Prices of top-shelf municipal bonds closed out the week unchanged to stronger, traders said, as the market moved into holiday mode on Friday after the release of the August employment report.

All U.S. markets are closed on Monday for the Labor Day holiday. Trading resumes on Tuesday, Sept. 8.

Secondary Market

The yield on the 10-year benchmark muni general obligation was one basis point weaker at 2.18% from 2.19% on Thursday, while the yield on the 30-year GO was two basis point weaker at 3.11% from 3.13%, according to the final read of Municipal Market Data's triple-A scale. Shorter maturities ended steady.

On Friday, Aug. 28, the yield on the 10-year muni stood at 2.16% while the 30-year muni was yielding 3.10%.

The Labor Department reported that non-farm payrolls rose 173,000 in August and it revised the June and July data upward by a total of 44,000 jobs. The unemployment rate fell to 5.1% in August from 5.3% in July.

Economists polled by IFR Markets had expected non-farm payrolls to rise by 220,000 and the unemployment rate to come in at 5.2%.

Treasury prices were mostly higher on Friday, with the yield on the two-year Treasury note unchanged from 0.70% on Thursday, while the 10-year yield fell to 2.12% from 2.17% and the 30-year yield decreased to 2.89% from 2.94%.

The 10-year muni to Treasury ratio was calculated on Friday at 102.6% versus 101.0% on Thursday, while the 30-year muni to Treasury ratio stood at 107.6% compared to 106.2%, according to MMD.

Primary Market

Volume for the week came in at a revised $3.32 billion during the week, according to Thomson Reuters.

This consisted of $2.38 billion of negotiated deals and $940.8 billion of competitive sales.

JPMorgan Securities priced the Dormitory Authority of the State of New York's $1.1 billion of Series 2015E general purpose state personal income tax revenue bonds for institutions after holding an order period for retail investors. The DASNY deal was rated Aa1 by Moody's Investors Service and triple-A by Standard & Poor's; the credit carries a stable outlook from both rating agencies.

The state of Wisconsin sold $391.33 million of Series 2015C general obligation bonds. Bank of America Merrill Lynch won the issue with a true interest cost of 3.32%. The issue offers an eight-year call instead of the traditional 10-year provision. The bonds were rated Aa2 by Moody's and AA by S&P and Fitch Ratings.

Barclays Capital priced the Lower Colorado River Authority, Texas' $135 million of Series 2015D refunding revenue bonds. The issue was rated A by S&P and Fitch and carries stable outlooks from both rating agencies.

Municipal Bond Funds See Outflows

Municipal bond funds saw outflows in the latest week, according to Lipper data released on Thursday. Funds which report weekly saw $586.481 million of outflows in the week ended Sept. 2, after seeing outflows of $344.563 million in the previous week, Lipper reported.

The latest outflow brings to 18 out of 36 weeks this year that the funds have seen redemptions. Inflows for the year to date are still in the green, totaling over $2 billion.

The four-week moving average remained negative at $219.075 million after being in the red at $149.516 million in the previous week. The moving average has now been negative for 15 weeks in a row. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced outflows, losing $323.912 million in the latest week, after seeing outflows of $29.224 million in the previous week. Intermediate-term funds saw outflows of $82.230 million after seeing outflows of $44.327 million in the prior week.

Exchange traded funds saw outflows of $41.635 million, after experiencing inflows of $61.284 million in the previous week.

And high-yield muni funds saw outflows of $123.945 million in the latest reporting week, after seeing an outflow of $40.317 million the previous week.

In the past 19 weeks, high-yield funds have seen outflows 13 times totaling $1.939 billion and inflows six times totaling $322.011 million.

The Week's Most Actively Quoted Issues

Puerto Rico and New Jersey were some of the most actively quoted names in the week ended Sept. 4, according to data released by Markit.

