Munis were slightly stronger on Wednesday afternoon, as one large deal hit screens, while most market participants are waiting for the Federal Open Market Committee's announcement on interest rates.

Secondary Market

U.S. Treasuries were stronger on Wednesday around midday. The yield on the two-year Treasury was lower at 0.74% from 0.75% on Tuesday, as the 10-year Treasury yield was lower at 1.54% from 1.55% and the yield on the 30-year Treasury bond slid to 2.25% from 2.26%.

Top-quality municipal bonds were slightly stronger on Wednesday. The yield on the 10-year benchmark muni general obligation was as many as two basis points lower from 1.45% on Tuesday, while the yield on the 30-year muni was as many as two basis points lower from 2.15%, according to a read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 93.0% compared to 92.1% on Monday, while the 30-year muni to Treasury ratio stood at 94.3% versus 93.8%, according to MMD.

Primary Market

North Carolina competitively sold $200 million of general obligation public improvement bonds for Connect NC. Citi won the deal with a true interest cost of 2.08%. The bonds were priced to yield from 0.45% with a 5% coupon in 2017 to 2.62% with a 2.50% coupon in 2036. The deal is rated triple-A by Moody's Investors Service, S&P Global Ratings and Fitch Ratings.

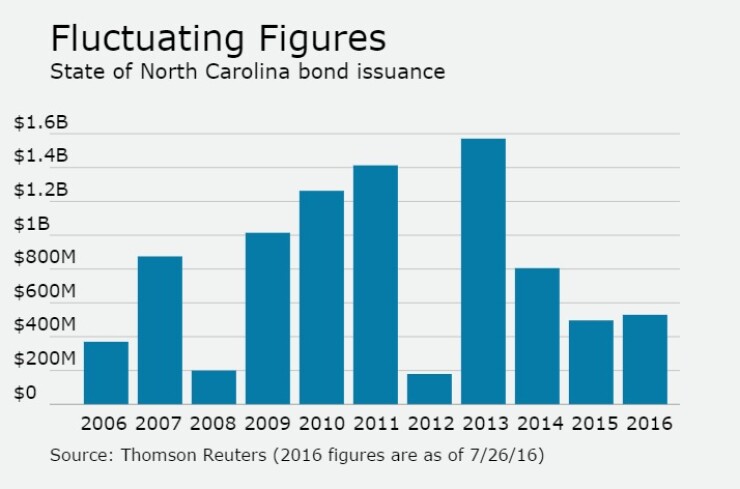

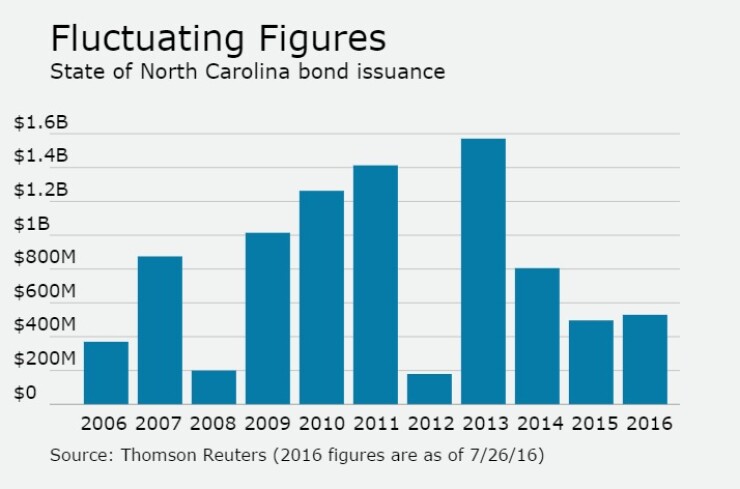

Since 2006, the state of North Carolina has issued about $8.7 billion of debt, with the largest issuance occurring in 2013 when it sold $1.6 billion of securities.

The state of Wisconsin's $317 million of GO refunding bonds was to be priced on Monday, according to the Dalcomp calendar, but sources are saying the deal will be priced by RBC Capital Markets on "Wednesday or Thursday."