Bank of America Merrill Lynch and Public Financial Management Inc. widened their leads in municipal market rankings in a record-setting year for issuance.

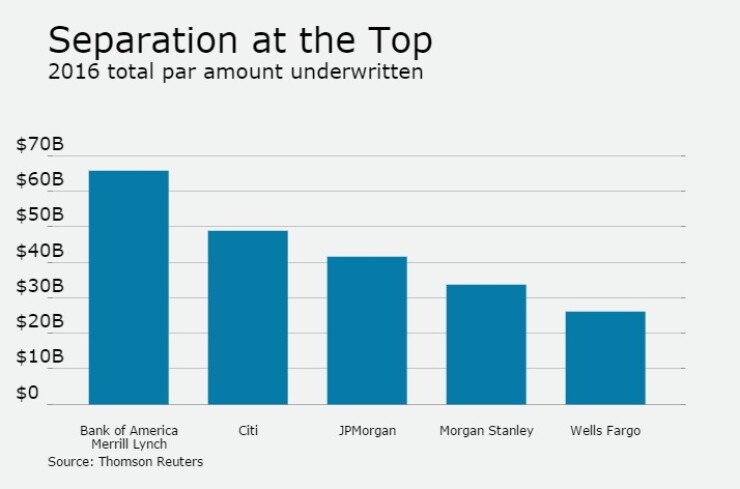

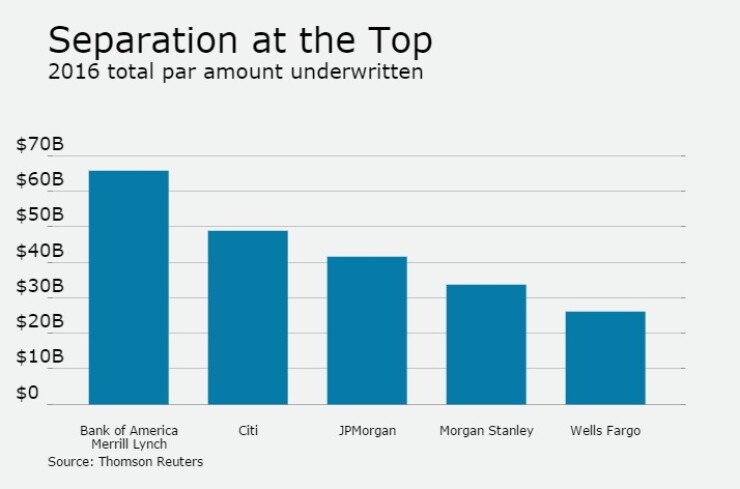

BAML closed 2016 with a par amount of $65.92 billion in 518 issues, or 15.6% market share, compared to $49.27 billion in 470 issues or 13.1% market share in 2015, to top the underwriter rankings, according to data from Thomson Reuters. PFM finished 2016 credited with $73.30 billion in deals, or 20.8% market share, up from the $62.42 billion and 20% market share for 2015.

For the year, BAML was the lead manager on four deals that were greater than $1 billion and 16 deals that were between $500 million and $1 billion. Among the largest transactions that BAML ran the book on were: the New York State Urban Development Corp.'s $1.65 billion sale in March; The state of Illinois' $1.30 billion in October; The commonwealth of Massachusetts's $1.11 billion in March; and the City of Chicago's $1.01 billion in November.

Overall, the top firms combined for a total par amount of $423.88 billion in 12,271 transactions in 2016, compared with $377.64 billion in 12,076 transactions during the same period last year. For the fourth quarter alone, BAML accounted for $16.55 billion in 107 deals.

Citi finished 2016 in second place with $48.89 billion in 529 deals, good for 11.5% market share and an improvement from the $43.50 billion in 486 deals the firm handled in 2015. Citi was also in second place for the fourth quarter, with $10.97 billion in 95 deals.

For the year, Citi was the lead manager on two deals greater than $2 billion and two deals bigger than $1 billion.

Although the largest deal the bank worked on was $2.70 billion from the state of California, the most talked about deal of the year was $2.41 billion from the New York Transportation Development Corp. of special facilities bonds, Series 2016A and B, LaGuardia Airport Terminal B Redevelopment Project, subject to alternative minimum tax.

"We expect to see more discussions around public-private partnership and how they can play a role in infrastructure," said David Brownstein, Head of Public Finance at Citi. "It's important to figure out how to maintain important projects while also coming up with creative ways to get other needed projects done."

JPMorgan finished in third for the year with $41.51 billion in 402 transactions, which compares to the $41.68 billion in 392 transactions the firm completed in 2015. For the fourth quarter alone, JPM finished in fourth place with $8.84 billion span across 80 deals.

"Market volatility post-election made for a challenging environment and we are very appreciative of the many issuers that put their trust in J.P. Morgan to lead them through that tumultuous period," said Jamison Feheley, JPM's head of public finance banking. "We are also very proud of the many value-added solutions we were able to deliver for clients this quarter and throughout the year that aren't reflected in the traditional league table."

