It was a record day in the municipal market in a couple of different ways, as yields descended further to new record lows on both the 10- and 30-year and the market saw the lowest yield ever for a 100-year bond.

Primary market

Morgan Stanley priced the University of Southern California’s (Aa1/AA/ / ) $320 million of taxable bonds. This is a century bond deal and it is set to mature in 2120.

Brian Wynne, head of public finance for Morgan Stanley, said this deal saw significant demand and it seems to grow by deal. He also noted that Morgan Stanley and USC were able to reduce spreads by 10 basis points from where they started.

"The deal went really well, started at a spread of plus 130 area and it ended up at plus 120 basis points. We had 70 participants in the deal and it seems the more century bonds deals we do, the more investors we see," Wynne said. "With yields near zero, investors were able to gain an extra 50 basis points than they would have if it were just a 30 year bond deal."

Eric Wild, managing director at Morgan Stanley, said that the deal was five times oversubscribed and had more than 70 different investors.

"The yield of 3.226% was the lowest yield ever for a century bond," Wild said. It beat a University of Virginia deal that came to market in 2019 by 0.001%, he said.

Morgan Stanley has been an industry leader in the century bond game, as there have only been seven higher education century bond deals since the start of 2019 and Morgan Stanley has been lead on four of them.

"Most of the 100-year bond deals have been in the higher ed sector, which makes sense because they have been issued by universities who are perpetual entities and have large endowments — they will still be around in 100 years," Wild said. "There have only been 20 century bond deals over the last 10 years and they are not for everyone — it helps to be well known, highly rated and have significant capital needs to be able to issue in large size."

Bank of America Securities priced the North Carolina Medical Care Commission’s (A2/AA-/ / ) $200 million of health care facilities revenue bonds for Rex Healthcare on Thursday.

“Surprise surprise, another day, another muni deal that is repriced and sees bumps up to double digit basis points in yields,” said one North Carolina trader. “The repricing saw yields lowered by five basis points in the 10-year maturity to 1.48% with a 5% coupon and the long bond (2049 maturity) saw yields lowered by 10 basis points to 2.37% with a 4% coupon.”

Secondary market

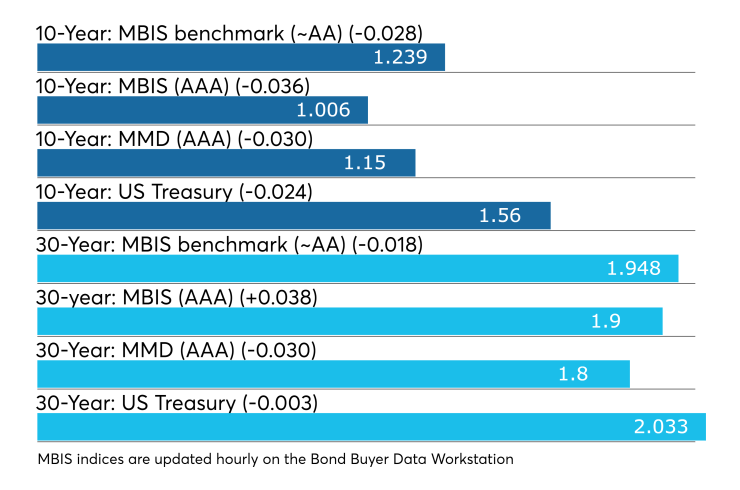

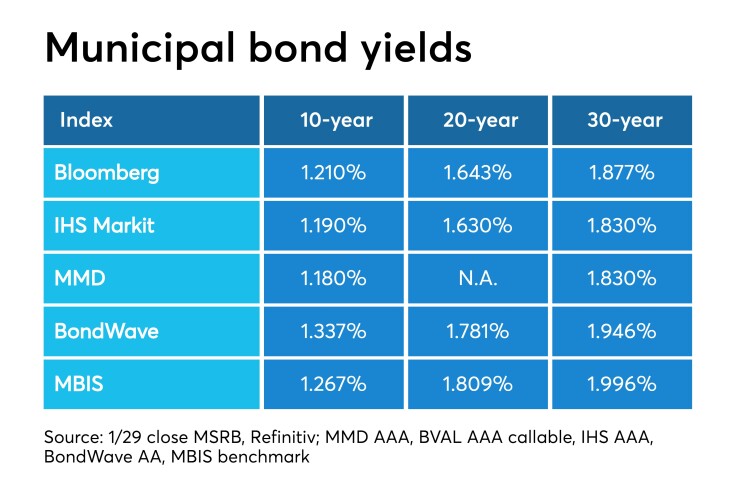

Munis were stronger on the MBIS benchmark scale, with yields falling by two basis points in the 10-year and by one basis point in the 30-year maturity. High-grades were mixed with yields on MBIS AAA scale decreasing by three basis points in the 10-year maturity and increasing by three basis points in the 30-year maturity.

On the MMD benchmark scale, the yield on both the 10- and 30-year were three basis points lower to 1.15% and 1.80%, respectively. With this move, both maturities set a new record low. The 10-year muni read hit an all-time low of 1.18% on Monday, beating the previous MMD record low of 1.21% set on Aug. 28, 2019. The 30-year on Monday tied its previous low of 1.83% also set on Aug. 28 last year.

