Top-shelf municipal bonds finished stronger Friday, according to traders, ahead of the upcoming $7.9 billion new-issue calendar.

Total volume for the upcoming week is estimated by Ipreo at $7.88 billion, down a revised total of $8.12 billion in the previous week, according to Thomson Reuters data. The calendar is divided up into $6.02 billion of negotiated deals and $1.86 billion of competitive sales.

"The calendar should receive solid reception boosted by continued positive fund flows," said Janney Municipal Strategist Alan Schankel.

The supply slate is dominated by issues from the Far West.

The Alameda Corridor Transportation Authority, Calif., will be coming to market on Wednesday with the biggest deal of the week.

Bank of America Merrill Lynch is set to price the authority's $662 million of Series 2016 A&B tax-exempt subordinate and second subordinate lien revenue refunding bonds.

The Series A bonds are rated Baa2 by Moody's Investors Service and BBB-plus by Standard & Poor's and Fitch Ratings. The Series B bonds are rated Baa2 by Moody's and BBB by S&P and Fitch.

"The Alameda Corridor Trans issue should see strong demand since it is among the yieldiest issues of the week and benefits from monopoly status for rail cargo at the two busiest west coast ports, Long Beach and Los Angeles," Schankel said.

Also from California, Loop Capital Markets is expected to price the Los Angeles International Airport's $293 million of Series 2016A subordinate revenue bonds on Wednesday. The deal, which is subject to the alternative minimum tax, is rated A1 by Moody's and AA-minus by S&P and Fitch.

In the competitive arena, the city and county of San Francisco's Public Utilities Commission will be selling on Tuesday over $308 million of bonds in two separate offerings. The sales consist of $241 million of Series 2016A wastewater revenue green bonds and $68 million of Series 2016B wastewater revenue bonds. Both deals are rated Aa3 by Moody's and AA by S&P.

And the California Department of Water Resources is competitively selling $108 million of Series AV Central Valley Project water system revenue bonds on Tuesday. The deal is rated Aa1 by Moody's and triple-A by S&P.

Morgan Stanley is set to price the state of Oregon's $306 million of Series 2016 D, E, F, G and H Article XI-M seismic projects and Article XI-Q state projects general obligation bonds on Wednesday.

In the Midwest, Chicago is coming to market with a $546 million sale of tax-exempt and taxable and second lien water revenue bonds. PNC Capital Markets is expected to price the deal on Wednesday. The issue is rated AA by Kroll Bond Rating Agency.

In the Southwest, JPMorgan Securities is expected to price the Central Texas Regional Mobility Authority's $369 million of Series 2016 senior lien revenue refunding bonds on Thursday. The issue is rated Baa2 by Moody's and BBB-plus by S&P.

Also in Texas, Ramirez is expected to price Austin's $252 million of Series 2016 water and wastewater system revenue refunding bonds on Tuesday. The deal is rated Aa2 by Moody's, AA by S&P and AA-minus by Fitch.

Secondary Market

Municipals were stronger on Friday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.57% from 1.58% on Thursday, while the 30-year muni yield dropped two basis points to 2.49% from 2.51%, according to the final read of Municipal Market Data's triple-A scale.

Yields trended downward on the week, with most movement seen on the long end. On Friday, April 29, the yield on the 10-year muni stood at 1.61% while the 30-year muni was at 2.58%.

U.S. Treasuries were weaker on Friday. The yield on the two-year Treasury inched up to 0.73% from 0.72% on Thursday, while the 10-year Treasury yield gained to 1.78% from 1.75% and the yield on the 30-year Treasury bond increased to 2.63% from 2.61%.

The 10-year muni to Treasury ratio was calculated at 88.4% on Friday compared with 90.6% on Thursday, while the 30-year muni to Treasury ratio stood at 94.7% versus 96.4%, according to MMD.