On the bid side, the Puerto Rico commonwealth GO 8s of 2035 were quoted by 10 unique dealers. On the ask side, the New Jersey Economic Development Authority revenue 4 1/4s of 2026 were quoted by 22 dealers. And among two-sided quotes, the Puerto Rico commonwealth GO 8s of 2035 were quoted by 14 dealers, Markit said.

The Week's Most Actively Traded Issues

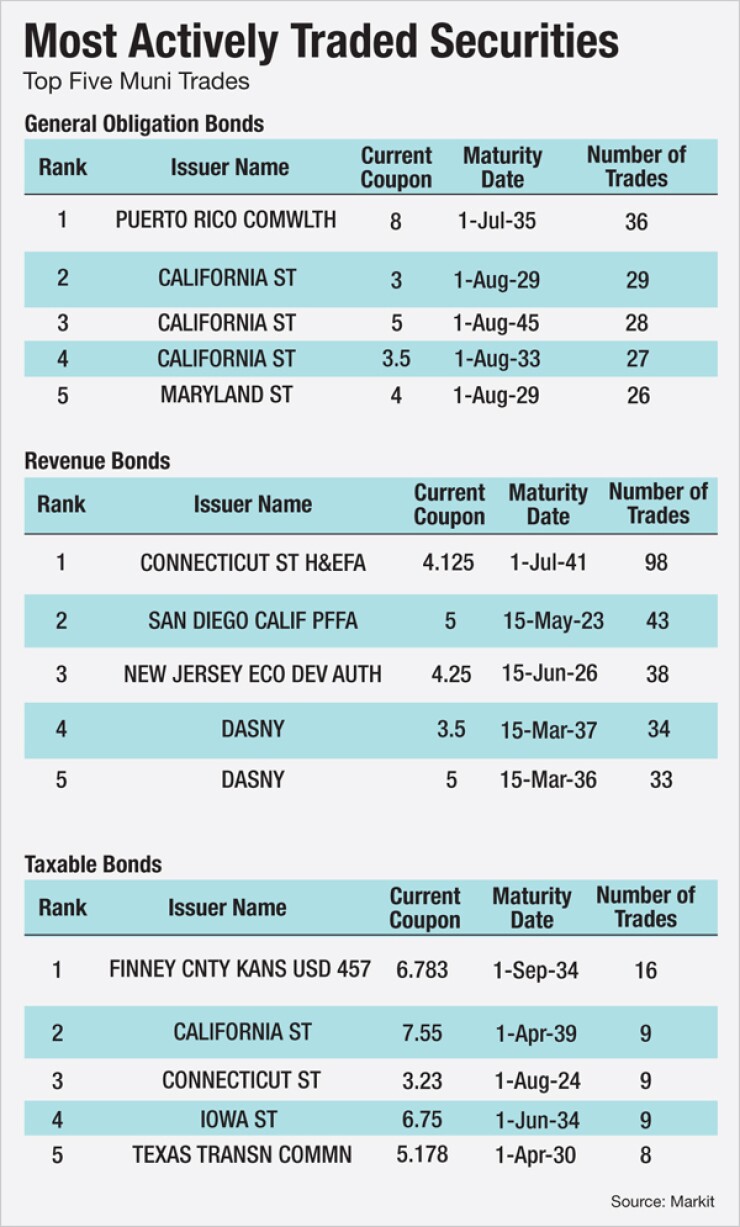

Some of the most actively traded issues in the week ended Sept. 4 were in Connecticut, Puerto Rico and Kansas, according to Markit.

In the revenue bond sector, the Connecticut state Health and Education Facilities Authority 4 1/8s of 2041 were traded 98 times. In the GO bond sector, the Puerto Rico commonwealth 8s of 2035 were traded 36 times. And in the taxable bond sector, the Finney County Unified School District No. 456, Kan., 6.783s of 2034 were traded 16 times, Markit said.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,368 trades on Thursday on volume of $6.059 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar rose $773.9 million to $7.15 billion on Friday. The total is comprised of $2.40 billion competitive sales and $4.75 billion of negotiated deals.