The 10-year muni-to-Treasury ratio was calculated at 73.8% while the 30-year muni-to-Treasury ratio stood at 88.8%, according to MMD.

Stocks were slammed most of the day due to the spreading of the coronavirus, but rebounded before the close after the World Health Organization declared a global health emergency, but set to assure that efforts to contain the spread were underway. The Centers for Disease Control reported the first case of human-to-human transmission of the virus in the U.S. just after noon eastern time in Chicago. Most Treasury yields were heading south.

The Dow Jones Industrial Average was up about 0.50%, the S&P 500 Index gained around 0.24% and the Nasdaq rose about 0.26%.

The Treasury three-month was yielding 1.564%, the two-year was yielding 1.391%, the five-year was yielding 1.380%, the 10-year was yielding 1.560% and the 30-year was yielding 2.033%.

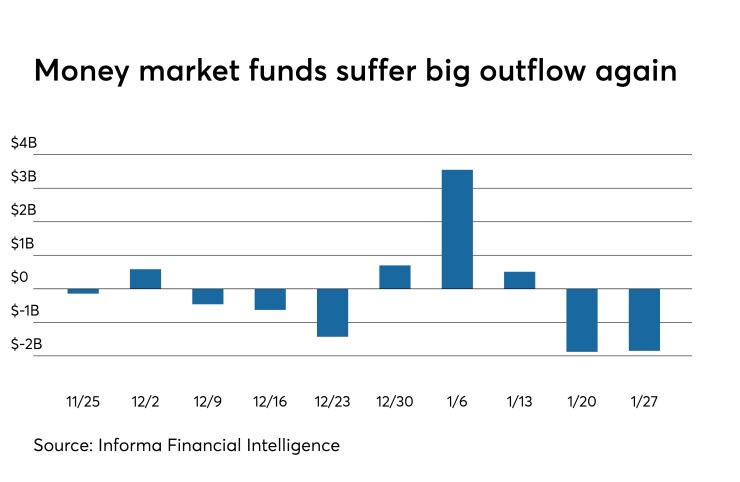

Muni money market funds still deep in the red

Tax-exempt municipal money market fund assets decreased by $1.85 billion, lowering their total net assets to $137.44 billion in the week ended Jan. 27, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds remained at 0.49% from the previous week.

Taxable money-fund assets rose by $1.87 billion in the week ended Jan. 28, bringing total net assets to $3.437 trillion. The average, seven-day simple yield for the 802 taxable reporting funds slipped to 1.25% from 1.26% the prior week.

Overall, the combined total net assets of the 989 reporting money funds increased by $15.7 million to $3.574 trillion in the week ended Jan. 21.

Previous session's activity

The MSRB reported 35,006 trades Tuesday on volume of $14.69 billion. The 30-day average trade summary showed on a par amount basis of $10.78 million that customers bought $5.40 million, customers sold $3.59 million and interdealer trades totaled $1.79 million.

California, New York and Texas were most traded, with the Golden State taking 14.89% of the market, the Empire State taking 13.43% and the Lone Star State taking 11.403%.

The most actively traded security was the Escambia County Health Facilities Authority, Florida, revenue 3s of 2050, which traded 52 times on volume of $48.65 million.

The original pricing for the 30-year split maturity was priced to yield 3.00% with a 3% coupon with Assured Guaranty insurance. The other half was priced to yield 2.78% with a 4% coupon. That same 2005 maturity saw 20 trades today alone for the 3% coupon and insured half of the maturity with an average yield of 2.863%. The 4% coupon half of the maturity has seen 5 trades today with an average yield of 2.722%.

Treasury auctions bills

The Treasury Department Thursday auctioned $45 billion of four-week bills at a 1.545% high yield, a price of 99.879833.

The coupon equivalent was 1.573%. The bid-to-cover ratio was 2.69.

Tenders at the high rate were allotted 99.61%. The median rate was 1.505%. The low rate was 1.475%.

Treasury also auctioned $45 billion of eight-week bills at a 1.550% high yield, a price of 99.758889.

The coupon equivalent was 1.580%. The bid-to-cover ratio was 3.01.

Tenders at the high rate were allotted 46.25%. The median rate was 1.520%. The low rate was 1.495%.

Treasury bill announcement

The Treasury Department said Thursday it will auction $45 billion 91-day bills and $39 billion 182-day discount bills Monday.

The 91s settle Feb. 6 and are due May 7; the 182s settle Feb. 6 and are due Aug. 6.

Currently, there are $42.998 billion 91-days outstanding and no outstanding 182s.

Bond Buyer indexes descend further

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was lower to 3.53% from 3.56% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields were lower by seven basis points to 2.47% from 2.54% the week before.

The 11-bond GO Index of higher-grade 11-year GOs dropped seven basis points to 2.00% from 2.07% the prior week.

The Bond Buyer's Revenue Bond Index were down seven basis points to 2.97% from 3.04% from the previous week.

The yield on the U.S. Treasury's 10-year note was lower to 1.57% from 1.73% the week before, while the yield on the 30-year Treasury fell to 2.04% from 2.18%.

Chip Barnett contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.