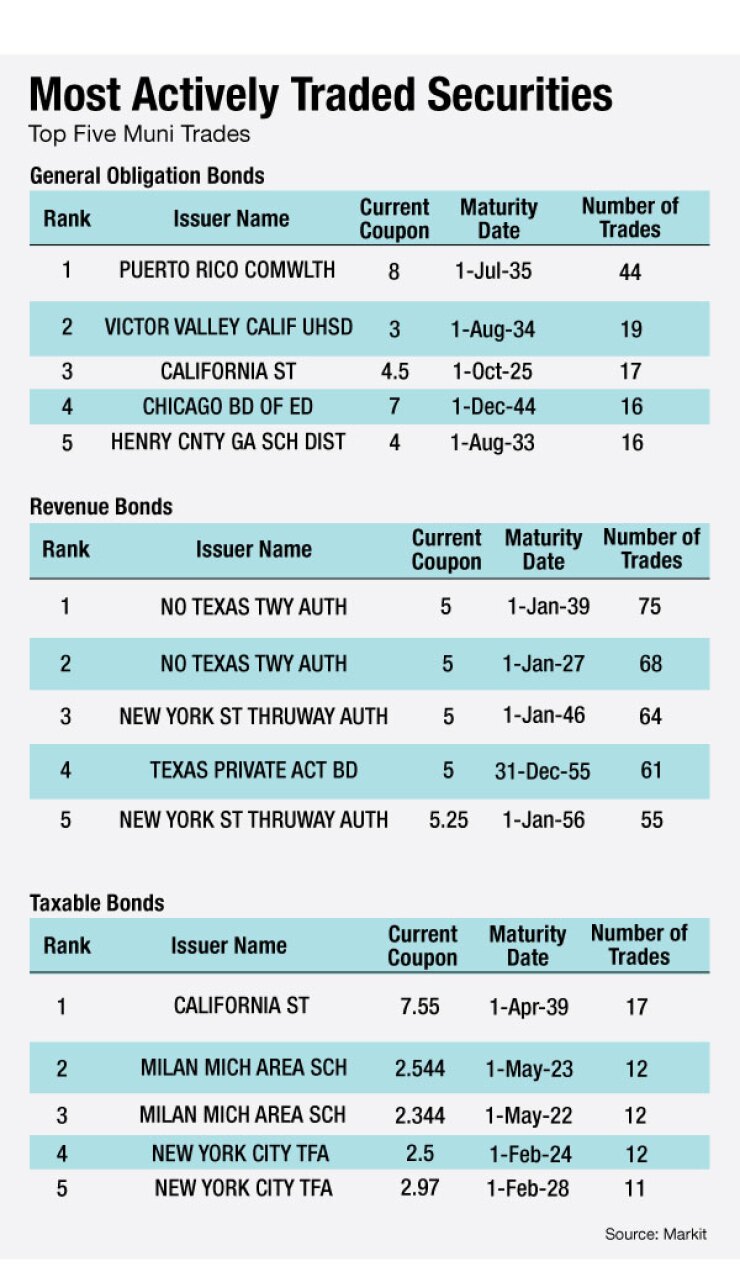

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended May 6 were from Puerto Rico, Texas and California issuers, according to data

In the GO bond sector, the Puerto Rico 8s of 2035 traded 44 times. In the revenue bond sector, the North Texas Tollway Authority 5s of 2039 traded 75 times. And in the taxable bond sector, the California 7.55s of 2039 traded 17 times, Markit said.

The Week's Most Actively Quoted Issues

California, Texas and Oho issues were among the most actively quoted names in the week ended May 6, according to Markit.

On the bid side, the California taxable 7.3s of 2039 were quoted by 14 unique dealers. On the ask side, the Houston GO 5s of 2025 were quoted by 21 unique dealers. And among two-sided quotes, the Buckeye Tobacco Settlement Financing Authority, Ohio revenue 5.875s of 2047 were quoted by eight dealers.

Muni Bond Funds See Inflows for 31st Straight Week

For the 31st week in a row, municipal bond funds reported inflows, according to Lipper data released Thursday. Weekly reporting funds saw $709.727 million of inflows in the week ended May 4, after inflows of $1.173 billion in the previous week, Lipper said.

The four-week moving average remained positive at $725.712 million after being in the green at $674.752 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.