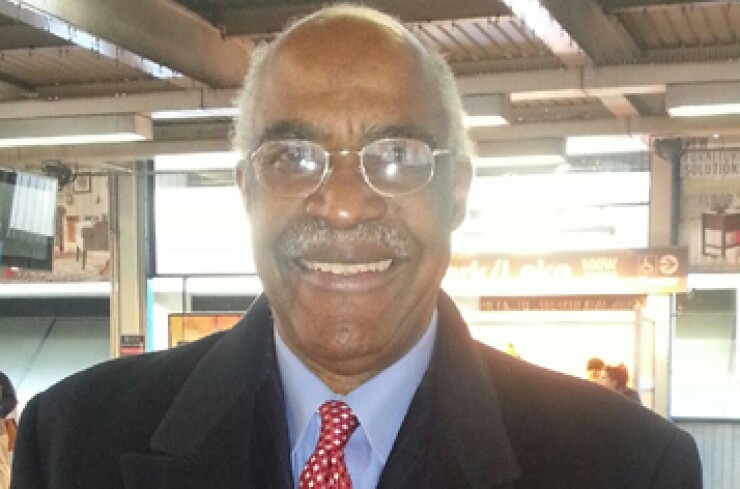

BRADENTON, Fla. Calvin Grigsby, president of California-based Grigsby & Associates Inc., filed a federal discrimination lawsuit Saturday against the Shreveport, La., City Council in a long-running flap over his financial advisory fees.

The suit, filed in U.S. District Court in the western district of Louisiana, alleges that the City Council and five named individuals are guilty of breach of contract, fraud, unfair trade practices, malicious prosecution, defamation, and discrimination based on race.

Grigsby is seeking preliminary and permanent injunctions as well as $3.5 million plus legal fees. The complaint names City Councilors Oliver Jenkins, Michael Corbin, and Jeff Everson, city attorney Terri Scott, and assistant city attorney Julie Glass, in addition to the council as a whole.

City officials conspired to terminate Grigsby’s contract and destroy his business by using city money “to make false and wantonly malicious statements about [Grigsby’s] failure to perform the requirements of his FA contract in order to have the contract terminated and awarded to financial advisors acceptable to the political supporters of individual defendants Jenkins, Corbin and Everson,” the federal suit said.

Scott and City Councilor Oliver Jenkins said the city does not comment on ongoing litigation. “After it is concluded, I am sure we will have some formal comments,” Jenkins said in an email to The Bond Buyer.

Grigsby’s federal suit is an outgrowth of a dispute between him and the Shreveport council over fees he charged for financial advisory work on the sale of $81.5 million of general obligation bonds in 2011.

After months of investigating the FA’s charges, the City Council in February filed a petition in Caddo Parish District Court demanding that Grigsby’s firm repay $53,450, plus interest and legal costs.

“The debt owed by Grigsby to the city is based on an August 1, 2011 overbilling by Grigsby for services as financial advisor under its contract with the city, the city paying the amount of overbilling, and Grigsby refusing to repay the city the overbilled amount despite amicable demand,” the city’s petition said.

The city said its contract with Grigsby was breached by the overbilling related to 2011 GO bonds, which were issued in a single sale though they were sold in three series as they were from three separate voter authorizations on the same ballot.

Grigsby “chose to treat the 2011 GO bond issue as three separate competitive bond transactions and charged $151,887.67 in fees,” the city’s petition said.

By charging for three bond issues instead of one, Grigsby was paid the higher fee, which the city paid, according to the petition. It said if Grigsby charged for one bond issue the fee would have been $98,437.50.

Grigsby’s attorney, Charles Kincade, filed a motion March 25 to dismiss the city’s petition “for lack of procedural capacity.”

In a subsequent filing, Kincade said the council has no legal ability to sue or to be sued. Only the mayor can bring suit, according to the city charter, Kincade argued. A hearing is set for Aug. 14.

Kincade is also representing Grigsby in the federal suit. It said that the City Council gave the mayor discretionary authority to authorized payments to him. The suit said Grigsby’s invoice discloses that his bills were related to the three voter propositions approving the bonds.

Grigsby referred questions to Kincade, who was in court and could not be reached for comment at press time.