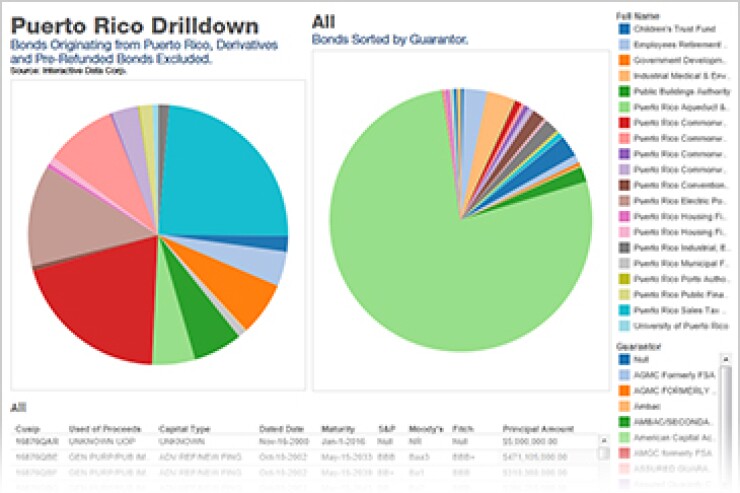

The Bond Buyer and Interactive Data Corp. have introduced Puerto Rico Drilldown, an interactive tool to help bond investors sort and analyze the roughly $70 billion of outstanding Puerto Rico bond debt.

The Puerto Rico Drilldown tool gathers all the bonds in Interactive's data base where Puerto Rico is listed at the "state," as of August. Derivatives and pre-refunded bonds are excluded. Included are the obligations of 20 separate issuers, ranging in size from the Puerto Rico Sales Tax Financing Corp., with almost $16.4 billion in principal amount of "COFINA" bonds listed, to the Puerto Rico Housing Finance Authority, with just over $401 million of principal amount.

The tool allows investors to sort all Puerto Rico bonds by issuer or by guarantor. They can also select and click on an individual issuer and sort its bonds by guarantor. Finally they can drill further into the data to view such details on individual bonds as the use of proceeds, type of financing, maturity, and ratings.

Puerto Rico's government is weighing an economic growth plan in hopes of getting investors to cooperate in a restructuring of its debt. Officials also are looking to Washington for Federal assistance, including the authority for public corporations to file for protections under Chapter 9 of the bankruptcy code.

Among the issuers in the Puerto Rico Drilldown is the Puerto Rico Electric Power Authority, with about $8.6 billion of principal amount in bonds. PREPA already has agreed with a forbearing bondholder group to a plan that would cut the amount of outstanding debt, reduce near-term debt service, and lower interest rates. Also shown are more than $1 billion of bonds issued by the Puerto Rico Public Finance Authority, which missed payments due in August and September.