Prices of top-shelf municipal bonds were weaker at mid-session, traders said, as the city of Detroit returned to the market with its first post-bankruptcy bond sale.

Barclays Capital priced the Motor City's $245 million of local government loan program revenue bonds, which were being issued as a remarketing through the Michigan Finance Authority.

The $134.73 million tax-exempt Series 2014F-1 Detroit financial recovery income tax revenue and refunding local project bonds were priced at par to yield 3.40% in 2020, 3.60% in 2021, 3.80% in 2023, 4.00% in 2024 and 4.50% in 2029.

The $110.28 million of Series 2014F-2 taxable Detroit financial recovery income tax revenue and refunding local project bonds were priced at par to yield 4.60%, or about 300 basis points above the comparable Treasury security, in 2022.

The issue is being converted from variable-rate bonds owned by Barclays to fixed-rate current interest bonds.

According to the investor roadshow, proceeds will be used to "refund $120 million debtor-in-possession/quality of life financing; finance reinvestment and revitalization incentive projects in the city; pay all or a portion of the city's obligations with respect to certain classes of claims; fund a debt service reserve account; and pay costs of issuance."

The documents add "on the conversion date, [Sept. 1] the city will retire $30 million of the taxable portion of the original December 2014 transaction, reducing its borrowing to $245 million from $275 million."

The bonds are enhanced with a statutory lien and intercept feature on Detroit's income tax, which will pay off the bonds. These protections, along with debt-service coverage levels of 6.5 times, helped the deal get an A rating from Standard & Poor's.

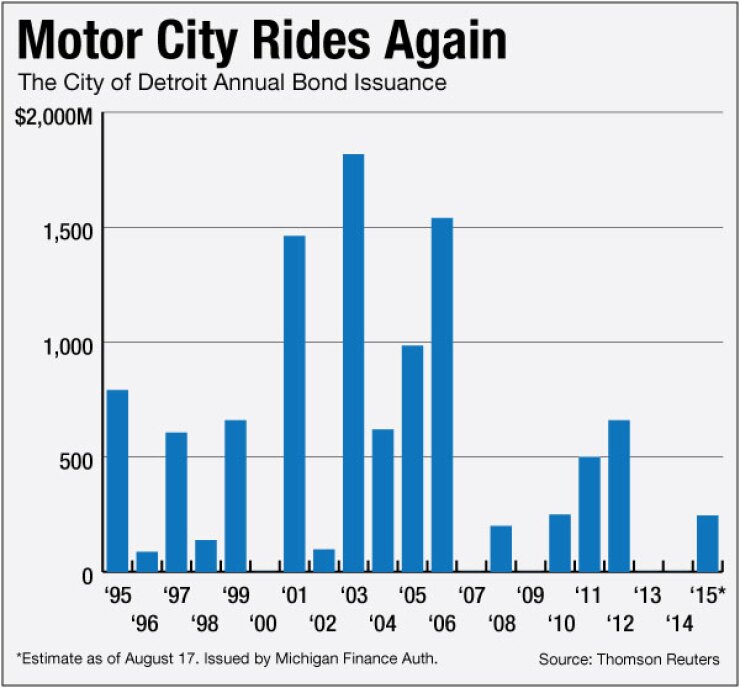

Since 1995, the city of Detroit has issued roughly $10.65 billion of debt. The years of 2003 and 2006 saw the most issuance with $1.82 billion and $1.54 billion, respectively. The Motor City did not issue any debt in 2000, 2007, 2009, 2013 and 2014.

Barclays continued to have a busy day as it also priced $558.74 million of tax-exempt and taxable deals from the Illinois Finance Authority for the University of Chicago.

The $408.23 million of Series 2015A tax-exempt revenue bonds were priced at par with a 2.10% coupon in 2025 to 3.44% with a 5% coupon in 2036. A 2040 term bond was priced as 5s to yield 3.57% and a split 2046 term bond was priced as 4s and as 5s to yield 4.10% and 3.66%, respectively.

The $150.51 million of Series 2015B taxable fixed-rate bonds were priced at par with a 1.05% coupon in 2016; and priced to yield about 65 basis points above the comparable Treasury in 2017 to about 180 basis points above the comparable Treasury in 2030. A 2033 maturity was priced about 140 basis points above the comparable Treasury.

The issue was rated Aa2 by Moody's Investors Service, AA by S&P and AA-plus by Fitch Ratings.

Citigroup priced the New York Convention Center Development Corp.'s $581.13 million of Series 2015 hotel unit fee secured revenue refunding bonds.

The issue was priced to yield from 1.12% with 3% and 5% coupons in a split 2018 maturity to 3.75% with a 3.625% coupon and 3.48% with a 5% coupon in a split 2035 maturity. A 2040 split term bond was priced at par to yield 4% and as 5s to yield 3.60%; a split 2045 term was priced as 4s to yield 4.06% and as 5s to yield 3.66%. The 2016 and 2017 maturities were offered as sealed bids. The issue is rated Aa3 by Moody's.

Goldman, Sachs priced the New York Metropolitan Transportation Authority's $294.19 million of Series 2015D transportation revenue refunding bonds for retail investors ahead of the institutional pricing on Thursday.

The $242.27 million of Subseries 2015D-1 fixed rated bonds were priced as 5s to yield 2.50% in 2024 and from 2.82% in 2026 to 3.39% in 2034; a 2035 split maturity was priced as 3 3/8s to yield 3.50% and as 5s to yield 3.43%. The $51.92 million of Subseries 2015D-2 mandatory tender bonds were priced as 4s to yield 1.44% in 2035 with a mandatory maturity date of 2019.

The issue is rated A1 by Moody's, AA-minus by S&P, A by Fitch and AA-plus by Kroll Bond Rating Agency.

Secondary Trading

The yield on the 10-year benchmark muni general obligation on Wednesday strengthened by as much as one basis point from 2.21% on Tuesday, while the yield on the 30-year GO was up by as much as one basis point from 3.08%, according to a read of Municipal Market Data's triple-A scale.

Treasury prices were mixed on Wednesday, with the yield on the two-year Treasury note flat at 0.71% from Tuesday, while the 10-year yield declined to 2.17% from 2.19% and the 30-year yield decreased to 2.83% from 2.86%.

The 10-year muni to Treasury ratio was calculated on Tuesday at 100.6% versus 102.2% on Monday, while the 30-year muni to Treasury ratio stood at 107.6% compared to 109.1%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 37,668 trades on Tuesday on volume of $7.682 billion.

The most active bond, based on the number of trades, was the Washington state Series R-2015C various purpose general obligation refunding 5s of 2029, which traded 201 times at a high/low price of 118.225/117.912, and a high/low yield of 2.81%/2.775%. The bonds were initially priced at 124.013 to yield 2.33%.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $982.0 million to $8.83 billion on Wednesday. The total is comprised of $2.46 billion competitive sales and $6.37 billion of negotiated deals.

Yvette Shields contributed to this report