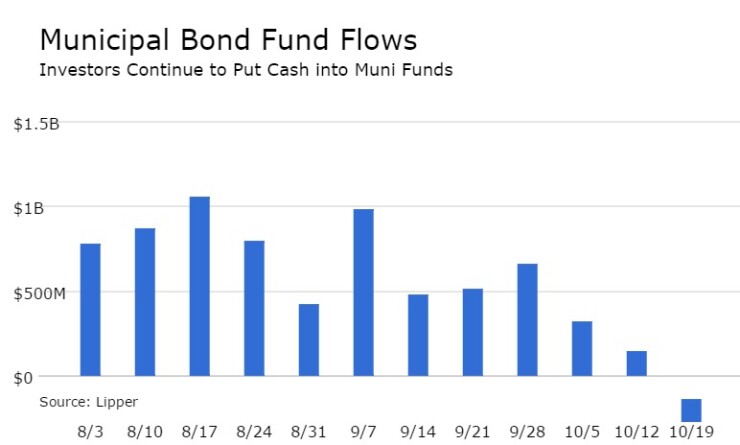

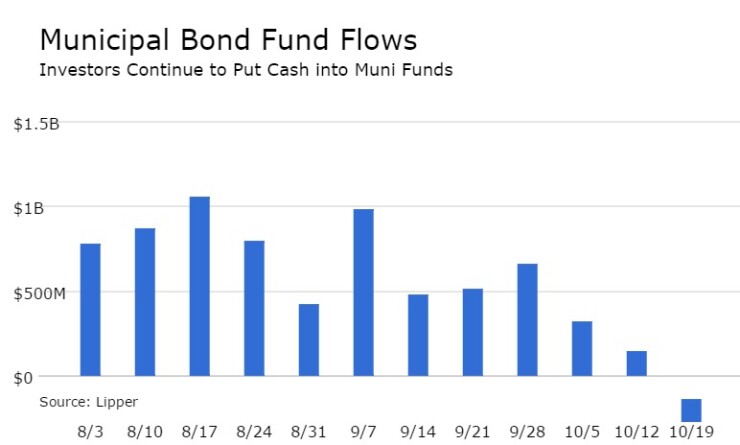

After 54 straight weeks of inflows, municipal bond funds reported investor money leaving the industry, according to Lipper data released on Thursday.

The weekly reporters saw $135.937 million of outflows in the week ended Oct. 19, after inflows of $147.312 million in the previous week, Lipper said.

The four-week moving average remained positive at $250.058 million after being in the green at $413.441 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced outflows, losing $553.787 million in the latest week after outflows of $55.575 million in the previous week. Intermediate-term funds had inflows of $316.627 million after inflows of $130.884 million in the prior week.

National funds had outflows of $171.326 million after inflows of $105.906 million in the previous week. High-yield muni funds reported outflows of $460.438 million in the latest reporting week, after outflows of $247.536 million the previous week.

Exchange traded funds saw outflows of $109.062 million, after inflows of $138.071 million in the previous week.