DALLAS – A $1 billion retractable-roof ballpark for Major League Baseball’s Texas Rangers could fall victim to Congressional tax reform plans.

Under plans unveiled Thursday by House Republican leaders, bonds for professional sports stadiums would no longer be tax-exempt, and private activity bonds would be forbidden. Those are among proposed changes in tax law that would have a major

If approved, the provision could impede the city of Arlington's plans to issue up to $500 million of stadium bonds approved by voters in 2016.

“When the voters voted on this project, the expectation was that the bonds would be tax-exempt,” said city of Arlington spokesman Jay Warren. “That was what the rules were at the time.” Warren said the city believes bonds for the stadium could still be issued but would be taxable.

The city had planned to issue bonds early next year. The city’s

According to the congressional Joint Committee on Taxation’s summary of Republican proposals, the ban on tax-exempt stadium bonds would affect any bonds issued after Nov. 2, 2017. Thus, Arlington has no way to beat the clock if the legislation passes intact.

“There are a lot of standards that have to be met before we can issue those bonds,” Warren said. “We are watching what’s happening in Washington D.C., clearly. It’s got to pass the House first, and it’s got to pass the Senate. There are lots of ‘ifs’ and lots of steps. We hope to be a participant in the conversation.”

The Arlington City Council will hear from representatives of its Washington lobbying firm at its meeting Tuesday, where the impact of the tax proposal on stadium bonds could be discussed, Warren said.

But the city’s chance to be heard on the subject could be limited. Republican leaders, including House Ways and Means Committee Chairman Kevin Brady, R-Texas, said they plan to have the major tax overhaul signed into law by Christmas. With Congress out of session the week of Thanksgiving, that allows less than six weeks for passage compared to the 16 months that Congress took to pass the 1986 tax reform.

Arlington isn't the only issuer recalculating its plans; the stadium provision

Arlington’s Congressional Rep. Joe Barton, a Republican, has not said where he stands on the legislation, but told CNN that the issue of ending tax breaks is going to cause “anguish.”

"Everybody is for lower rates, but in order to pay for it, then you have to close loopholes and eliminate deductions. Or, cut spending," said Barton, who in 1986 voted for the last rewrite of the tax code. "And that is where it gets more difficult. Ultimately, each member has to decide what is the right thing to do."

Rep. Blake Farenthold, R-Texas, introduced a measure in September titled the Properly Reducing Overexemptions for Sports Act, which would also end tax-exempt status for professional sports teams.

“Professional sports leagues should not be exempt from paying taxes,” Farenthold said in a prepared statement. “These are highly profitable businesses that make tens of millions of dollars each year and have been exploiting loopholes to game the system. It's time we blow the whistle on this foul, and get this bill over the goal line.”

Although Congress eliminated a provision expressly allowing tax-exempt financing for sports facilities in the 1986 tax reform, local governments and their professional sports teams found ways to circumvent the two-part test for private activity bonds, which are taxable.

Roughly $8.5 billion in stadium bonds are outstanding, according to Municipal Market Analytics.

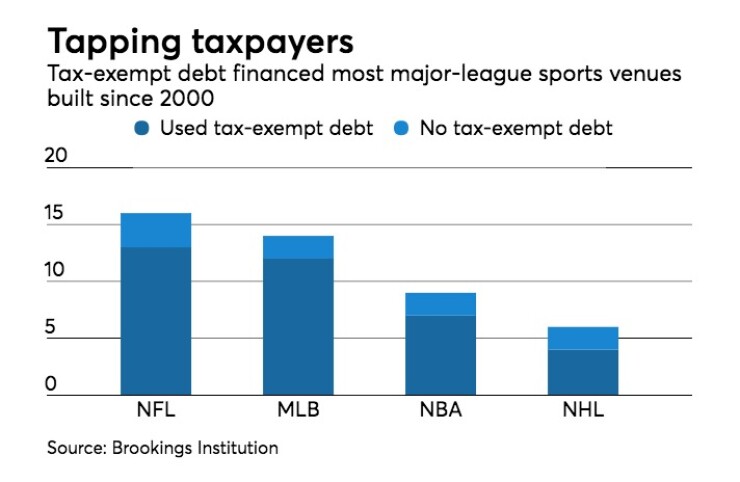

A 2016 Brookings Institution

“We estimate that the total tax-exempt bond principal issued to fund these stadiums was approximately $13.0 billion, the present value subsidy to the bond issuers was $3.2 billion (assuming a 3% discount rate) or $2.6 billion (assuming a 5% discount rate), and the present value federal tax revenue loss was $3.7 billion (3% discount rate) or $3.0 billion (5% discount rate), with all terms in 2014 dollars.

Local governments have intentionally structured the tax-exempt bond issuance and related transactions so that revenues backing the debt do not come from the teams. That means that the second part of the PAB test – that private revenues provide debt service – fails.

In Arlington’s case, the Texas Rangers would provide about half of the stadium financing and be responsible for cost overruns. The city would pledge a portion of taxes on hotels, rental cars and other services to pay off the bonds.

Voters in 2016 approved a half-cent sales tax, 2% hotel occupancy tax and 5% car rental tax to pay off those bonds over 30 years. The ballot measure included a 10% ticket tax and parking tax of up to $3 at the new stadium.

To finance the Rangers’ new stadium, Arlington had to restructure its outstanding debt for the $1.3 billion Dallas Cowboys AT&T stadium that opened in 2009 near the Rangers’ existing Globe Life Park stadium. Arlington issued $337 million of tax-exempt bonds for the stadium backed by the so-called "tourism taxes" on hotels, rental cars and stadium fees.

The city considered two

Working with the city on financing the ballpark is David Gordon, managing director at financial advisor Estrada Hinojosa & Co. Estrada has played a role in financing many of the region's stadiums and arenas.

The $110 million advance refunding of the Cowboys debt produced cash-flow savings of more than $31 million and net present value savings of $18.8 million or 5%, according to the finance team. The bonds were rated A1 by Moody’s Investors Service, A-plus by S&P Global Ratings and AA-plus by Fitch Ratings. Under the Republican tax bill, advance refundings would also be disallowed.

Announcement of the Republican tax proposal came one day after Arlington officials broke ground on a $150 million Loews hotel that ties in with the new Rangers stadium and an area that has been declared the Arlington Entertainment District. Known as Texas Live!, the district is said to represent $250 million of development.

The hotel is sited between the Rangers existing Globe Life Park and the Cowboys’ AT&T Stadium. With the new Rangers stadium under construction nearby, Globe Life Park will be preserved for some future use, according to the city.