Picking up where they left off on Friday, municipal bonds continued to rally on Monday with Treasuries in the wake of the British vote to leave the European Union.

In morning trade, the yield on 10-year benchmark muni general obligation was five to seven basis points lower from 1.36% on Friday, while the 30-year muni yield declined from seven to nine basis points from 2.08%, according to a read of Municipal Market Data's triple-A scale. Friday's reads were the lowest for munis since MMD began calculating them in 1980.

U.S. Treasuries continued to rally on Monday. The yield on the two-year Treasury dropped to 0.59% from 0.65% on Friday, while the 10-year Treasury yield declined to 1.49% from 1.57% and the yield on the 30-year Treasury bond decreased to 2.31% from 2.42%.

On Friday, the 10-year muni to Treasury ratio was calculated at 86.3% compared to 88.1% on Thursday, while the 30-year muni to Treasury ratio stood at 85.8% versus 87.3%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 25,000 trades on Friday on volume of $10.65 billion.

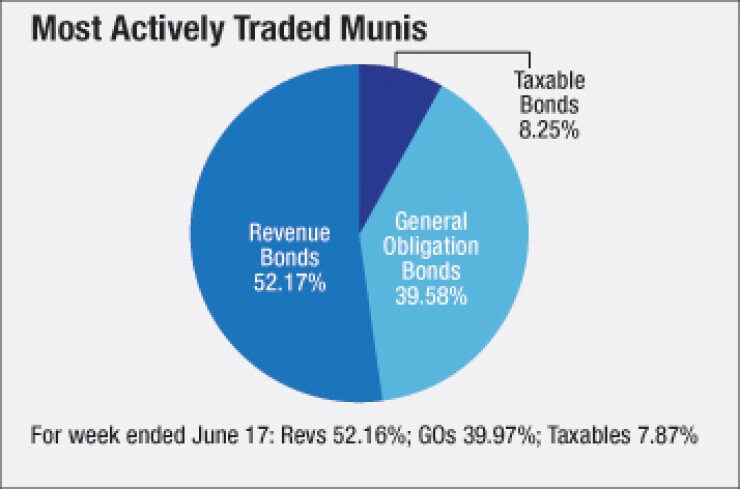

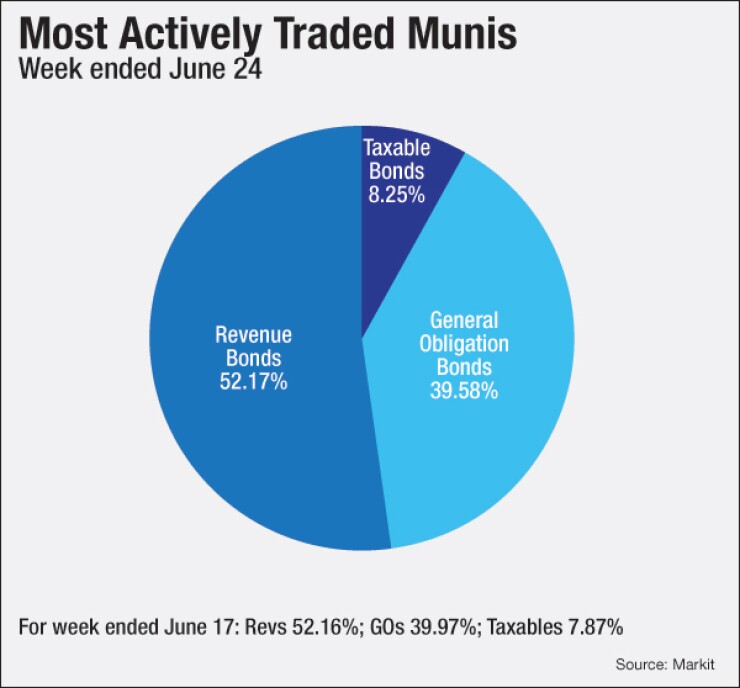

Prior Week's Actively Traded Issues

Revenue bonds comprised 52.17% of new issuance in the week ended June 24, up from 52.16% in the previous week, according to Markit. General obligation bonds comprised 39.58% of total issuance, down from 39.97%, while taxable bonds made up 8.25%, up from 7.87%.

