Municipal volume is forecast to surge to $8.74 billion in the coming week led by deals of roughly $2 billion apiece from the Port Authority of New York and New Jersey and Chicago's O'Hare International Airport.

The new volume will consist of $6.98 billion of negotiated deals and $1.76 billion competitive, according to Ipreo. The projected volume compares with total sales of $4.91 billion in the past week. In addition to the two mega deals, the calendar shows 13 deals of $100 million or larger, including four larger than $300 million.

"Muni bond volume will grow much higher this week as issuers attempt to take advantage of lower interest rates," said Daniel Berger, Senior Market Strategist, Thomson Reuters/Municipal Market Data. Market participants are split as to when we will finally see a rise in rates, following the Federal Open Market Committee's decision in September to hold off for now.

The Port Authority's $2 billion sale will consist a non-alternative minimum taxable portion of $1.2 billion, and AMT portion of roughly $300 million and $500 million of taxable. Wells Fargo Securities is expected to price the deal on Thursday. It is rated Aa3 by Moody's Investors Service and AA-minus by both Standard and Poor's and Fitch Ratings.

O'Hare will be coming with a $1.99 billion deal to be priced by JP Morgan on Wednesday. About $1.7 billion of the sale will refund outstanding general airport revenue bonds, with the remaining $300 million as new money to fund terminal and airfield projects, capitalized interest, and pay down commercial paper used for interim financing.

The city of Chicago has been promoting O'Hare's recent growth spurt, improved credit, and conservative debt portfolio as it preps a $2 billion issue that will mark the city's largest deal ever.

The airport's finances are well-segregated from the troubles of the city government, but the city's general credit deterioration coupled with the mammoth size of the deal is likely to create yield penalties compared to similar revenue debt, market participants said.

"There is headline risk there: will O'Hare get hit with some of the burden? Yes. Is it fair? No, but life isn't fair. That is the way the market acts," said John Mousseau, executive vice president and director of fixed income at Cumberland Advisors. "That being said, O'Hare will be a good deal and the credit is very good, but it's an example of an issuer getting penalized at the margin for the city's problem."

Mousseau also said that the general state of the market is good and he anticipates the spike in issuance for the week to be digested by the market.

"There is plenty of demand right now; the ship's only going one way, if you are an issuer you've got a good window here to try and come to market," he said. "The market is in pretty good shape and it needs supply in order to base other things off of - particularly large deals that reset the market so people can base block trades off and grease off the wheels."

Secondary Trading

Treasury prices were higher Friday after the release of September's weaker-than-expected employment data. Equities dropped at the open, but later turned around to move higher.

Non-farm payrolls rose less than projected last month while the jobless rate held at 5.1%. The economy added 142,000 jobs in September and a followed a downwardly revised 136,000 gain in August, originally reported as a 173,000 gain. Economists polled by IFR Markets had expected a 203,000 gain in non-farm payrolls jobs last month.

"To say the September labor data was a disappointment may be an understatement," MMD analyst Randy Smolik wrote in a Friday comment. "Outside of the unemployment rate staying flat at 5.1% everything else looked weak. Not only were payrolls well under expectation at 142,000 versus a 203,000 consensus, but the prior month was revised lower to 136,000 from 173,000. Labor participation was not gaining ground over the past several months and even dropped to 62.4% from 62.6%. Average earnings saw no growth."

The yield on the 10-year benchmark muni general obligation on Friday finished five basis points weaker at 1.98% from 2.03% on Thursday, while the yield on the 30-year GO was weaker by two basis points at 3.02% from 3.04%, according to the final read of Municipal Market Data's triple-A scale.

On Friday, Sept. 25, the yield on the 10-year muni stood at 2.09%, while the 30-year muni's yield was at 3.10%.

Treasury prices were higher with the yield on the two-year Treasury note dropping to 0.58% from 0.64% on Thursday, while the 10-year yield fell to 2.00% from 2.04% and the 30-year yield decreased to 2.83% from 2.88%.

The 10-year muni to Treasury ratio was calculated on Friday at 99.9% versus 99.8% on Thursday, while the 30-year muni to Treasury ratio stood at 107.1% compared to 106.8%, according to MMD.