Feheley said JPM expects a more challenging year ahead, with new issue volume expected to drop following a record year as uncertainties come into play with a new administration in Washington.

Morgan Stanley concluded the year in fourth place with $33.89 billion in 388 deals, up from $31.68 billion in 431 deals in 20155. Morgan Stanley finished the fourth quarter in third place with $10.63 billion in 93 transactions.

Wells didn't lose any ground in terms of rankings, even after a fake account scandal that prompted issuers including the state of California, the commonwealth of Massachusetts, the state of Ohio and the city of Chicago to curtail business with the firm. Wells Fargo rounds out the top five for the second year in a row, finishing the year with $26.09 billion, up from $24.83 billion a year earlier. Wells had a par amount underwritten of $5.03 billion for the fourth quarter alone.

RBC Capital Markets came in sixth place with a total of $23.61 billion for the year, followed by Stifel with $17.82 billion, Raymond James with $17.77 billion, Barclays with $17.06 billion, Piper Jaffray with $16.42 and Goldman Sachs with $15.80 billion.

Financial Advisors

Public Financial Management increased its par amount and market share from the previous year. For the fourth quarter alone PFM finished with $14.95 billion.

"PFM continues to focus on helping our clients achieve a level of strong financial stability that enables them to enter the market with a strong credit posture both to borrow for vital infrastructure projects and to refinance debt for savings," said John Bonow, managing director and chief executive officer of PFM. "While the market in 2016 was conducive to economic refundings through much of the year, the recent uncertainty about federal economic policies may persist well into 2017."

Bonow said expectations are growing that increased federal assistance to spur infrastructure investments may materialize soon and that the market seems to have found some footing in terms of interest rate stability. Volume may be strong again this year, he said, although it's unlikely to rise to another record.

"We continue to focus on being a strong, independent voice for our clients, providing them with the information and analysis needed to make the major financial decisions. We are deeply appreciative of the trust so many clients have put in us, which has enabled our mutual success," he said.

Hilltop Securities came in second with $34.96 billion after finishing in second in 2015 with $32.74 billion. Public Resources Advisory Group was right behind, finishing in third with $33.49 billion.

After the top three, the gap widens. Acacia Financial Group wound up in fourth place for the year with $13.78 billion, moving up one spot after finishing in fourth in 2015 with 9.11 billion.

Kaufman Hall & Associates Inc. jumped up into fifth place, after finishing ninth last year. In 2016, the firm had a par amount of $8.55 billion, up from $5.16 billion.

Top Issuers

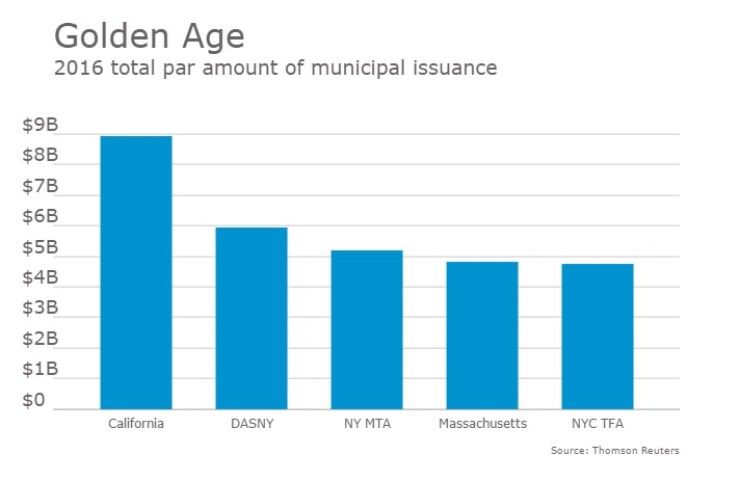

The state of California was the top municipal bond issuer by par amount in 2016, well ahead of the next biggest issuer. The Golden State issued $8.92 billion in 2016, moving up from second place in 2015 when the state issued $6.38 billion.

"The office has greater responsibilities than just the state's general obligation bonds. In total we were responsible for selling roughly $21 billion this past year for all state agencies," said Tim Schaefer, California's deputy treasurer for public finance. "We are pleased that we had a year of very favorable rates, eventually those refundings will save tax payers $1.8 billion in direct savings and $500 million in public benefits."

Schaefer said the highlight of the year came in October when the state completed what is believed to be one of the largest competitive sales in more than 25 years. Although it came in three separate sales, they were all under a common plan of finance, which was various purpose.

"In total the combined sale just under $1.7 billion and that is an important size milestone for the state and for the market," said Schaefer.

The Dormitory Authority of the State of New York finished in second place with $5.92 billion, slipping a bit one year after it finished in first place with $9.02 billion.

Another New York issuer, the Metropolitan Transportation Authority finished in third place with $5.19 billion, up from $3.11 billion in 2015, which was good for eighth place.

Massachusetts came in fourth with $4.83 billion, improving from $2.55 billion, while the New York City Transitional Finance Authority rounded out the top five with $4.75 billion.