Some of the most actively traded issues by type were from California, New York and Oregon. In the GO bond sector, the Los Angeles 3s of 2017 were traded 177 times. In the revenue bond sector, the N.Y. MTA 4s of 2036 were traded 81 times. And in the taxable bond sector, the Port Morrow, Ore., revenue 1.782s of 2021 were traded 14 times.

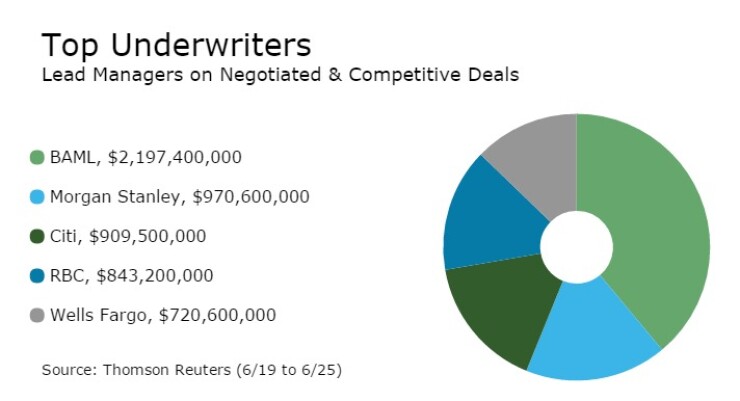

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, Morgan Stanley, Citigroup, RBC Capital Markets and Wells Fargo Securities, according to Thomson Reuters data. In the week of June 19-June 25, BAML $2.20 billion, Morgan Stanley did $971 million, Citi had $910 million, RBC did $843 million and Wells Fargo had $721 million.

Muni Volume Estimated at $8.2B

Total volume for this week is estimated by Ipreo at $8.18 billion, down from a revised total of $9.28 billion sold last week, according to data from Thomson Reuters.

There are $5.92 billion of municipal bond deals and $2.26 billion of competitive sales on the calendar for this week.

Primary Market

Washington State is expected to hit the market with four separate competitive sales totaling $1.3 billion on Tuesday. The largest deal is $535.125 million of various purpose general obligation refunding bonds. There are also $392.265 million of various purpose GOs, $272.470 million of motor vehicle fuel tax GO refunding bonds and $101.345 million of GO taxable bonds. All of the deals are rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

The commonwealth of Massachusetts will be selling three separate negotiated deals, totaling roughly $891 million.

Bank of America Merrill Lynch is slated to price the two larger issues, the first of which is $441 million of GO refunding bonds on Wednesday, following a one-day retail order period. The firm will also price $250 million of GO consolidated loan of 2016 series F taxable green bonds on Wednesday.

Additionally, Barclays is scheduled to price Massachusetts' $200 million of GO consolidated loan of 2014 Series D multi-modal bonds and Subseries D-1 bonds on Wednesday. All three deals carry ratings of Aa1 by Moody's and AA-plus by Fitch.

BAML is slated to price San Antonio, Texas's $564 million of electric and gas systems revenue refunding bonds on Tuesday. The deal is rated Aa1 by Moody's, AA by S&P and AA-plus by Fitch.

Barclays is on the docket to price the South Carolina Public Service Authority's $750 million of revenue obligations, which is expected to include a tax-exempt refunding portion as well as a taxable portion on Wednesday. The deal is rated A1 by Moody's, AA-minus by S&P and A-plus by Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $362.1 million to $10.23 billion on Monday. The total is comprised of $3.16 billion of competitive sales and $7.08 billion of negotiated deals.