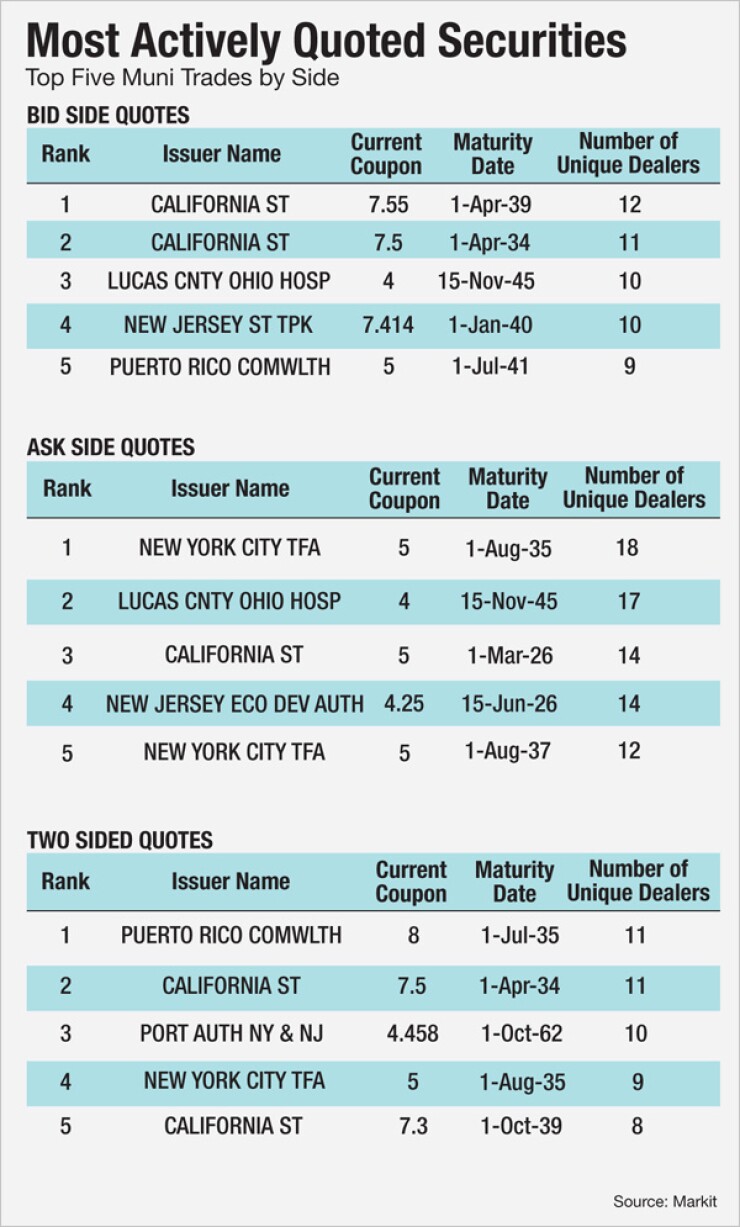

The Week's Most Actively Quoted Issues

California, New York and Puerto Rico were some of the most actively quoted names in the week ended Oct. 2, according to data released by Markit.

On the bid side, the California state tax 7.55s of 2040 were quoted by 12 unique dealers. On the ask side, the New York City Transitional Finance Authority revenue 5s of 2035 were quoted by 18 dealers. And among two-sided quotes, Puerto Rico commonwealth GO 8s of 2035 were quoted by 11 dealers, Markit said.

The Week's Most Actively Traded Issues

Some of the most actively traded issues in the week ended Oct. 2 were in Florida and Pennsylvania, according to Markit.

In the revenue bond sector, the Miami-Dade County, Fla., Educational Facilities Authority 4s of 2045 were traded 86 times. In the GO bond sector, the Reading School District, Pa., 4 1/8s of 2036 were traded 57 times. And in the taxable bond sector, the Miami-Dade County, Fla., Educational Facilities Authority 5.073s of 2050 were traded 30 times, Markit said.