Municipal bond issuance is set to jump in the coming week led by deals from the West Coast, as issuers look to lower borrowing costs.

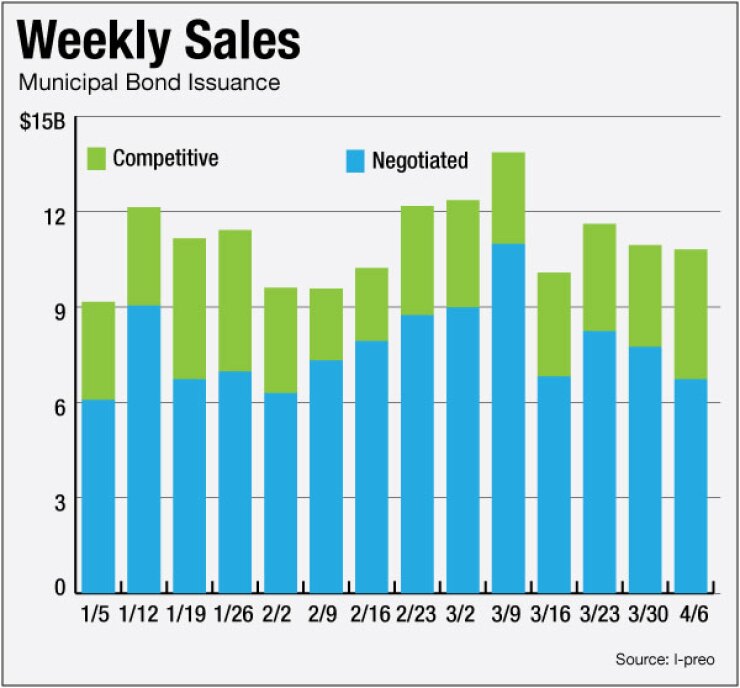

Deals scheduled for sale are estimated to total $8.7 billion, according to Ipreo and The Bond Buyer. This is up from a revised $7.9 billion in the past week, according to Thomson Reuters. Six of the 11 largest planned deals hail from the west coast. Issuers plan $6.2 billion of negotiated deals and $2.5 billion of competitive sales.

Issuance surged 59% in the first quarter from a year earlier, led by refundings, as municipalities looked to reduce costs by borrowing while historically low interest rates last. Economists expect the Federal Reserve to lift its benchmark rate from near zero sometime this year.

Leading off the calendar are three separate competitive offerings from California totaling $1.1 billion. The sales, slated for Tuesday, consist of $592.7 million of tax-exempt various purpose general obligation refunding bonds, Bid Group C; $403.5 million of tax-exempt various purpose GO refunding bonds, Bid Group B; and $105.36 million of taxable various purpose GO, Bid Group A. The bonds are rated Aa3 by Moody's Investors Service and A-plus by Standard & Poor's and Fitch Ratings.

The proceeds of the taxable bonds will be used to fund projects and pay taxable general obligation notes as they mature. Proceeds of the tax-exempt bonds will be used for advanced and current refundings on some of the state's outstanding general obligation bonds for debt service savings and to pay costs of issuance, the official statement said.

The largest negotiated deal scheduled is an $888 million negotiated deal for Washington's Energy Northwest. JPMorgan is slated to price the tax-exempt and taxable bonds on Thursday in six series, consisting of $101.32 million of Series 2015-A Project 1 electric revenue refunding bonds; $314.63 million of Series 2014-A Columbia generating station electric revenue and refunding bonds; $74.29 million of Series 2014-A revenue refunding bonds; $25.43 million of Series 2015B Project 1 taxable electric revenue refunding bonds; $332.96 million of Series 2015-B Columbia generating station taxable electric revenue and refunding bonds; and $39.23 million of Series 2015-B taxable revenue refunding bonds. The issue is rated Aa1 by Moody's, AA-minus by S&P and AA by Fitch.

The proceeds will be used to fund Columbia Generating Station's fiscal 2016 and 2017 capital-related costs, refinance existing bonds and to extend maturities as part of the regional cooperation debt initiatives to more closely align the weighted average maturities with the original useful lives of facilities.

"In part, a large portion of the extended maturities will make available Bonneville Power Administration funds and enable Bonneville to advance the repayment of certain higher rate federal obligations," said Jeff Windham, Energy Northwest's assistant treasurer. "Bonneville has existing federal repayment obligations that bear a higher interest rate than the expected rates of interest on the 2015A/B bonds."

Windham also said that a large portion of the transaction includes a refinancing strictly for savings in which EN intends to obtain lower rates of interest on the 2015A/B bonds than the existing rates of interest on certain Project 1, Columbia, and Project 3 bonds. The bonds that are currently anticipated to be refinanced were issued to refinance bonds issued to obtain funding for the construction of facilities or to obtain funding for ongoing capital related improvements.

"It would be uncommon, and perhaps unprecedented, for a transaction as large and complex as this one to be sold via a competitive sale," Windham said. "This transaction requires a considerable amount of detailed quantitative and tax analysis. The transaction will also benefit from a comprehensive investor outreach effort that we have conducted over the past several months. We have a team of very capable banking firms that provide valuable, necessary assistance in these areas."

Windham said that the expected pricing was set for the upcoming week to maximize investor outreach efforts, to time the transaction based on expected need to obtain funding for capital related expenses at Columbia beginning July 1, 2015, to time the extension of bonds prior to their current maturity on that date, and to obtain net present value savings on existing bonds that can be refinanced.

Phoenix, Ariz., is scheduled to come to market with $391 million of tax-exempt and taxable Series 2 civic improvement subordinated excise tax revenue refunding bonds, Wells Fargo Securities is slated to price the issue on Tuesday. The issue is rated Aa3 by Moody's and AA-plus by S&P.

Kathleen Gitkin, deputy finance director and city treasurer for the city of Phoenix said that the bonds are refunding the city of Phoenix civic improvement corporation subordinated excise tax revenue bonds, series 2005A, series 2006A, series 2007A and taxable series 2006C and the city of phoenix subordinated excise tax certificates of participation, series 18.

Phoenix chose the negotiated route because "extensive pre-marketing to investors is a major priority of the city," said Gitkin. "We provide an internet roadshow presentation to investors prior to pricing the bonds; generally, the city uses a negotiated process when issuing refunding bonds due to the variability of the amortization structure. In this case, the city has structured the savings to accommodate a new money sale that is anticipated in fiscal year 2015-16; the negotiated sale also provides us with more flexibility in terms of timing."

If current interest rates hold steady through next week, it will help the city refund before the fiscal year ends on June 30, she said.

"Market conditions are continuously changing whether it is changes in interest rates, demand for bonds, supply of bonds, economic news, etc.," she said. "The last time we were in the market was in Dec. 2014 to refund $497 million of water bonds. Rates were favorable at that time, and we had over $73 million of present value savings (14.7% of refunded par). For this excise tax refunding, we are refunding $425 million of bonds and are anticipating strong present value savings."