Top-quality municipal bonds finished stronger on Tuesday, traders said, as the New York State Environmental Facilities Corp. priced a deal for institutions.

Bank of America Merrill Lynch priced and repriced the New York State Environmental Facilities Corp.'s $594.39 million of state clean water and drinking water revolving funds revenue bonds for New York City Municipal Water Finance Authority projects for institutions on Tuesday after holding a one-day retail order period.

The Series 2017A second resolution subordinated SRF bonds were repriced to yield from 0.75% with a 2% coupon in 2017 to 3.47% with a 4% coupon and 3.17% with a 5% coupon in a split 2037 maturity. A 2042 term bond was priced as 5s to yield 3.25% and a 2046 term was priced as 5s to yield 3.30%.

On Monday, the deal was priced for retail to yield from 1.14% with a 5% coupon in 2019 to 3.20% with a 3.125% coupon in in 2031, as 3 1/2s to yield 3.60% in 2035, as 4s to yield 3.47% in 2037 and as 5s to yield 3.29% in 2046. There were no retail orders taken in the 2032-2035 or 2042 maturities.

The deal is rated triple-A by Moody's Investors Service, S&P Global Ratings and Fitch Ratings.

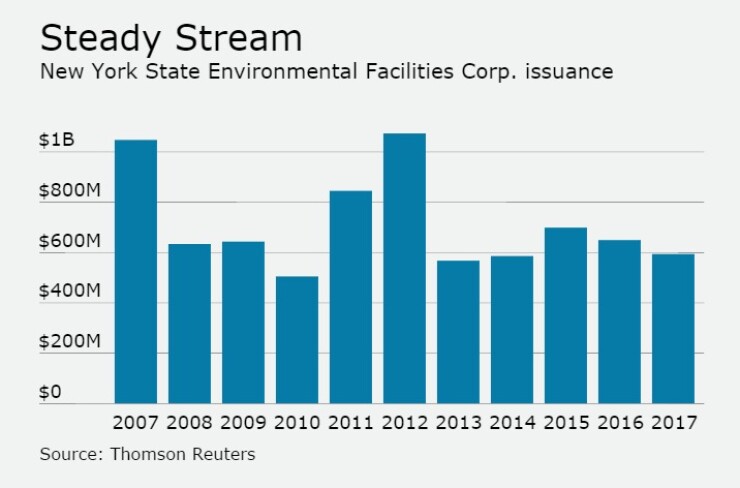

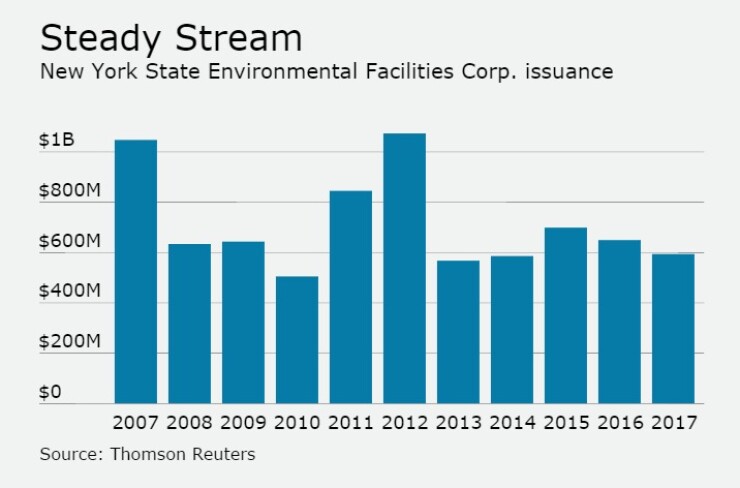

Since 2007, the NYS EFC has issued about $7.7 billion of debt, with the most issuance occurring in 2012 when it sold $1.07 billion and the least happening in 2010 when it offered $505 million.

Goldman Sachs priced the Dutchess County, N.Y., Local Development Corp.'s $102.56 million of Series 2017 revenue refunding bonds for Vassar College.

The issue was priced to yield from 0.93% with a 3% coupon in 2018 to 3.36% with a 5% coupon in 2037. A 2042 term bond was priced as 5s to yield 3.43% and a 2046 term was priced as 4s to yield 3.85%.

The deal is rated Aa3 by Moody's and AA-minus by S&P.

JPMorgan Securities priced the Clark County, Nev.'s $116.88 million of airport system subordinate lien refunding revenue bonds.

The $67.11 million of Series 2017A-1 bonds subject to the alternative minimum tax were priced as 5s to yield from 1.18% in 2018 to 2.13% in 2022. The $49.77 million of Series 2017A-2 non-AMT bonds were priced as 5s to yield 3.48% in 2036, 3.50% in 2037 and 3.52% in 2040.

The deal is rated Aa3 by Moody's and A-plus by S&P.

In the competitive arena, the San Francisco Unified School District sold two deals totaling $239.9 million.

Citigroup won the $180 million election of 2016 Series A general obligation bonds with a true interest cost of 3.23%. JPMorgan won the $59.9 million of 2017 GO refunding bonds with a TIC of 1.74%. No pricing information was available.

Both sales are rated Aa2 by Moody's, AA-minus by S&P and triple-A by Fitch.

Secondary Market

Bond prices turned higher as U.S. equities fell with financial stocks leading the way down.

The yield on the 10-year benchmark muni general obligation fell five basis points to 2.33% from 2.38% on Monday, while the 30-year GO yield dropped three basis points to 3.13% from 3.16%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Tuesday. The yield on the two-year dropped to 1.26% from 1.29% on Monday, while the 10-year Treasury yield declined to 2.43% from 2.47%, and the yield on the 30-year Treasury bond decreased to 3.04% from 3.09%.

In late trading the Dow Jones Industrial average was down 1% with the S&P 500 off 1.1%.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,134 trades on Monday on volume of $7.88 billion.