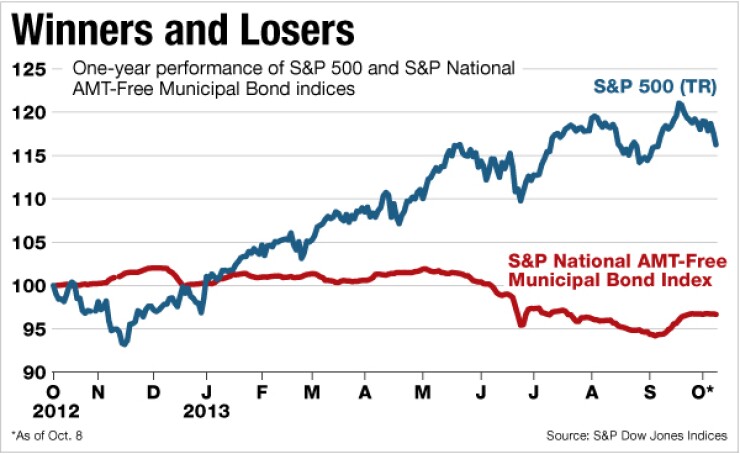

This year's rally in stocks and slump in Treasury and municipal bonds has set the stage for a spate of tax-loss swaps in the remainder of 2013 that may increase muni selling.

According to a research report from Citi muni analysts, conditions are ripe for retail investors to ratchet up their use of tax-loss swaps, transactions in which they sell a bond that has lost value versus its cost and buy a similar bond in order to realize capital losses and offset gains on their equities.

Equities rallied by up to 18% over the last year to Oct. 3, as yields for 10- and 30-year Treasuries increased by 85 and 75 basis points, respectively.

Yields for 10- and 30-year munis jumped by 75 and 125 basis points, respectively, and those selling at a discount suffered even more disproportionate price erosion, the report found.

"The last time that we had year end with a significant equity rally combined with a sell-off in the Treasury and municipal markets was in 1998," Vikram Rai, a municipal strategist at Citi, wrote.

In theory, increased selling for tax swaps could incrementally weaken the market for munis and cause difficulties with distribution over the next two months, industry watchers say. But it could also lead to added liquidity and price discovery.

A spate of tax swaps could drive up selling at year end, and thus complicate new-issues by flooding the market with paper, said Matt Fabian, managing director at Municipal Market Advisors.

"But it does create more flow and price discovery at year end, which for munis ... you never want to discourage price discovery," Fabian said. "And it does soften the blow of market value losses that people have taken in their portfolios during the year."

Tax swap trades would involve underperforming munis that were bought over the last 12 months, Fabian said, or generally lower-coupon, lower-rated bonds purchased during a very aggressive period in the market at very compressed credit spreads and low yields. Retail investors, who bought many lower-coupon bonds over the past couple of years, are primed to harvest tax losses.

"At the end of the year, if you have a bond that's underwater, you sell it and buy something very similar," Fabian said. "But then you get the capital loss to write off your taxes."

From another angle, the best candidates for a tax-loss swap appear to include non-market discount bonds, discount bonds inside of de minimis, or long-dated bonds outside of de minimis, for which the present value of the tax does not significantly outweigh the benefit of the swap, Philip Fischer, municipal research strategist at Bank of America Merrill Lynch, wrote in a research report.

As rising rates drive prices lower, bonds can fall into de minimis range and become subject to a tax penalty, as appreciation from the discounted price can be treated as a capital gain or even regular income.

"It's a circumstance which we're sorry to see happen because it means people have losses" Fischer told The Bond Buyer. "But the government's going to offset a good chunk of those. And we will get some extra liquidity out of this."

For individual sellers, though, the actual trade for the swap could prove taxing, said Ashton Goodfield, managing director and portfolio manager at Deutsche Asset and Wealth Management. Generally, it's

"Most individuals own blocks of bonds under a million," Goodfield said. "Usually, a lot of times their blocks can be 10 bonds, 20 bonds, and those have a wide bid-ask spread, so it's hard to do efficient trading for tax-swap purposes."

The market will most likely see tax-swap selling between the middle of this month and early December, said Peter Hayes, managing director and head of municipal bond portfolio management, trading and research at BlackRock. Thereafter, clients and financial advisors probably will shift their attention to the holidays and vacations.

Though he doesn't predict such selling would have a significant effect on the muni market, it would stand out because of when it occurred, he added.

"Obviously, anything that takes place in December tends to be exaggerated, because typically, liquidity isn't as good then as it is other times of the year," Hayes said.

For their part, mutual fund portfolio managers have been doing tax swaps already, as they're part of active portfolio management, Goodfield said. Typically, they do the trades to recognize losses and increase the distribution yield for their portfolios, she added, as well as try to improve the coupon structure of the bonds they buy.