LOS ANGELES — Los Angeles Unified School District will price a $1.7 billion refunding in the week's largest deal.

The bonds are slated for pricing Thursday by JPMorgan Securities following a retail order period to Wednesday.

The deal will have four series, with maturities ranging from 2015 to 2031, according to the preliminary official statement: $197.4 million Series A, $365.8 million Series B, $981.5 million Series C, and $167.2 million Series D.

Series A is an advanced refunding of bonds issued in 2006 that have a redemption date of July 1, 2016, according to a supplement added to the POS initially posted on May 21.

The huge deal helped boost this week's muni primary to its highest volume in three months.

Moody's Investors Service rates the bonds Aa2 rating while Standard & Poor's rates the bonds AA-minus.

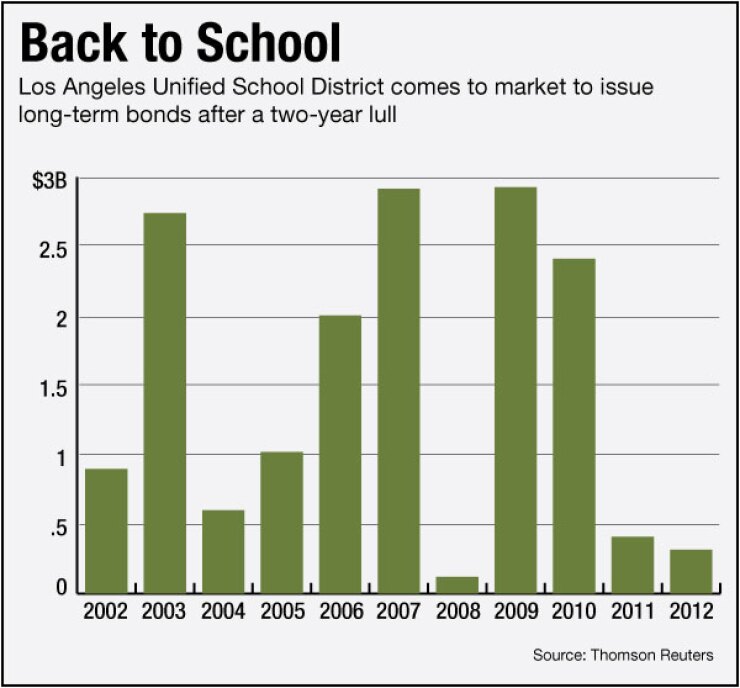

A $150 million new money deal is expected to follow in August - the first new money bonds issued by the nation's second largest school district since 2010. That bond sale would use the remaining capacity from voter-approved measures R & Y.

The lion's share of that money would repay the district for costs associated with the purchase of iPads in the first two phases of a multi-year roll-out of tablet computers to students, , according to John Walsh, LAUSD's financial policy director.

The district is also evaluating using commercial paper to fund the program. The infrastructure to support the initial phases would be paid for using existing cash flow, he said.

LAUSD captured headlines in 2013 with the proposal to issue bonds to pay for iPads for its roughly 600,000 students, plus associated software and information technology infrastructure, at an estimated $1 billion cost.

Snafus in the official roll-out of the first phase of the iPads in September 2013 resulted in a decision to slow the program and fine-tune any issues that cropped up in rolling out Phase 1 and Phase 2, which placed tablets in the hands of students at 47 of the district's 786 K-12 schools.

The district doesn't have final cost figures for the first two phases, but the budget estimate is $115 million, Walsh said.

Short-term GO bonds would finance the tablets, while longer-term bonds would be used to finance IT infrastructure needs, Walsh said.

The district's Common Core staff is preparing recommendations for Phase 3, Walsh said. The school board doesn't meet from July 1 through early August, so it's likely the report will not go before the board until after summer break ends.

"We are going to look at whatever the board proposed in Phase 3 for planning purposes in terms of cash needs," Walsh said. "We are going to try to gear the debt issuance to make sure we have the cash on hand."

If another new money issuance is placed on the calendar to fund that program, and construction needs, it probably won't occur until next spring.

"It all depends on the cash flow situation," Walsh said.

The district launched a massive construction and remodeling program in 1997. It has received approval from voters for several bond measures authorizing $20.1 billion in debt capacity.

Of the total authorized by voters, the district has issued $12.9 billion, according to the POS, with a remaining bond capacity of $7.6 billion.

District officials wouldn't comment on potential savings from the refunding.

LAUSD's massive general obligation bond program was designed to address "historic issues of overcrowding," Megan Reilly, the school district's chief financial officer, said during an internet "roadshow" presentation.

The district is nearing its goal of returning all of the students to a traditional calendar year, Reilly said.