Top-shelf municipal bonds were stronger in early activity, according to traders, as the last of the week’s big new issues were set to come to market.

Secondary Market

The yield on the 10-year benchmark muni general obligation was one to three basis points weaker from 1.65% on Wednesday, while the 30-year muni yield was one to three basis points weaker from 2.61%, according to a preliminary read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Thursday. The yield on the two-year Treasury fell to 0.81% from 0.86% on Wednesday, while the 10-year Treasury yield dropped to 1.86% from 1.87% and the yield on the 30-year Treasury bond decreased to 2.71% from 2.72%.

The 10-year muni to Treasury ratio was calculated at 88.5% on Wednesday compared with 86.0% on Tuesday, while the 30-year muni to Treasury ratio stood at 96.5% versus 95.4%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 40,251 trades on Wednesday on volume of $14.07 billion.

Primary Market

Citigroup is expected to price the Mission Economic Development Corp., Texas’ $198 million of Series 2016B senior lien revenue bonds for the Natogasoline project. The deal is rated BB-minus by Standard & Poor’s.

Bank of America Merrill Lynch is set to price the Public Power Generation Agency, Neb.’s $136 million Series 2016A revenue refunding bonds for the Whelan Energy Center’s Unit 2. The deal is rated A2 by Moody’s Investors Service and A-minus by Fitch Ratings.

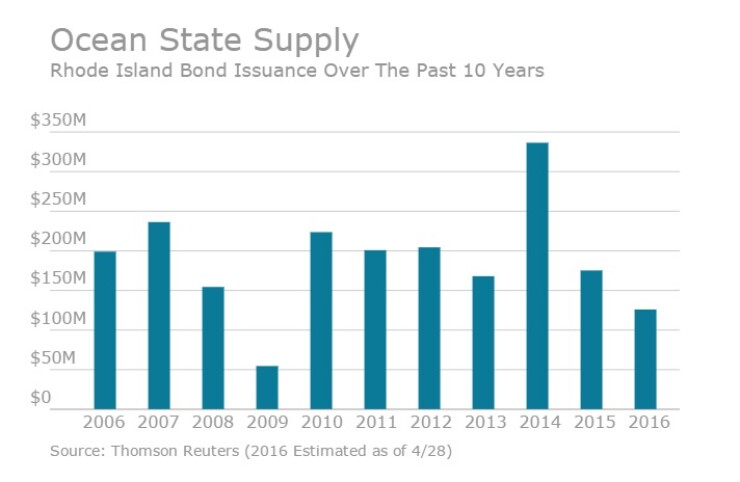

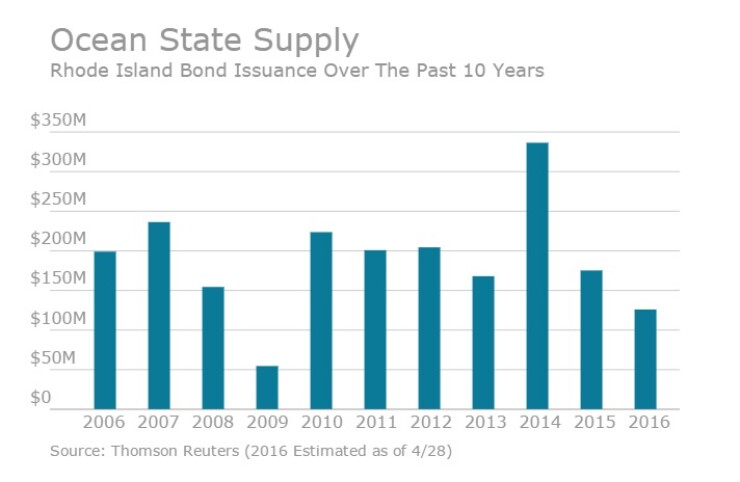

In the competitive arena, Rhode Island will sell a total of $125.99 million of general obligation bonds in two separate sales.

The offerings consist of a sale of $112.82 million of tax-exempt Series A consolidated capital development loan of 2016 bonds and tax-exempt Series C consolidated capital development loan of 2016 refunding bonds; and a sale of $13.17 million of taxable consolidated capital development loan of 2016 Series B.

Both sales are rated Aa2 by Moody’s and AA by S&P and Fitch.

Since 2006, the Rhode Island has sold about $2 billion of debt with the most issuance occurring in 2014 when it issued $336.4 million of bonds. The state sold the least amount of bonds in 2009 when it offered $54.6 million of debt.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $968.8 million to $10.30 billion on Thursday. The total is comprised of $5.46 billion of competitive sales and $4.84 billion of negotiated deals.

Tax-Exempt Money Market Funds See Outflows

Tax-exempt money market funds experienced outflows of $3.85 billion, bringing total net assets to $217.75 billion in the week ended April 25, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $2.73 billion to $221.60 billion in the previous week.

The average, seven-day simple yield for the 315 weekly reporting tax-exempt funds was unchanged from the previous week at 0.05%.

The total net assets of the 909 weekly reporting taxable money funds increased $18.87 billion to $2.476 trillion in the week ended April 26, after an outflow of $31.82 billion to $2.457 trillion the week before.

The average, seven-day simple yield for the taxable money funds dipped to 0.10% from 0.11% in the prior week.

Overall, the combined total net assets of the 1,224 weekly reporting money funds increased $15.02 billion to $2.694 trillion in the period ended April 26, which followed an outflow of $34.55 billion to $2.679 trillion.