Municipal bond traders are awaiting the first of the week's big deals to hit the screens on Tuesday as they watch the direction of muni yields.

Secondary Market

Treasuries were little changed on Tuesday. The yield on the two-year Treasury declined to 1.19% from 1.20% on Monday, while the 10-year Treasury yield dropped to 2.36% from 2.37%, and the yield on the 30-year Treasury bond was unchanged at 2.98%.

Top-rated municipal bonds finished mostly weaker on Monday. The 10-year benchmark muni general obligation yield rose one basis point to 2.29% from 2.28% on Friday, while the yield on the 30-year GO increased one basis point to 3.05% from 3.04%, according to the final read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni to Treasury ratio was calculated at 96.8% compared to 98.5% on Friday, while the 30-year muni to Treasury ratio stood at 102.2%, versus 102.9%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,678 trades on Monday on volume of $7.07 billion.

Primary Market

On Tuesday, Siebert Cisneros Shank is set to price the New York City Municipal Water Finance's Authority's $395.57 million of Fiscal 2017 Series EE water and sewer second general resolution revenue bonds for institutions after holding a retail order period on Monday.

The issue was priced for retail as 5s to yield 3.06% in part of a split 2033 maturity, as 3 1/2s to yield 3.55% in 2035, as 5s to yield 3.23% in part of a split 2036 maturity, as 5s to yield 3.26% in part of a split 2037 maturity, as 3 5/8s to yield 3.67% in part of a 2038 maturity and as 4s to yield 3.61% in part of a 2039 maturity.

No retail orders were taken in part of a 2033 maturity, or parts of the 2036-2039 maturities.

The deal is rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings. The bonds carry a stable outlook from all three rating agencies.

On Tuesday, Morgan Stanley is set to price the California Infrastructure and Economic Development Bank's $450 million of clean water state revolving fund revenue green bonds.

The deal is rated triple-A by S&P and Fitch.

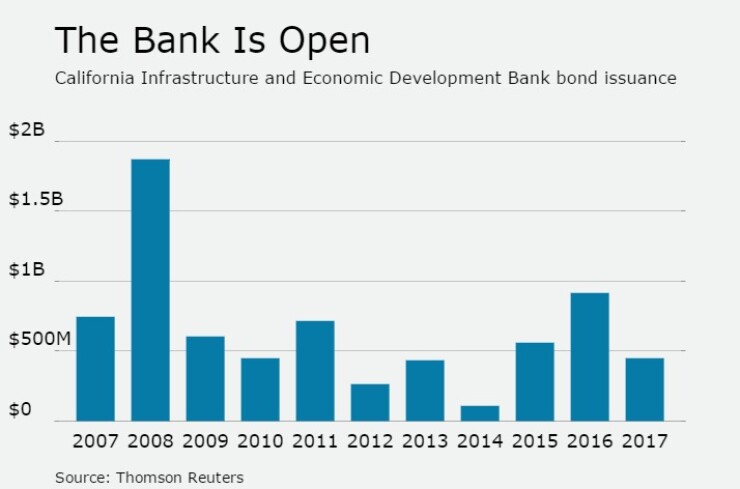

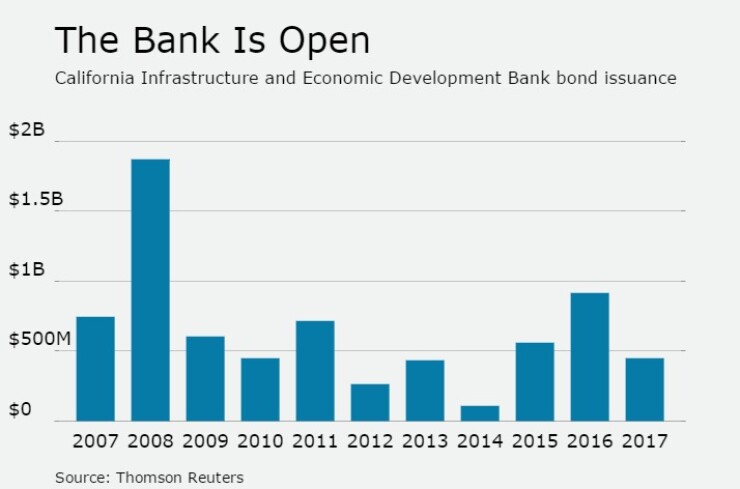

Since 2007, California Ibank has sold about $7.14 billion of bonds, with the most issuance coming in 2008 when it offered $1.87 billion.

Piper Jaffray is expected to price the Douglas County, Neb., Hospital Authority No. 2's $100 million of Series 2017 revenue bonds for Children's Hospital on Tuesday.

The deal is rated A1 by Moody's and AA-minus by Fitch.

In the competitive arena on Wednesday, Baltimore County, Md., is selling $545 million of notes and bonds in three separate sales.

The offerings consist of $225 million of Series 2017 metropolitan district bond anticipation notes, $121 million of Series 2017 consolidated public improvement BANs, and $199 million of metropolitan district bonds, 79th Issue.

The BANs are rated MIG1 by Moody's, SP1-plus by S&P and F1-plus by Fitch. The bonds are rated triple-A by Moody's, S&P and Fitch.

NYC TFA to Sell $800M Refunding Bonds

The New York City Transitional Finance Authority said it expects to sell $800 million future tax secured subordinate refunding bonds on Tuesday, March 7.

The deal will be priced by book-running senior manager J.P. Morgan Securities, with Bank of America Merrill Lynch, Citigroup, Goldman, Sachs, Jefferies, Loop Capital Markets, Ramirez & Co., RBC Capital Markets, Siebert Cisneros Shank and Wells Fargo Securities serving as co-senior managers.

There will be a two-day retail order period on Friday, March 3 and on Monday, March 6.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $139.9 million to $10.59 billion on Tuesday. The total is comprised of $4.98 billion of competitive sales and $5.60 billion of negotiated deals.