Facing costs incurred by this winter's mega-snow, Boston's MBTA might consider catastrophe bonds as a hedge against future damage.

The Massachusetts Bay Transportation Authority had previously looked into cat bonds and decided not to pursue issuance, according to Jonathan Davis, deputy general manager and chief financial officer at the agency.

But this was before the city's main transport agency had to contend with the record-setting 110 inches dumped on the city in the 2014-2015 season (so far).

"In light of last winter, we may take another look at" cat bonds, Davis said.

In July 2013, the New York's MTA became the first, and is still the only, urban transport agency in the U.S. to issue a cat bond, a field dominated by insurance companies. The deal came nine months after Hurricane Sandy, which produced losses of $5.1 billion at the MTA. As part of the $200-million deal, the MTA makes payments to investors for the life of the bond — it priced at a steep 450 basis points over U.S. Treasury Money Market earnings — unless a specified catastrophic event takes place. Then the investors could lose what's left of the principal.

So far, the MBTA damage from Boston's epic snow has been well below the Sandy figure for New York, reaching $35 million so far, Davis said. This includes lost revenue, cleanup costs, snow disposal and the cost of "bus bridges" to cover stretches of subway that were shut down. The MBTA operates most of the bus, subway, commuter rail and ferry routes in the greater Boston area.

The first avenue of recovering some of those losses is the property insurance currently held by the MBTA. The second is the Federal Emergency Management Agency (FEMA).

Whether a cat bond makes sense for the MBTA in the future depends, of course, on how the cost compares to the current insurance held by the MBTA. "We're going to have to weigh the cost-benefit," Davis said. "What kind of events does [a potential cat bond] cover? What kind of losses does it cover?"

Winter storms are generally considered a secondary peril in the U.S. re-insurance industry. Hurricane/cyclones and thunderstorms cause far more damage.

Still, winter storms are covered in a number of cat bonds issued by insurance companies. A market source said all cover winter storm peril on an indemnity basis — the trigger for withholding payments to bondholders is tripped when losses reach a certain level — as opposed to what's known as a parametric trigger, which is based on a predefined event as opposed to actual claims.

The MTA bond has a parametric trigger. If certain storm surge levels around New York are hit during a named storm, then the trigger gets tripped, and the principal of the bond flows back to MTA instead of ending up with the bondholders.

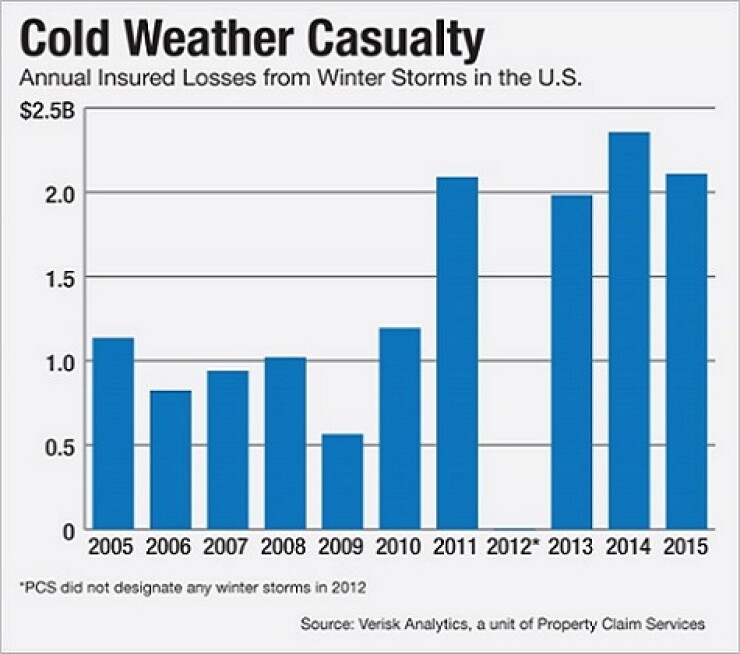

Insured losses from winter storms in the U.S. have averaged a little over $1.4 billion over the last ten years, according to Verisk Analytics, a unit of PCS.

By March 16, Boston had broken its previous record of snowfall. The January 22 to Feb 22 period was especially brutal, with snowfall totaling 94.4 inches.

Last year, the costliest natural event as measured by insured losses were snowstorms that hit swathes of Japan in February. The figure was over 320 billion yen $3.1 billion, with overall losses reaching $5.9 billion.