Tobacco bonds have lured investors with some of the highest returns in the muni market this year, raising concern among strategists that traditional municipal bond investors' are taking on too much risk.

The S&P Municipal Bond Tobacco Index, which tracks all tobacco bonds, had a total return of 10.87% through April 30, while the S&P National AMT-Free Municipal Bond Index returned 4.67%.

"The question is, 'is the currently yield environment rewarding investors for all that risk we've been talking about?'," J.R Rieger, global head of fixed income indices at S&P Dow Jones Indices at S&P, said in an interview. "Relative to the reward, is a pretty risky sector in general."

Rieger said that investors are mainly interested in tobacco bonds because they offer high-yields in a market where lack of supply has driven down municipal bond yields. Muni supply for 2014 totaled $89.34 billion as of April 30, compared to $122.7 billion for the same period last year.

The Buckeye Tobacco Settlement Finance Authority's benchmark tobacco bond with a 5.875% coupon maturing in 2047 traded at a yield of 7.69% on Thursday, according to data provided by Bloomberg. This year the yield hasn't dropped lower than 7.28% it fell to on March 5.

"We're seeing that demand is coming back into municipal bond funds, and as funds reach for anything with yield on it tobacco has that longer-duration high-yield aspect to it," Rieger said. "An average yield of over six percent is very hard to find in other sectors of the municipal market."

High-yield tobacco bonds topped the Barclays' Municipal Index's municipal returns by sector for both the month of April and year to date, according to a May 5 report. High-yield tobacco bonds reported 2.8% returns for April 2014, and returns of 14.1% so far this year.

As fund managers have poured more money into high yield funds, strategists are dubious about traditional municipal bond investors' ability to properly manage the tobacco bonds' credit risk. The Buckeye Tobacco benchmark bond mentioned above is currently rated B3 by Moody's Investors Service, B-minus by Standard & Poor's and B by Fitch ratings.

Tracy Rice, vice president and senior analyst at Moody's, and Irina Faynzllberg, vice president and senior credit officer at Moody's, wrote in a report Thursday that 79% of the tobacco bonds Moody's rates earned B1 or lower.

Tobacco bonds are unique because they are not paid from taxes on cigarettes, but from funds from the 1998 Tobacco Master Settlement Agreement. In the agreement the major tobacco companies agreed to pay states between $5 billion and $7 billion every year to manufacture and ship cigarettes in the U.S. without being subject to state lawsuits for medical costs associated with tobacco use.

That agreement tied tobacco bonds' performance to the amount of revenue generated from tobacco sales.

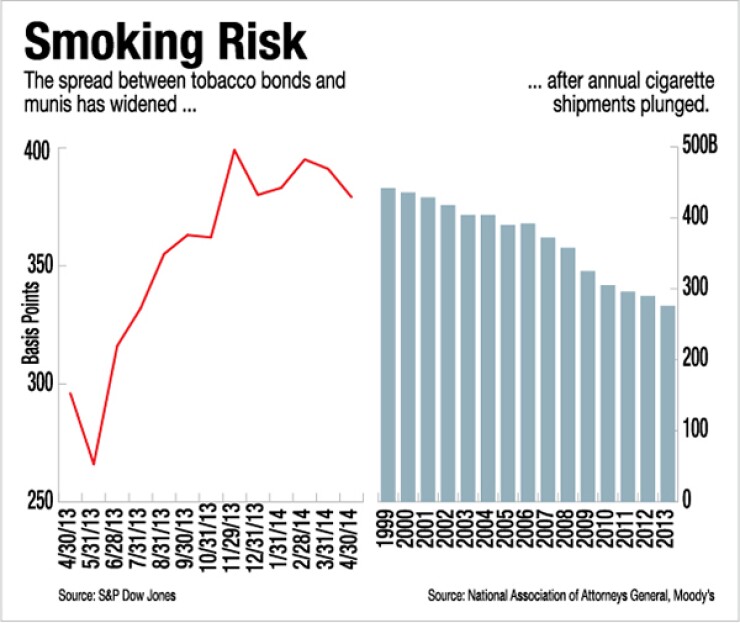

Last Thursday, the National Association of Attorneys General released data showing that domestic cigarette shipment volumes fell 4.9% in 2013, one of the largest annual declines since the group began reporting the figures in 1999, Rice and Faynzllberg wrote in the report, which concluded the decline was a credit negative for the bonds

"What we saw from data published recently was that there was a decline of 4.9%, outside of our range of 3%-4%," Debash Chatterjee, associate managing director at Moody's, said in an interview. "If you look at average annual decline over time, with some years higher and some lower, the long term trend still meets our expectations. Based on that expectation, a lot of these bonds could see default, and our ratings reflect that."

Moody's found that around 80% of the aggregate rated tobacco bond balance has a break-even annual rate of decline in cigarette shipments of less than 4%, and approximately 65% has a break-even annual rate of decline in shipments of less than 3%.

"Therefore, 65%-80% of the tobacco settlement bonds will default according to our projection of shipments falling at a rate of 3%-4% per year," Rice and Faynzllberg wrote in the report.

The bond's reliance on revenue from cigarette sales makes them highly volatile. Among all the sectors included in Barclay's high yield muni index, tobacco was the top performer in 2011 and 2012, with annual returns of 23.0% and 32.4% respectively; these returns dropped to the second worst in 2013 when the sector reported an 11.6% loss. Triet Nguyen, managing partner at Axios Advisors wrote in an April 17 report.

With the 14.1% return so far in 2014, high-yield tobacco bonds have already recouped all of last year's losses.

Nguyen said in an interview this volatility may be why crossover buyers such as hedge funds are attracted to tobacco bonds.

"Given their familiarity with mortgage-backed securities, crossover investors are very comfortable with cash flow securitization deals like tobacco bonds," he said.

Very few traditional municipal buyers have built the necessary models to do a cash flow analysis, he said.

"Traditional muni buyers have not been as disciplined in monitoring out the cash flow scenarios related to tobacco bonds."

Nguyen wrote in the April 17 report that he finds it surprising that many municipal investors still trade tobacco bonds in the traditional manner, which is on a yield-to-worst basis.

The YTW spread between S&P Municipal Bond Tobacco Index and S&P National AMT-Free Municipal Bond Index has widened to 379 as of April 30, from 296 for the same time last year.

"The preferred approach, at least in our view, would be to model each issue's future cash flows to maturity, with cigarette consumption rates as a key variable, and then decide if the current market price provides you with an acceptable internal rate of return based on various potential default scenarios," he wrote.

He wrote that alternatively investors could go back into a price they are willing to pay for the bonds based on their preferred default scenario.

"Having said that, we suspect very few muni buyers have devoted their resources to build internal tobacco bond cash flow models, putting them at something at a disadvantage versus many of the larger broker-dealer firms who have, in fact, made that analytical investment," he wrote.

"Most of the longer maturities will probably end up defaulting, so you have to take that into account," Nguyen said in the interview.

Richard Larkin, senior vice president and director of credit analysis at HJ Sims, said in an interview that he has been predicting for over 10 years that tobacco bonds will default in the not too distant future.

Larkin said that he projects bonds may now default even sooner, as early as mid-2020s and early-2030s."I think mid-2020 would be a little earlier than we would think for the bonds to default, but when we say a significant portion of bonds would default, you have to look at it from deal for deal," Chatterjee said. "For example, A lot of bonds have a longer maturity than others. The ones that are outstanding in late 2030s to mid-2040s are exposed to a bigger risk."