Prices of top-shelf municipal bonds were steady at mid-session as traders prepared for the week's upcoming new issuance, topped by sales from the state of Minnesota and a green bond deal in Washington state.

Secondary Market

The yield on the 10-year benchmark muni general obligation was steady (up by as much as one basis point on the August roll calculation) from 2.19% on Friday, while the yield on the 30-year GO was steady from 3.12%, according to a read of Municipal Market Data's triple-A scale.

Treasury prices were higher on Monday, with the yield on the two-year Treasury note slipping to 0.66% from 0.67% on Friday, while the 10-year yield fell to 2.18% from 2.20% and the 30-year yield decreased to 2.88% from 2.92%.

The 10-year muni to Treasury ratio was calculated on Friday at 99.5% versus 98.4% on Thursday, while the 30-year muni to Treasury ratio stood at 106.8% compared to 106.4%, according to MMD.

Primary Market

Total volume for the week is estimated at $7.8 billion, consisting of $5.58 billion of negotiated deals and $2.20 billion of competitive sales.

On the competitive calendar are two separate sales from the state of Connecticut totaling $500 million.

Scheduled to sell on Tuesday, the issues consist of $250 million of Series 2015E GOs and $250 million of Series 2015B taxable GOs.

Both sales are rated Aa3 by Moody's Investors Service and AA by Standard & Poor's and Fitch Ratings.

The last time the state competitively sold comparable bonds was on Aug. 6, 2014, when JPMorgan won $300 million of Series 2014E GOs with a TIC of 3.03%.

Leading off the negotiated slate, is a $923.84 million green bond sale from Sound Transit, the Central Puget Sound Regional Transit Authority, Wash.

The sales tax improvement bonds are slated to be priced by JPMorgan on Tuesday, and are initially structured as Series 2015S-1 green bonds and Series 2015S-2 green bonds. The issue is initially structured as serials running from 2018 through 2050. The issue is rated Aa2 by Moody's and triple-A by S&P.

Topping the competitive slate are five separate sales on Wednesday from the state of Minnesota totaling over $1 billion.

The offerings consist of $386.50 million of Series 2015D general obligation state various purpose refunding bonds; $376.11 million of Series 2015A GO state various purpose refunding bonds; $310 million of Series 2015B GO state trunk highway bonds; $14.89 million of Series 2015E GO state trunk highway refunding bonds; and $7.2 million of Series 2015C taxable GO state various purpose bonds.

The state last competitively sold comparable bonds on Aug. 12, 2014, when Bank of America Merrill Lynch won $429.67 million of Series 2014A GO state various purpose bonds with a true interest cost of 2.83%.

And Loudoun County, Va., plans a sale of $117.53 million of Series 2015 water and sewer system revenue and refunding bonds on Wednesday. The issue is rated triple-A by Moody's and Fitch.

Citigroup is expected to price the New York State Environmental Facilities Corp.'s $370 million of Series 2015D state revolving funds revenue bonds on Wednesday after a one-day retail order period. The issue is initially structured as serials running from 2016 through 2035, with a term in 2040. The bonds are rated triple-A by Moody's, S&P and Fitch.

And the Oakland Unified School District in Alameda, Calif., is selling $356.18 million of GOs on Wednesday. Siebert Brandford Shank is scheduled to price the bonds, which consist of $175 million of Series 2015A Election of 2012 GOs, $5 million of Series 2015B Election 02012 taxable GOs, and $176.18 million of GO refunding bonds.

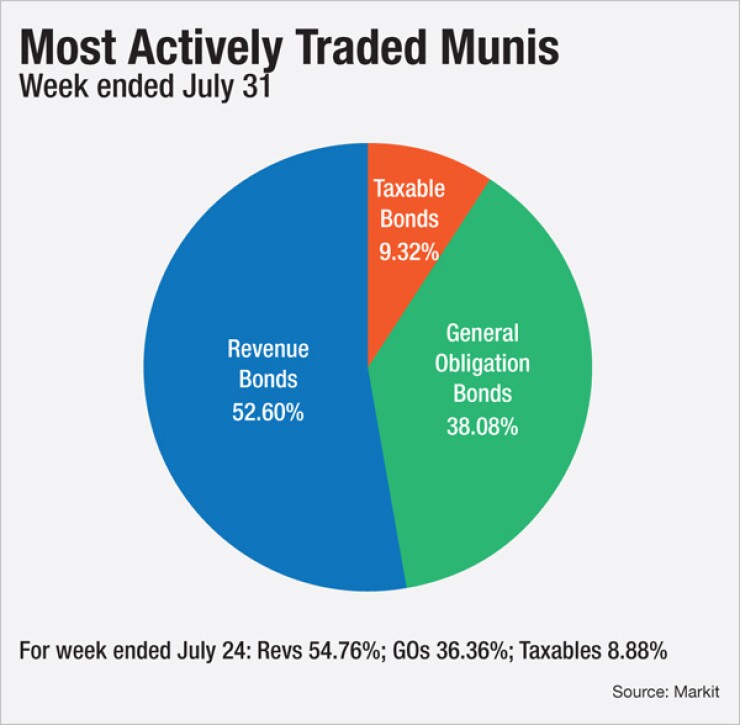

Prior Week's Actively Traded Issues by Sector

Revenue bonds comprised 52.60% of new issuance in the week ended July 31, down from 54.76% in the previous week, according to Markit. General obligation bonds comprised 38.08% of total issuance, up from 36.36%, while taxable bonds made up 9.32%, up from 8.80%.

Some of the most actively traded issues during the week were in New York, Puerto Rico and California, according to Markit.

In the revenue bond sector, the New York Metropolitan Transportation Authority 5s of 2035 were traded 76 times. In the GO bond sector, the Puerto Rico commonwealth 8s of 2035 were traded 58 times. And in the taxable bond sector, the California Earthquake Authority revenue 2.805s of 2019 were traded 13 times, Markit said.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 31,037 trades on Friday on volume of $7.948 billion.

The most active bond, based on the number of trades, was the Lehigh County General Purpose Authority, Pa., Series 2015A hospital revenue 4 1/4s of 2045, which traded 93 times at an average price of 100.264, an average yield of 4.25%. The bonds were initially priced at 97.352 to yield 4.41%.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar was down $430.1 million to $9.66 billion on Monday. The total is comprised of $3.60 billion competitive sales and $6.06 billion of negotiated deals.