget and place a spending cap on annual federal spending. It would also require a three-fifths supermajority vote to increase the debt limit or raise taxes. Goodlatte said he introduced the same resolution in the last Congress and gained 91 cosponsors.

Goodlatte's H.J. Res. 2 is similar and is identical to a balanced budget amendment voted on in the House in the 112th Congress.

"It is time for Congress to finally put an end to fiscal irresponsibility and stop saddling future generations with crushing debts to pay for our current spending," Goodlatte said in a release on Tuesday. "We must rise above partisanship and join together to send a balanced budget amendment to the states for ratification."